[ad_1]

Trade tensions intensified further at the end of last week when the United States threatened to impose new tariffs on Mexico. US automotive companies, including Ford engine (F) 's is clearly selling the news because many of them are producing cars in Mexico and will be affected by new taxes and a possible disruption of the supply chain. As the guiding risks have further increased as a result of the price announcement, I sold Ford Motor last week.

Update on the trade war

US President Trump has led another country in the trade war that will face new US tariffs on its imports: Mexico.

On May 31, 2019, the US President tweeted that the United States would impose a 5% tariff on Mexican imports. The new rates are expected to come into effect on June 10, 2019.

In addition, US President Trump has threatened to raise tariffs on Mexican products to 10% on July 1, and then to an additional 5% each month for three months. Taxes will remain at 25% "until the problem of illegal immigration is solved".

Clearly, opening a new front with Mexico in the trade war is not good news for Ford Motor. General Motors (GM), both of which produce cars in Mexico and import them into the United States. The rate increase, if implemented, poses a direct margin problem to Ford Motor and could derail the company's results for 2019 and adversely affect its forecast.

In addition, according to a New York Times article, China would prepare a "list of unreliable entities" in response to US tariffs and the blacklist of the Chinese technology company Huawei. According to the Chinese Ministry of Finance, unreliable entities are companies that "do not respect the rules of the market, violate the spirit of contracts, block and stop supplying Chinese companies for non-commercial reasons and seriously undermine the legitimate rights and interests of Chinese enterprises ".

What American companies will end up on China's "list of unreliable entities" is not an assumption, but the list will certainly be made up of major US (technology) companies with significant activities in China. As a result, everything points to further deterioration of trade relations, not an improvement.

More bad news

The bond market continues to flash a warning sign: the yield curve is still reversed, which can be seen as a recession warning.

A reverse yield curve means that the yield on short-term bonds is higher than long-term bonds, which is economically unwise. On the contrary, inverted yield curves point to a slowdown in economic activity and increased risk to corporate profits in 2019 and 2020.

50 to 60% chance that automakers set their profit forecasts

Given the most recent commercial developments, I think the chances of Ford Motor and General Motors cutting their profit forecasts for 2019 have increased by 50 to 60%, provided that Mexican import duties actually come into effect. effective in June. The new rates will certainly hurt US automakers and present a significant margin risk. American consumers end up creating tariffs because companies tend to pass on tariffs and other taxes. As a result, Ford Motor could see increasing pressure on domestic sales, a positive point in recent quarters. If sales in the United States begin to decline, it could put additional downward pressure on Ford Motor's stock.

I'm outside

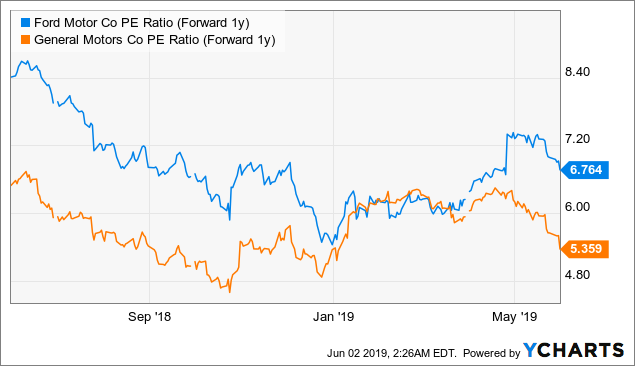

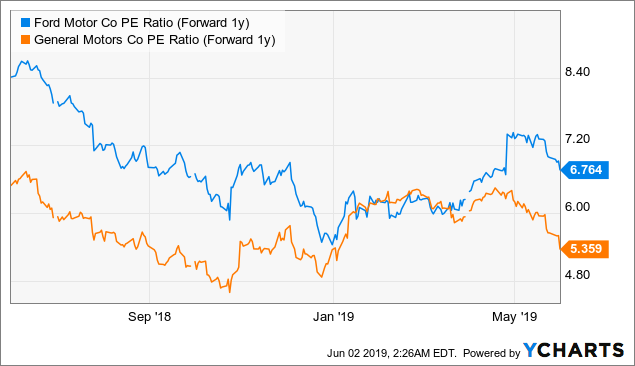

I sold Ford Motor last week (I was stopped) when the Ford stock price fell below the $ 10 mark. Although Ford's shares are far from overvalued, the risk / reward ratio is simply no longer attractive: in my opinion, the US economy is likely to head into a recession in 2019/2020 and new rates could catalyze this event. A downward earnings revision would also lead to higher forward price / earnings ratios for Ford Motor and General Motors.

Data by YCharts

Due to the increasing downside risks, I have taken significant portfolio measures over the past two months and wound up close to half of my portfolio. I sold General Motors @ $ 38 at the beginning of May for similar concerns.

Take away

Ford Motor's guidance risk increased again last week. It is very difficult to see a catalyst for rising share prices in the auto sector after the spectacular collapse of trade talks last month. The situation has worsened with the US threat of new tariffs on Mexican imports, which are on the verge of hurt Ford Motor and raise prices for US buyers. An inverse yield curve is another sign of a potential problem. In my opinion, there is no reason, for us, to be long US securities, because the risks are trending downward. I'm outside.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link