[ad_1]

Societe Generale Electric (NYSE: GE) announced Thursday that it has successfully demonstrated the feasibility of its giant earthworm tunnel boring robot.

The $ 2.5 million project, funded by the Defense Advanced Research Projects Agency’s (DARPA) Underminer program, enabled General Electric to create a flexible, fluid and deft stand-alone prototype capable of bypassing underground obstacles.

The robot is capable of tunneling a distance comparable to commercially available trenchless technologies. With its flexible, seamless design, General Electric’s earthworm can navigate extreme turning radii, operate in confined spaces, and can pick up and move objects of many shapes and designs.

The news may have helped General Electric’s stock avoid closing below a significant support level on a day when general markets shook investors. Now the stock could be tuned for a higher rebound.

See also: Is General Electric’s Reverse Stock Split a Smart Decision? Josh Brown thinks so

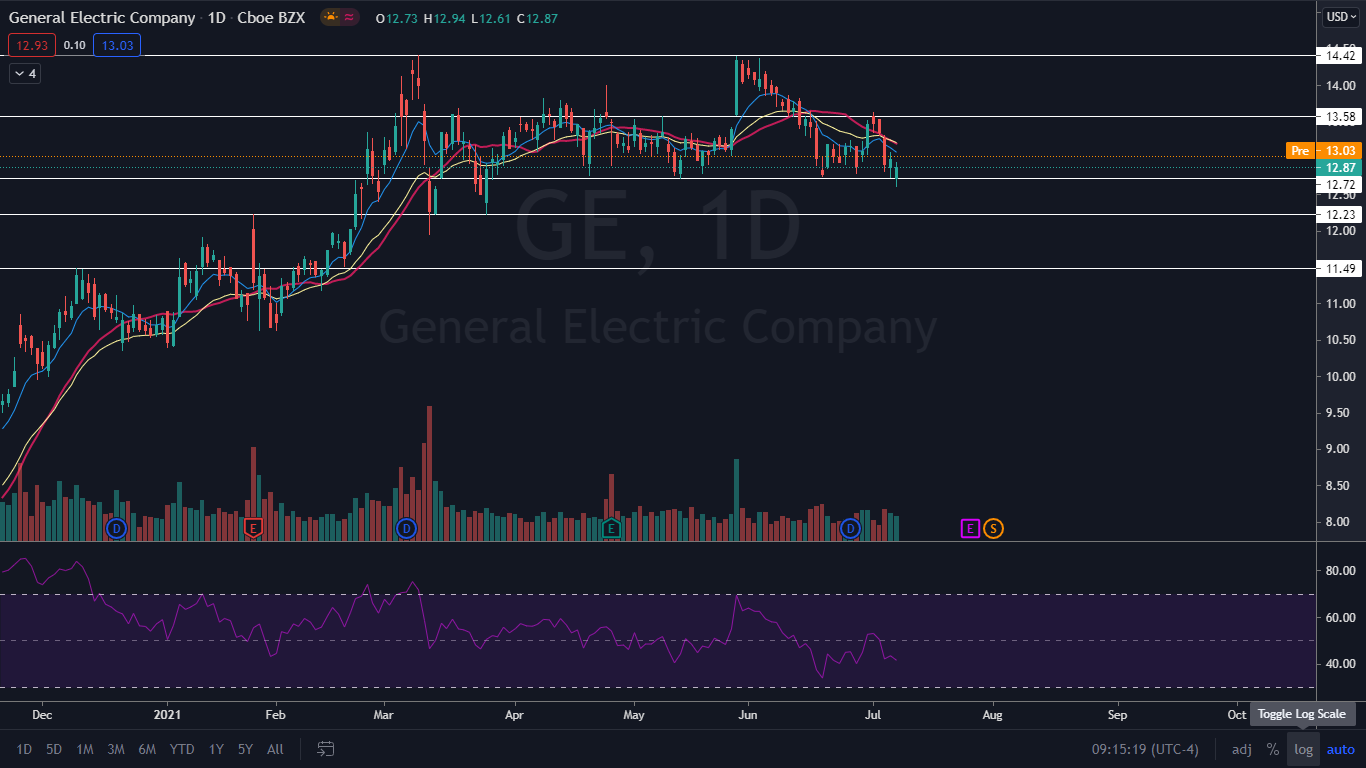

The general electrical panel: General Electric has traded sideways between $ 12.23 and $ 14.42 since February 22. The stock has not closed below the $ 12.72 mark since March 24, making the level critical as support.

On Thursday, amid general market weakness, General Electric shares briefly fell below the critical level but ended the day above. This demonstrates both the strength of the level as a support and the strength of the title as a whole.

The long lower shadow on Thursday’s candlestick also demonstrates that whenever the price fell below support, the bulls would buy the downside.

General Electric is trading below the eight-day and 21-day exponential moving averages (EMA), with the eight-day EMA trending below the 21-day EMA, both of which are bearish indicators. The stock is also trading below the 200-day simple moving average, indicating that general sentiment towards the stock is bearish. However, General Electric’s stock has been tracking moving averages for months, and as it is only 2.6% from regaining the indicators as support, it could easily.

The bulls want to see Thursday’s candlestick mark a return to the upside and bullish momentum to push General Electric’s stock up all three moving averages. If it can regain support levels, it has room to move up towards $ 13.58.

The bears want to see big bearish volume come in and push General Electric down below the critical support level of $ 12.72. Should the stock lose this level as support, it could drop to $ 12.23 before potentially rebounding.

GE Price Action: Shares of General Electric were trading up 2.06% to $ 13.14 as of the last check on Friday.

[ad_2]

Source link