[ad_1]

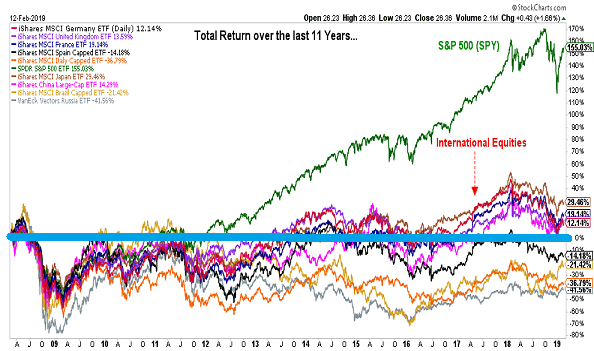

In 2008, emerging market equities and international equities dominated financial issues. "Talking Head" agreed that investors should allocate up to 50% overseas to a well diversified portfolio.

The reasoning? We should be aligned with the cake of the world stock market. After all, half of the world's market capitalization belonged to US equities and half to equities elsewhere in the world.

However, the real reason had very little to do with market capitalization. In truth, foreign stocks have significantly outperformed US equities. You had to be in the "euro zone". You had to be in "BRIC" (Brazil, Russia, India, China). In essence, more investment was needed in the winners.

Since 2008, however, the allowance abroad has been a futile exercise. While the US market recorded admirable total return gains that largely erased the memory of its "lost decade" (2000-2009), stocks outside the US have barely paid anything for 11 years.

What do you mean today about diversification with non-US stocks? You may be experiencing a 20th century heuristic such as 20%. You certainly do not want to talk about putting 50% of your money in foreign stocks because half of the world's market capitalization belongs to non-US public companies.

Ironically, there are many advocates for the allocation of 0% to foreign stocks. The justification? Many US companies derive at least half of their income and / or income from their operations abroad. According to this change of mentality, an investor in exclusively American equities is already diversified.

This sounds like another effort to return to the winner of the last decade. 50% in 2008. 0% in 2019.

It should be noted, of course, that the diversification of countries / regions since the financial crisis has hurt. In addition, an unbiased valuation of equities as an asset class should take into account the adverse effect of exposure to non-US equities.

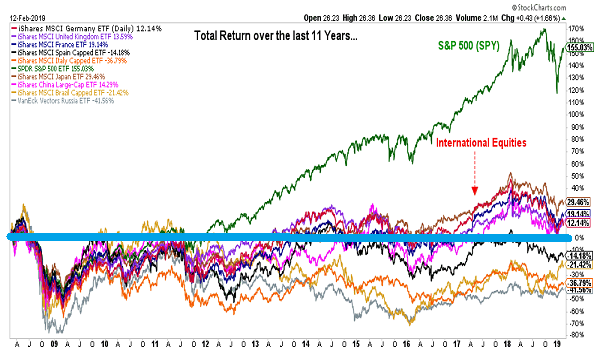

For example, did a global stock market bear start in 2018? Or do the eight consecutive weeks of recovery involve Did the central rocking banks set a permanent floor below stock declines?

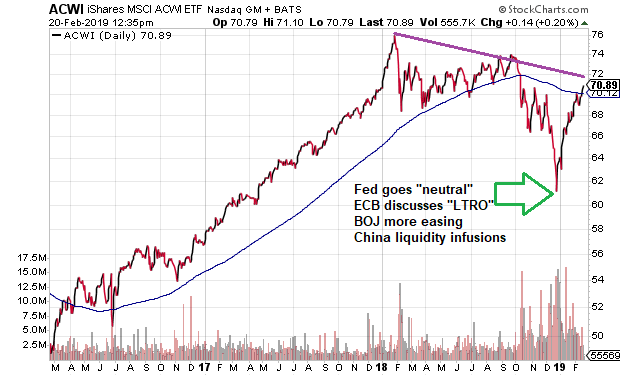

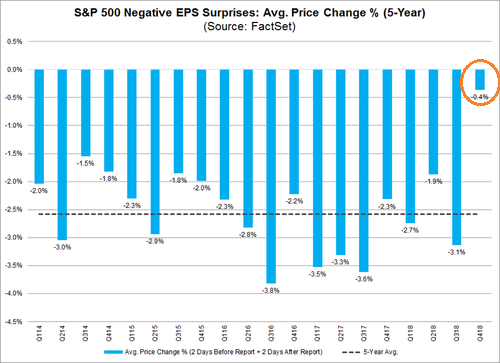

One thing is certain: US stocks are back in favor. In reality, bad earnings news goes unpunished.

