[ad_1]

(Bloomberg) – Overseas investors can soon own more Chinese stocks – the trouble is they do not seem to want them.

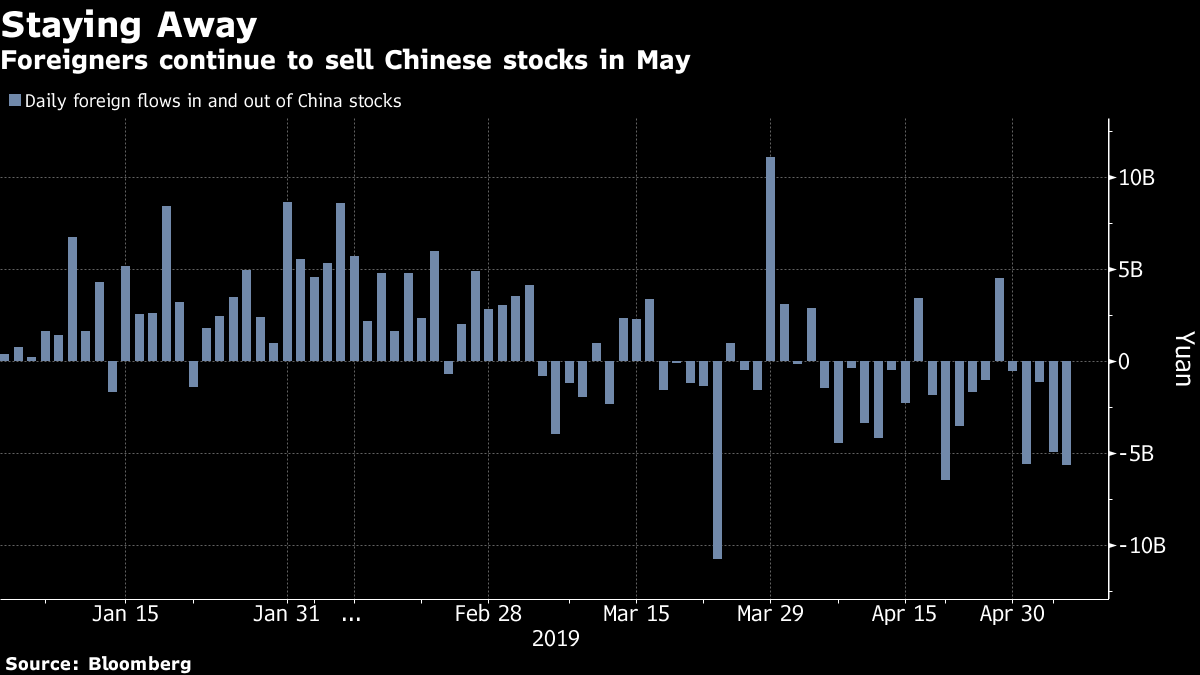

Foreigners are dumping mainland-listed shares at a record pace, just as MSCI Inc. prepares to expand their weighting in its benchmark indexes. Already this month, 17.4 trillion yuan ($ 2.6 trillion) of Hong Kong, putting it on track to surpass the 18 trillion yuan outflow in April.

Chinese stocks remain some of the best performing in this world, yet about $ 1 trillion has been caught up in the country's equity markets in just a few weeks as the trade dispute with the U.S. returned to center stage. Concern that Beijing may bounce back stimulus plans also weighed: the Shanghai Composite Index has dropped 11% from an April peak.

"Renewed fears of further trade escalation," said Jingyi Pan, a market strategist at IG Asia Pte Ltd. in Singapore.

The Shanghai gauge closed 1.2% lower Monday after the last round of trade talks ended in stalemate. U.S. officials are expected to announce details of their plans to impose a 25% additional tariff on all remaining imports from China. Northbound trading was closed in Hong Kong.

MSCI will increase the inclusion factor of a large-cap ChiNext board on May 29. It will announce the changes on Monday. The weightings are set to be increased again later this year.

The move will have a negative impact on the market, but it will not help the market for the first time. Inflows from the inclusion in the market of China, which is dominated by retail investors.

Why China's First Steps Into MSCI Are Such a Big Deal: QuickTake

MSCI's recent volatility in Chinese shares will not be affected by MSCI's plans, but according to Zhen Wei, director of China's research at MSCI Inc. They are included in the November review, he said in an interview in Singapore on Thursday.

"If A shares, it will be reflected in market share," and vice versa, he said.

(Updates with Monday's trading throughout.)

–With assistance from Mengchen Lu and Amanda Wang.

To contact the reporter on this story: Livia Yap in Singapore at [email protected]

To contact the editors responsible for this story: Sofia Horta and Costa at [email protected], Will Davies, Philip Glamann

<p class = "canvas-atom-canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "For more articles like this, please visit us at bloomberg.com"data-reactid =" 45 "> For more articles like this, please visit us at bloomberg.com

© 2019 Bloomberg L.P.

[ad_2]

Source link