[ad_1]

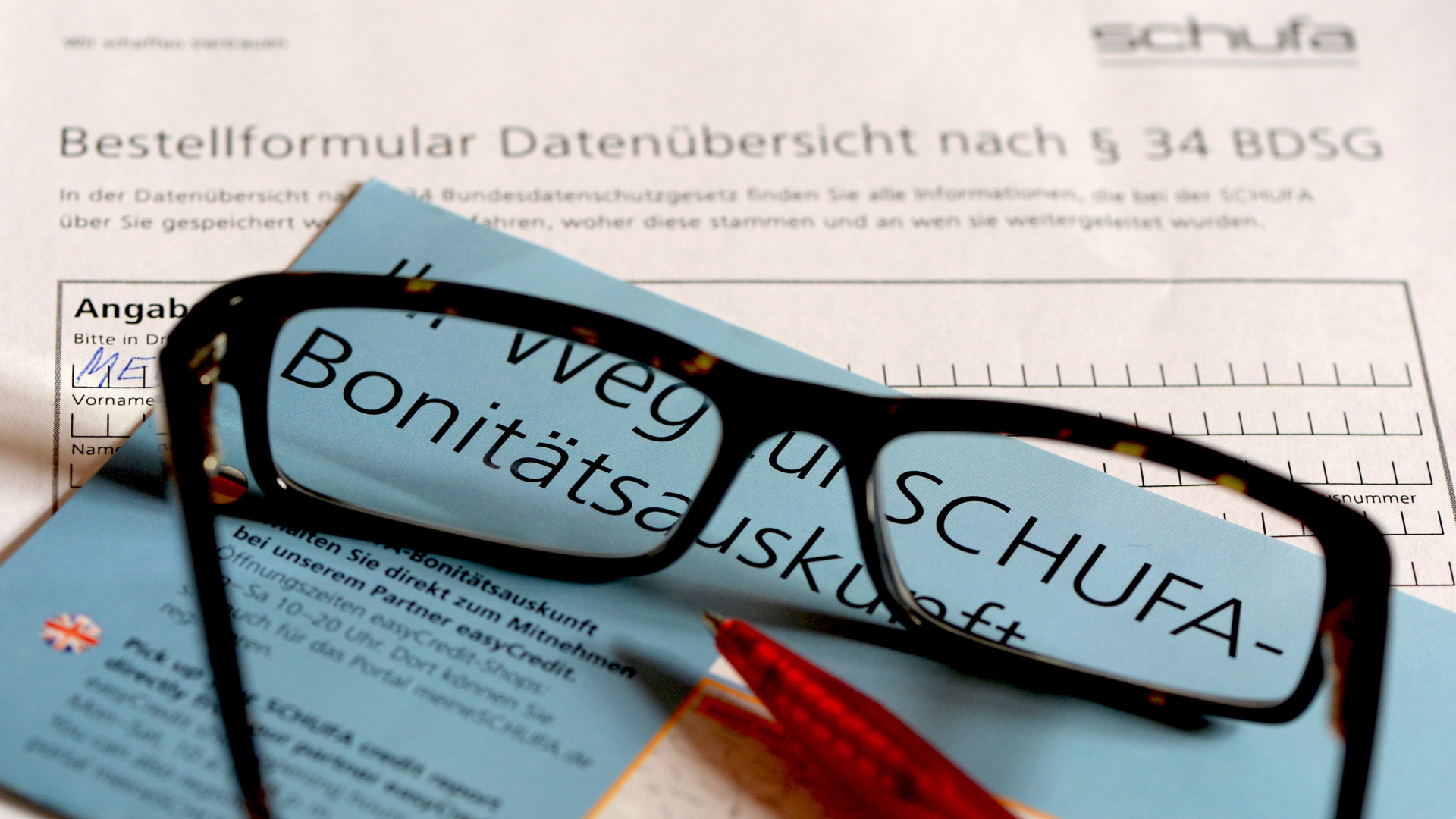

It is the most famous credit agency of Germany. But how are Schufa's badessments made? A data badysis of BR and "Spiegel" shows: Many people are apparently declared innocent as presenting a risk.

By Oliver Schnuck and Maximilian Zierer, BR

What is the creditworthiness of consumers? This is what is called the rate of credit bureaus. The best known is the Schufa, which contains data on 67.5 million people in Germany and calculates the likelihood of consumers settling their claims. How she does it's her secret business.

Data journalists from Bavarian Radio and the information magazine "Der Spiegel" together evaluated more than 2000 Schufa information. The latter had collected the Open-Schufa initiative and provided it anonymously. Representative is not the record – men are overrepresented, older people are underrepresented – but it gives insights into how the rating works.

Consumers with positive contract information

Schufa itself states: Of more than 90% of consumers, they only recorded positive contractual information. "And that's a good thing," says the Schufa website, as this could make life easier for the consumer.

But the evaluation of BR and "Spiegel" shows: Only positive information does not mean a perfect score for a long time. Among the consumers of the dataset for which there are no default values, Schufa certifies that the basic score is only satisfactory or even high, out of eight.

As a result, consumers may not get a mobile phone contract or increase their line of credit.

sure BRSchufa answers a question about his working methods in writing, but does not want it to be quoted in the letter.

Is it based on the number of chequing accounts?

Whether this decision is based on the number of checking accounts or the decisive factor, or not, the second credit card, consumers do not learn from Schufa.

Schufa often knows less than expected. For nearly a quarter of the people in the registration, the score is based on three or fewer pieces of information from the company, for example, if the person has a checking or credit card account. Nevertheless, even in these cases, Schufa calculates a precise forecast of solvency.

Experts call for more transparency

Consumer advocates criticize calculations that are unclear. Professor Gerd Gigerenzer co-authored a report on ratings as an expert of the Federal Ministry of Justice and Consumer Protection. It requires more transparency:

"I think we need to rethink our country thinking that we are not always protecting more credit bureaus, but protecting consumers, who are better protected by telling them what's going on."

More information on the research conducted today in the magazine ARD Plusminus from 21:45

The magazine Plusminus speaks on November 28, 2018 at 21:45.

Source link