And bad economic news? It simply means that the Fed and other central banks will remain accommodative.

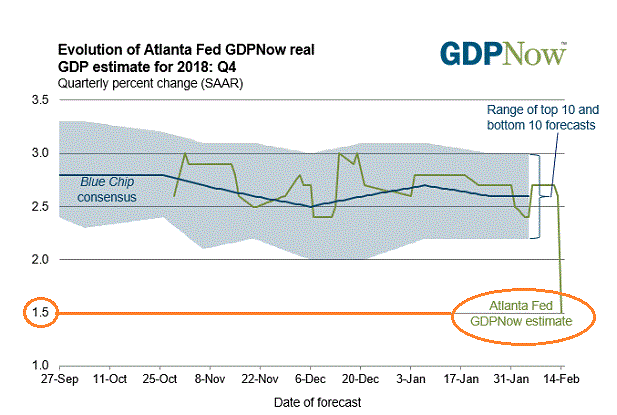

Keep in mind that recent tax reform stimulus measures were supposed to support economic growth of 2% in the range of 3% to 4%. No one seems to be talking about 3% anymore.

In light of declining economic prospects, both in the United States and in influential economies abroad, many attribute the significant decline of the Federal Reserve. However, the effects of decision-making on the fly may not be felt for some time.

Consider what the Fed should do to mitigate the impact of the previous three recessions. Committee members had to reduce the overnight loan rate of federal funds by an average of 500 basis points. And that still did not stop two bears from 50% and more.

If a recession starts in 2019 or 2020, the Fed could have a poor 225 basis points for lowering the overnight lending rate. (Unless it also introduces a negative interest rate policy.) Nor is it clear how many billions of billions of electronic e-credits will have to be created from scratch to buy US Treasury bonds and other assets in difficulty to promote liquidity while stimulating borrowing. The $ 4 trillion already in the accounts of the Fed are already rather discouraging.

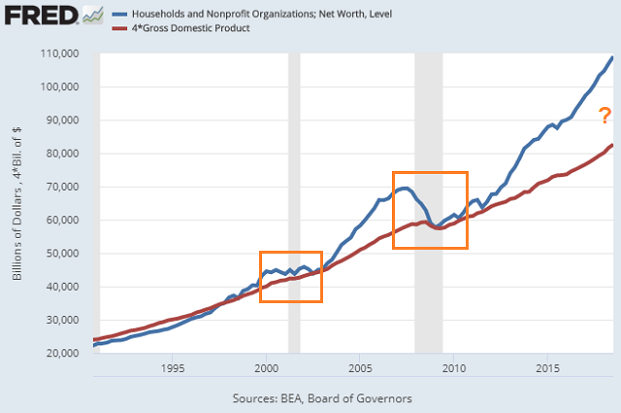

What we usually forget with investors' craze for central banks is that their shares are unlikely to prevent the next slowdown or eliminate the downward depreciation of prices. Are we not going to see the net worth of households, made up largely of stocks, bonds and real estate, back to the economic trend? If this is the case, asset prices would fluctuate over a long period of time or, more likely, collapse.

It may be easy for some people to exclaim that they are enjoying the opportunity to buy the next big bear down. On the other hand, you can not acquire stock, real estate or assets that have lost a third or half of their value with no money on the side.

Money can be hogwash when the Fed gives it 0%. But today? Cash equivalents such as SPDR 1-3 months T NY (NYSEARCA: BIL), First Trust Enhanced Short Maturity (NASDAQ: FTSM) and JPMorgan Ultra Short Income (BATS: JPST) rival the yield on 10-year Treasuries 2.63%.

DisclosureGary Gordon, MS, CFP, is President of Pacific Park Financial, Inc., a registered investment advisor to the SEC. Gary Gordon of Pacific Park Financial, Inc. and / or his clients may hold positions in the ETFs, mutual funds and / or any of the investment assets mentioned above. The commentary does not constitute personalized investment advice. The opinions presented in this document do not constitute personalized recommendations for the purchase, sale or retention of securities. In some cases, publicly traded issuers pay Pacific Park Financial, Inc. or its affiliates for the advertising displayed on the ETF Expert website. ETF Expert content is created independently of any advertising relationship.

[ad_2]

Source link