[ad_1]

The South Korean hedge fund that made a bold bet on GameStop Corp. nearly a year ago becomes less bullish on the shares of the US video game retailer after a seemingly endless rally that has badly taken by many short sellers.

Kim Doo-yong, CEO of Must Asset Management, said that the stock’s high volatility and its skyrocketing more than ten times The last interview with Bloomberg in March 2020 arouses his less optimistic view.

The Seoul-based hedge fund, which has 602 billion won ($ 546 million) in assets under management, held a 4.7% stake in GameStop in April 2020, according to Bloomberg data based on a deposit. This made the Korean fund one of the biggest investors in the Texas-based company Grapevine.

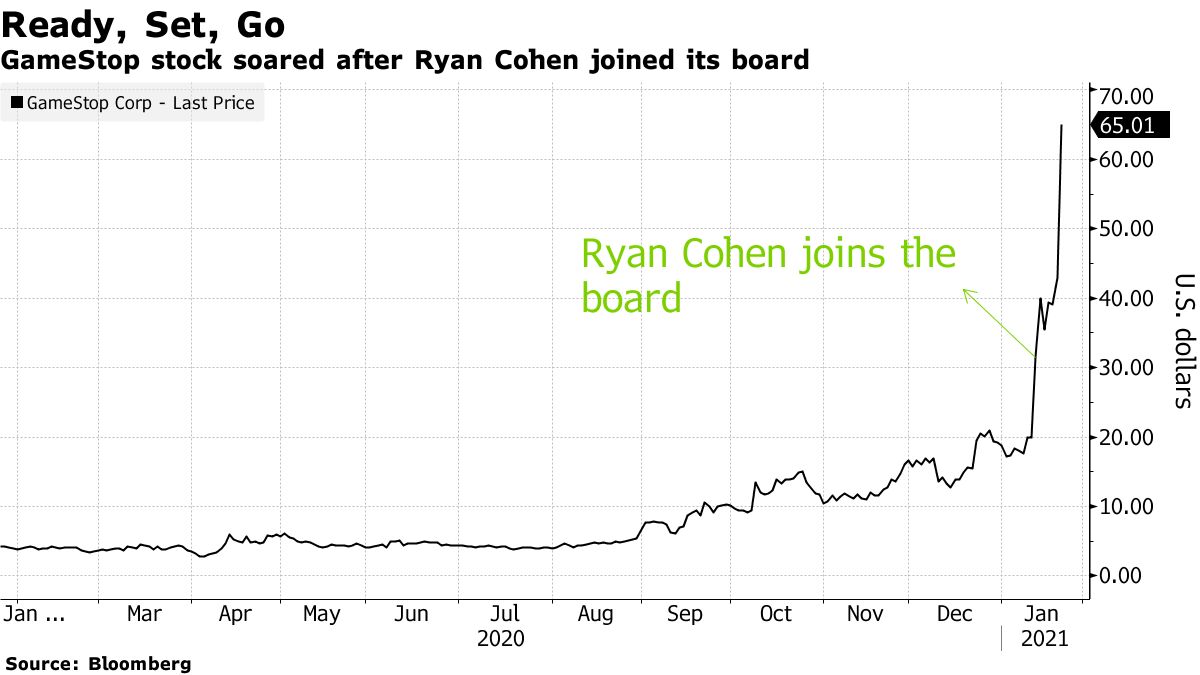

Kim declined to comment on the fund’s current position in US-listed stocks, a favorite of retail investors who have become increasingly influential in the markets during the pandemic. GameStop shares soared following a rush for short-cover and day trading after Ryan Cohen, activist investor and co-founder of online pet retailer Chewy Inc., joined its board of directors on January 11.

GameStop Record Run Gives Reddit Army Victory In Citron Clash

“We have become less optimistic and have become more neutral on GameStop,” Kim said in an interview with Bloomberg on Monday. “This stock will continue to be very volatile and unpredictable in the short term.”

Swimming against a bearish wave of analysts ‘views, Kim told Bloomberg in March last year that GameStop is “the only place” where potential customers can try out the companies’ games in person. He still believes in the business.

GameStop rallies after adding three new directors to the board

“We are always very positive about the new direction of GameStop,” said Kim. “We think Ryan Cohen and his team can repeat the success he has achieved on Chewy.com.”

Kim said he recently bet on another US company. The fund increased its holdings in securities Kaleyra Inc and now owns a 5.2% stake in the software company.

[ad_2]

Source link