[ad_1]

The tax notices of individuals who have made their declaration on paper, will be sent in a few days. They integrate the future rate of withholding tax, which can be modified.

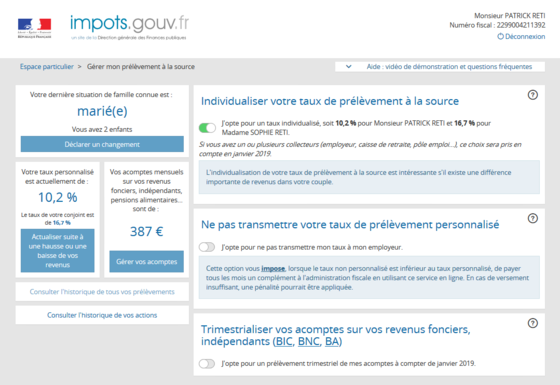

Are you among the 40% of French people who have not declared their taxes on the Internet this year? You may need to log in to your particular online space in a few days. In fact, while the tax notices are being sent, they include for the first time the rate of withholding tax applied from January 2019. This rate calculated by the tax authorities is the income fireplace. But by connecting to the service "Manage my collection at source" of your particular space, you will be able to change it to opt for an "individualized" rate, or for a "non-personalized" rate (also called neutral rate ). What are these two options?

The "individualized rate" is available only for married or pacified couples who complete a common income tax return. It does not change the amount of tax payable on the year, but only the distribution of it between the two members of the couple, according to their income. The one who earns the least will then be charged a lower rate, the higher a higher rate. This can be very useful, especially for those with large income disparities.

The "non-personalized" rate (or neutral rate) was designed to preserve the taxpayer's confidentiality: it is based on the only earned income and not all of your income. Still, this rate – calculated on the basis of a single without children – must be handled with care. As we explained in a recent article, it can be very penalizing for most taxpayers, especially for large families and people with large income variations from one month to the next. Surely, the amounts paid in excess will be reimbursed by the tax authorities a year later. But, in the meantime, you will have made a nice cash advance to the administration …

>> Discover Capital.fr services to optimize your financial investments, better manage your real estate, be better covered by your insurance , control your expenses, boost your career and retirement, and help entrepreneurs succeed

>> Read also – Withholding: Are you sure you've understood everything?

>> Read Also – The withholding tax will be expensive for investors in Pinel

Source link