[ad_1]

Photographer: Alessia Pierdomenico / Bloomberg

Photographer: Alessia Pierdomenico / Bloomberg

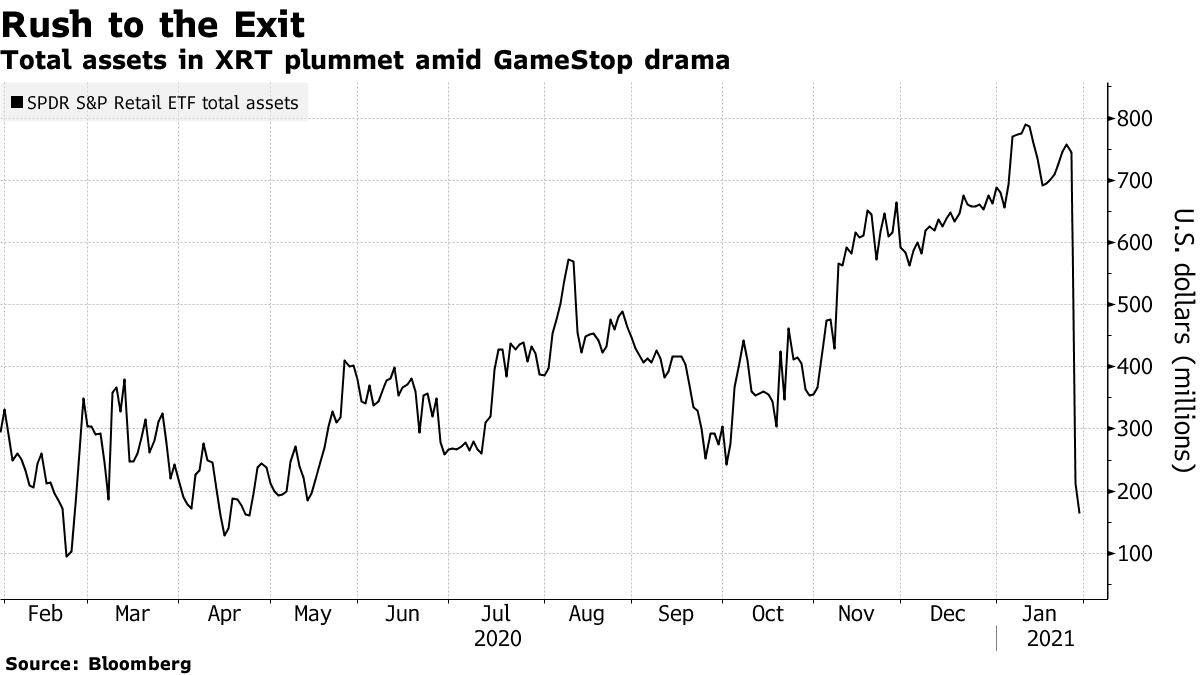

While the GameStop Corp. Continuing to unfold in the markets, the drama has now cost what was an $ 800 million exchange-traded fund nearly 80% of its assets.

Investors withdrew around $ 700 million from the SPDR S&P Retail ETF (ticker XRT) this week, draining total assets to just $ 164 million. The releases come after the soaring GameStop Inflated its XRT weighting to 20% – given that the fund tracks an equally weighted index, the video game retailer’s weighting should be closer to 1%.

Theories abound as to what motivated the exits, given that they occurred alongside an almost 20% rally in XRT this week alone. One possibility is that, since XRT redemptions are delivered in-kind – meaning its shares are traded for the underlying shares of the fund – investors are ditching the ETF to get their hands on hard-to-borrow GameStop shares. . Others believe that with such a weighting of the highly volatile GameStop, some holders might choose to take profits.

Bloomberg Intelligence analysts support the first theory. “GameStop’s rising lending rates signal strong demand for equities, with short hedge funds potentially seeking to close or adjust positions,” BI analysts James Seyffart and Eric Balchunas wrote in a report Friday. “The in-kind buyout was likely an attempt by investors to get their hands on rare GameStop stocks.”

The cost of borrowing GameStop shares climbed to 200% this week and was around 50% on Friday, according to data from financial analysis firm S3 Partners.

This is made worse by the fact that there isn’t a whole lot of GameStop action out there. The company has a relatively small free float, with only 69.7 million shares outstanding. And with over 100% of the total loaned to bears betting against it (stocks can be borrowed more than once), it created a stock hunt, according to BI.

But State Street’s Matt Bartolini said there are likely many motivations at work, rather than the desire to share GameStop. One consideration is that the strong GameStop weighting increased the overall volatility of XRT, leading investors to seek other vehicles to gain exposure to the retail sector.

“These are more risk averse investors who are not looking to speculate, who are probably playing some sort of trend that started the year, like the economy rebounding,” Bartolini, director of SPDR Americas Research, said at the time. a telephone interview. “Because of this price appreciation, this investment thesis has been distorted.”

Others believe the exits could simply be investors taking profits after an incredible ramp-up. XRT gained around 40% in January, on track for its best month ever.

“Anyone who was XRT long BEFORE this all started had a reason. Whatever reason, he was NOT a winner of a mechanical pop in a meme stock that was inside, ”wrote Dave Nadig, chief investment officer at data provider ETF Trends, in a report. -mail. “So it’s pure 100% profit taking.”

[ad_2]

Source link