[ad_1]

VIDEO – On Tuesday, Bruno Le Maire said he was "open to postpone the entry into force" of the European project of taxation of the digital giants at the end of 2020, an opening made to Germany who wishes to enter in force only if no global agreement is reached before the summer of 2020. The other EU member states are moving in a piecemeal fashion on this issue.

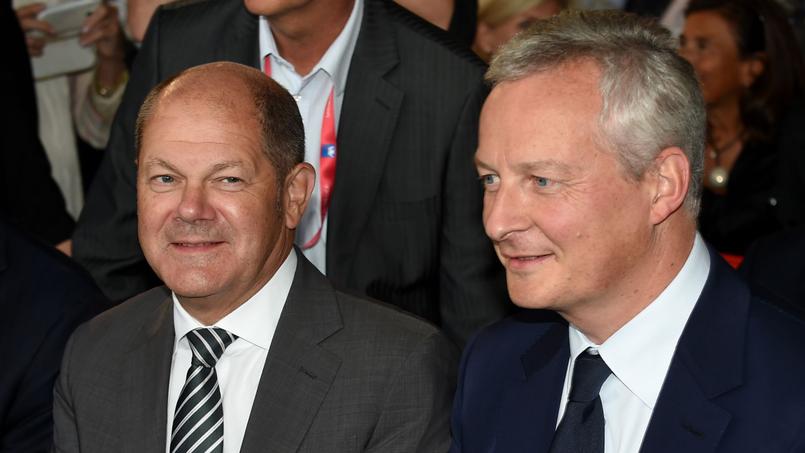

Will the "absolute priority" turn into a fiasco? After having spearheaded the taxation of digital giants (the famous "Gafa", Google, Amazon, Facebook and Apple), Bruno Le Maire has made much more moderate remarks this Tuesday morning, during a meeting of the 28 Finance Ministers of the European Union in Brussels. If he still wants a European directive on the subject to be adopted by the end of the year, he also said he was "open to postpone the entry into force" of the project of taxation at the end of 2020 This would bring a rapprochement with the German position. His German counterpart, Olaf Scholz, who recently expressed his reluctance on the draft, is in favor of the entry into force of the European text only if no global agreement is reached before the summer.

READ ALSO – "Gafa tax" worries European tech

The minister explained that there remained "technical difficulties to solve" which, according to him, can be overcome in the coming weeks. To rebadure its partners who are more in favor of an international agreement, to which the OECD works, France proposes that if such a global agreement is implemented, it will be useless to trigger the European tax. The adoption of taxation by the end of December, however, remains a "red line" of the French government, said Bruno Le Maire in Brussels. The report therefore only concerns the application of the project.

For months, Bruno Le Maire, who has made this issue his hobbyhorse, believes that the agreement to the OECD could intervene more quickly if Europe had previously adopted its "digital tax". He argues today that delaying entry into force can put pressure on international discussions and speed up the agreement under the auspices of the OECD.

The Commission proposed last March to introduce a 3% tax on the turnover generated by the digital services of companies. However, only firms with an annual worldwide turnover of more than 750 million euros and an income of more than 50 million euros in the Union would be affected.

Paris and Berlin are leading two different policies on this issue. France defends the implementation of a temporary turnover tax for Gafa, the time a solution is found at the global level within the OECD. For Angela Merkel, the Union should wait for the international organization to make progress on this issue and the European solution should only come into play if the negotiations fail.

GAFA, who are they? – Watch on Figaro Live

European disagreement

Tuesday's Ecofin again highlighted European differences, with three countries still dubious about the usefulness of a "Gafa tax", Ireland, Sweden and Denmark. Danish Finance Minister Kristian Jensen said it was "very difficult to see an agreement on the tax because a lot of technical problems have not been solved yet". According to him, the European project will lead "obviously a reaction of the United States", and the tax is "not a good idea" for the economy of the Union.

French ambitions have met with reluctance from other EU Member States, including Finland, Sweden and Ireland, which host the European headquarters of companies such as Google and Facebook. Germany is also worried that the digital giants will put pressure on Washington to change the stance of Brussels, thus fueling the trade dispute between the United States and the Union. The Minister of Finance's entourage said during the summer that "a lot of intellectual work" was still to be done on this issue, and that "no decision" had been taken. A change of tone that had much appealed to the German business community, worried about the effect of such a tax on domestic companies.

The French proposal remains supported by Spain, which wants to introduce, nationwide, a digital tax of 3% for some companies in the sector. For its part, at the end of October, the United Kingdom also proposed in its draft budget a tax of 2% on the turnover achieved by large digital platforms on its soil. Introduced from April 2020, this new tax could yield, according to the ministry, more than 450 million euros annually. The British preferred to introduce a national tax instead of waiting for an OECD-wide solution, while adding that Britain would waive its tax if the agreement was found before it was put in place. . This Tuesday, leaving the Ecofin, the Italian Finance Minister Giovanni Tria warned that in case of failure of negotiations within the Union by the end of the year, La Botte would set up its own tax on digital businesses.

[ad_2]

Source link