[ad_1]

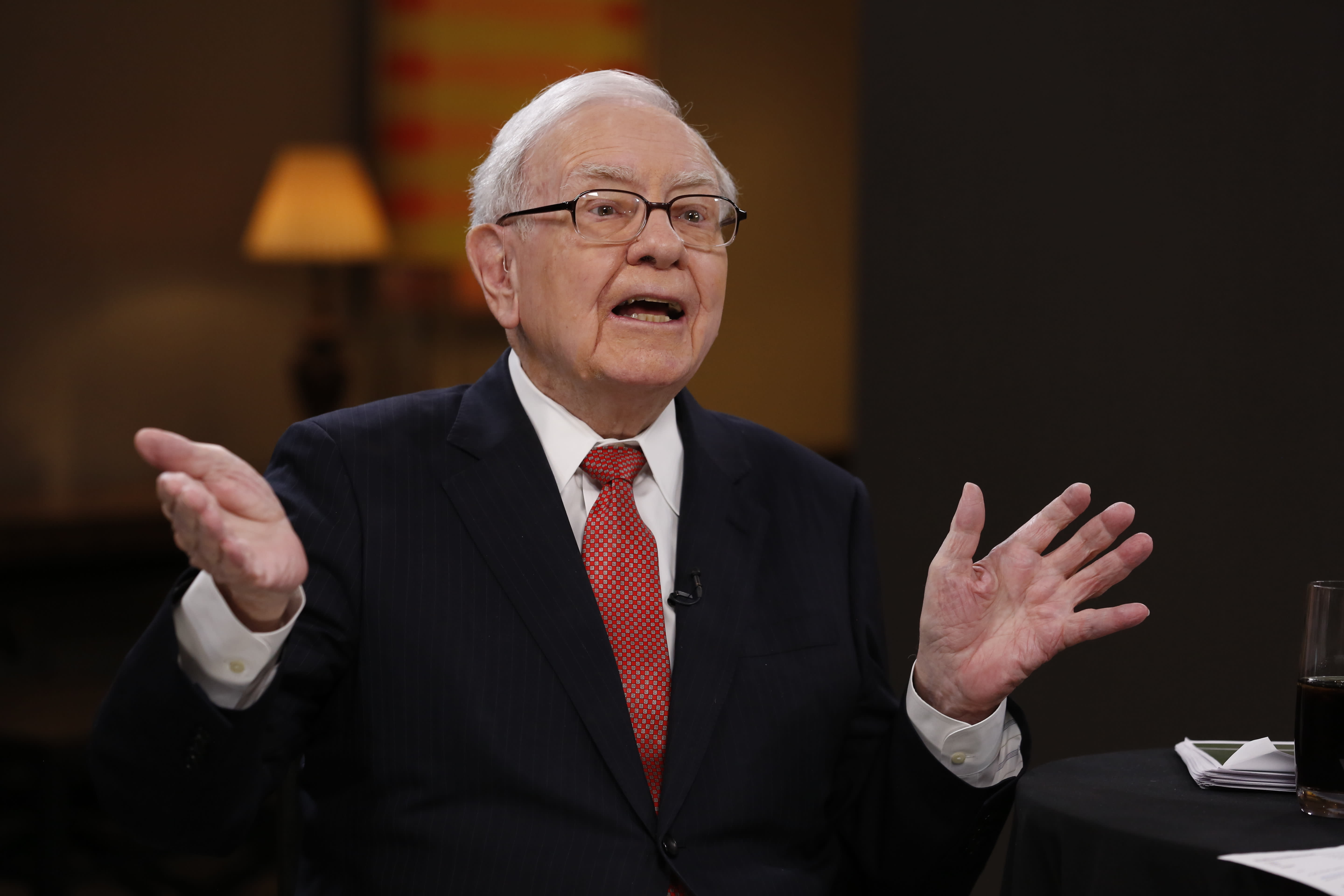

OMAHA, Nebr. – The Berkshire Hathaway Foundation is meeting Saturday and investors are ready to confront two conglomerate leaders, Warren Buffett and Charlie Munger, on five key issues.

First, Berkshire Hathaway continues to underperform the broader market and investors want to know what the Oracle of Omaha is planning to fix.

Secondly, Berkshire has a mass of money that exceeds $ 100 billion. Shareholders want to know if Buffett is considering trading or will buy more Berkshire shares.

There is also the problem Kraft Heinz. Kraft Heinz's investment by Berkshire was hit hard last year after the consumer goods maker reduced the value of two of its most popular brands. Shareholders and analysts want to know where Berkshire is going in this experiment.

At the same time, shareholders are digesting the news of Berkshire's involvement in a bidding war between two energy companies.

Finally, the estate continues to be a problem for shareholders. Buffett alluded to two possible replacements, but given his age, shareholders want to know more about it.

This guide breaks down these five questions to help navigate the whirlwind surrounding this year's Woodstock for Capitalists.

The S & P 500 beats Buffett

Buffett founded Berkshire Hathaway in the early 1960s and has since erased the S & P 500. Berkshire Hathaway shares have grown by more than 1,000,000 in book value since 1964, according to Buffett's latest annual letter to shareholders. At that time, the S & P 500 grew by only about 15,000%, including dividends.

