[ad_1]

CAC 40 – WKN: 969400 – ISIN: FR0003500008 – Price: 5.106.75 pts (Euronext Paris)

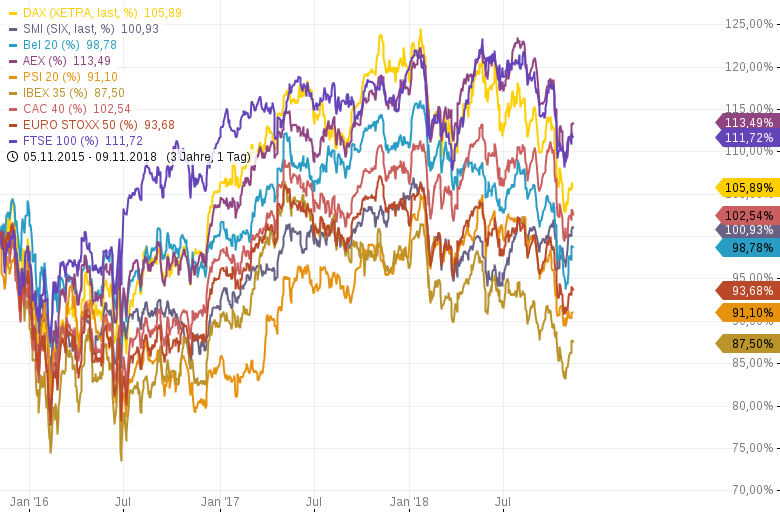

DAX – WKN: 846900 – ISIN: DE0008469008 – Price: 11,529.16 pts (XETRA) Ranking of the relative strength of European indices

Ranking of the relative strength of European indices

The price 19.10. can be read in the DAX as a small reverse SKS. Up to now, the trail is dropping but since the lowest of 26.10. just high. Not really dynamic. Other European indices, such as CAC40 (France), Bel20 (Belgium) or AEX (Netherlands) have also formed small SKS inverse trays. However, more dynamic and in a more convincing structure. Sometimes you have to transform everything on the markets and look for signals. Perhaps the most beautiful reverse schemas of SKS among other Europeans indicate that, alas, with a little noise and even on the European stock market, a little higher is possible.

If the DAX exceeds 11,680 points at the end of the day, as dynamically as possible (which is unlikely), this triggers a buy signal (!) Low with the target 12,068 to 12,068 , the line of the multi-confirmed downtrend (red triggers) crosses since 15.06. The CAC40 must exceed 5,170 points to trigger a purchase signal targeting the target 5,330. Also a possible signal rather short term. Signals completed in the medium term are not available on the European stock market. I would like to talk about it, but we have to take what the signaling market emits from us.

21,530 traders follow me and comment daily on Guidants. You too are invited to follow me for free: click here.

If you have any questions about using Guidants, feel free to post them on the help desk: https://go.guidants.com/#c/help

There you will quickly receive competent answers.

CAC 40 France

CAC 40 France DAX Germany

DAX Germany

See you in the world of trading? My colleagues and I look forward to meeting you in person at the prestigious Frankfurt Financial Fair on 23 and 24 November 2018. Come visit us on our booth number 27! Sign up now and get your free entry. Register now!

(© BörseGo AG 2018 – Author: Harald Weygand, Head of Trading)

Source link