[ad_1]

As my colleague Fiona Cincotta said earlier today,"[g]Given the outdated nature of the minutes given the recent escalation of trade disputes between the United States and China and fears of a global recession, the reaction to the minutes may be limited.

Interestingly, while the international economic outlook has deteriorated due to new tariffs and a total contraction, US data released since last month's Fed meeting have generally improved. Since then, we have seen a report on strong non-farm payroll (although not spectacular), a higher-than-expected CPI report, and a strong reading of retail sales. Specifically, Fed stakeholders over the past few weeks (Bullard and Daly) have not suggested that their outlook would have changed since last month's mid-cycle adjustment.

The latter has just confirmed the generally optimistic outlook of the Fed both internally and internationally. The headlines of the minutes follow [emphasis mine]:

- A NUMBER OF OFFICIALS OF THE EDF NEEDS FLEXIBILITY IN THE EDF

- SOME CONSIDERATIONS HAVE CONCERNED AN INVERSION OF 3M / 10A YIELD CURVE

- Most viewed 25 BP <! – (LON:-> BP <! –) -> CUT LIKE A … ADJUSTMENT TO MID CYCLE

- A couple of decision makers would have preferred a 50 BP <! – <! – (LON:-> BP <! –) -> -> CUT TO ADDRESS A LOW INFLATION

Divergent views ("many" favorable rates unchanged, "one couple" would have preferred a 50 basis point discount) suggest that we could continue to see divergent views in response to future Fed decisions. Therefore, it will be particularly important to observe the comments of the central bank's leaders (Powell and Clarida) to get the most accurate signals about future policy.

Market reaction

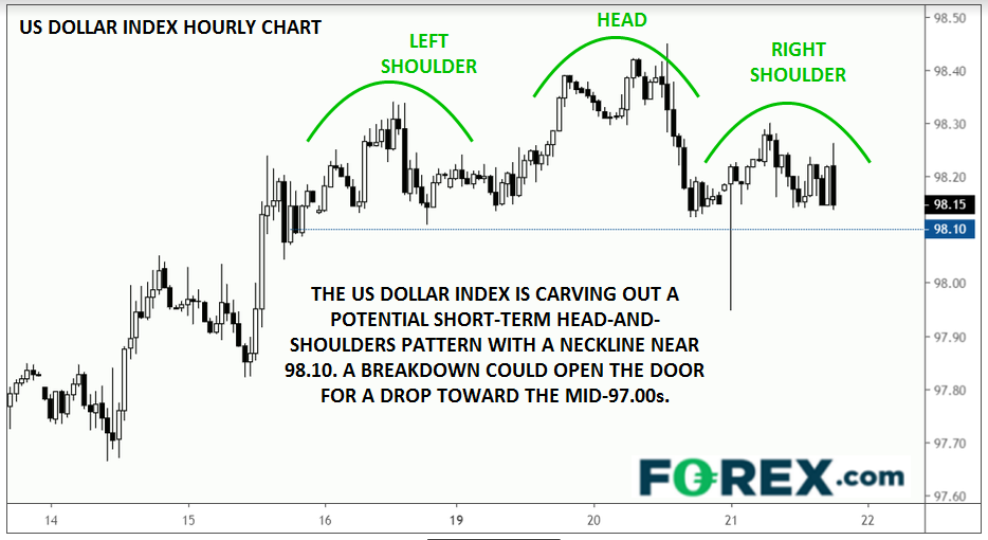

To say that the market reaction to the FOMC minutes is dull is a euphemism. The US dollar rose about 5 pips from its rivals before it reversed and traded about 5 pips from pre-Fed levels, as indicated by the US dollar. graph below. . The price of gold has risen from a few dollars to $ 1506, while major US indices and Treasury yields are essentially unchanged.

All eyes are now turning to Fed Chairman Powell's keynote speech on "Monetary Policy Challenges" at Jackson Hole on Friday morning.

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of the information, including data, quotes, graphics and buy / sell signals contained in this site Web. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link