But that has not been the case recently. Berkshire's total returns are lower than those of the S & P 500 for one, five, ten, and fifteen years. For example, $ 1,000 invested in Berkshire in 2009 would be more than $ 3,500 now. Meanwhile, the same amount invested in the S & P 500 would amount to more than $ 4,000.

During these periods, the shares of tech companies such as Microsoft, Apple and Amazon have grown, pushing up the S & P 500. Meanwhile, Buffett has largely avoided such companies until the day before. in recent years. In 2016, Berkshire started buying Apple, which is now its main asset. CNBC also announced Thursday that one of Berkshire's fund managers, led by Buffett, had begun buying Amazon shares.

"The stock has clearly underperformed and people will want to understand why this is happening," said Meyer Shields, an analyst at Keefe, Bruyette & Woods. "I'm not sure you'll get a good answer on this because Warren Buffett and Charlie Munger have already said: short-term things tend to bounce back."

"Nevertheless, the question is in people's minds."

The problem of 112 billion dollars

Shareholders want to know what Buffett will do with the company's $ 112 billion stockpile.

He said in his February annual letter that he wanted to make an "elephant-sized" purchase with the $ 112 billion in cash on which Berkshire was sitting, but that he did not could not because "prices are exorbitant".

Buffett does not invest in companies that he thinks are overvalued. He prefers to invest in companies when they are undervalued and earn money as the market realizes their true value.

But Buffett hinted that the money could be spent in another way: through redemptions. Berkshire repurchased $ 1.3 billion of stock last year, but Buffett said in his letter that it was "likely" that Berkshire would buy more shares in the company. 39; future. The Financial Times also reported that Buffett had said that without providing a deadline, the conglomerate could buy back $ 100 billion in shares.

"I do not mind that they buy a lot more from Berkshire," said Trip Miller, managing partner of Gullane Capital Partners, also owner of the Berkshire shares. "They're going to keep some money and do almost nothing, I think it's a much smarter decision to buy back shares of Berkshire." I think he should have some $ 50 billion in cash right now.I do not think he'll find anything for $ 50 billion or more to buy. "

What to do about Kraft Heinz

Buffett told shareholders in his annual letter that Berkshire received $ 3 billion in the fourth quarter of 2018 after Kraft Heinz reduced the value of its Oscar Mayer and Kraft brands by $ 15.4 billion. Investors and analysts want to know what will be Buffett's next move on this front.

Berkshire partnered with 3G Capital, a Brazilian private equity firm, to acquire Heinz in 2013. Two years later, Berkshire helped finance Kraft's $ 49 billion merger with Heinz. The stock has lost more than half of its value since the merger.

On February 25, Buffett told Becky Quick of CNBC that Berkshire Hathaway was "overpaid" for Kraft, but not for Heinz.

"Kraft Heinz's recent troubles have raised concerns about whether Berkshire's partnership with 3G Capital has become a weakness for Berkshire," said Jay Gelb, an analyst at Barclays, in a note earlier this week. "We doubt that Berkshire is reducing its investments in Kraft Heinz, but we also believe that Berkshire may be less likely to re-associate with a major deal with 3G."

Berkshire jumps into the pool

Buffett may not have found his purchase "at the size of an elephant" yet, but he sees an opportunity in a bidding war within the energy space.

Berkshire said Tuesday it has committed $ 10 billion in a preferred equity investment in Occidental Petroleum, which was contingent upon the acquisition of Anadarko Petroleum by the energy company. This investment places Berkshire at the heart of a fierce war between Occidental and Chevron, which had offered $ 33 billion in cash and stock to Anadarko.

Although it is rare that Berkshire is involved in such a bidding war, Catherine Seifert, an analyst at CFRA Research, thinks that this move makes perfect sense for Buffett. However, there are some risks for Berkshire.

"The structure of this transaction is a classic Berkshire financing transaction … although the terms of this transaction are not as attractive as some of Berkshire's previous transactions," Seifert said in a note. "We also believe that Berkshire is facing reputational risk in this transaction, as this transaction is conditional upon OXY's takeover of its APC buyout relative to its competitor Chevron ( CVX). "

Succession

The only question for Berkshire Hathaway investors is who will run the company after Buffett leaves.

Buffett is 88 years old and most of the company is now headed by Greg Abel and Ajit Jain, Berkshire executives, last year. Abel, 56, now heads the non-insurance business of Berkshire, while Jain, 67, is in charge of all insurance-related activities.

Abel and Jain are the two favorites to take the reins of Buffett, but he did not say when – or if – he was going to leave.

"To a certain extent, I think that complicates things," said Shields of Keefe, Bruyette & Woods. "If someone is the designated successor and he's not in charge for two or five years, it may seem a little strange." Again, the situation is a little different in the future. 39, Berkshire empire, but I think that's the main problem. "

– Tom Franck and Michael Bloom of the CNBC contributed to this report.

Subscribe to CNBC on YouTube.

[ad_2]

Source link