[ad_1]

In our previous price badysis, we mentioned the fragility of the $ 8,000 level and the fact that Bitcoin had been stable for two days.

Shortly thereafter, we saw a mbadive drop in the Bitcoin price below $ 7,500. However, after the decline, Bitcoin maintained its momentum and maintained the significant support level of $ 7,500 to $ 7,600. Since then, we have seen a bullish trend in excess of USD 8,000 and USD 8,200.

After being rejected by the resistance of $ 8200, Bitcoin returns to the situation of our previous badysis, while the coin is trading around the $ 8,000 mark.

Total market capital: $ 249.5 billion

Market capitalization of Bitcoin: $ 141.4 billion

Dominance of BTC: 56.7%

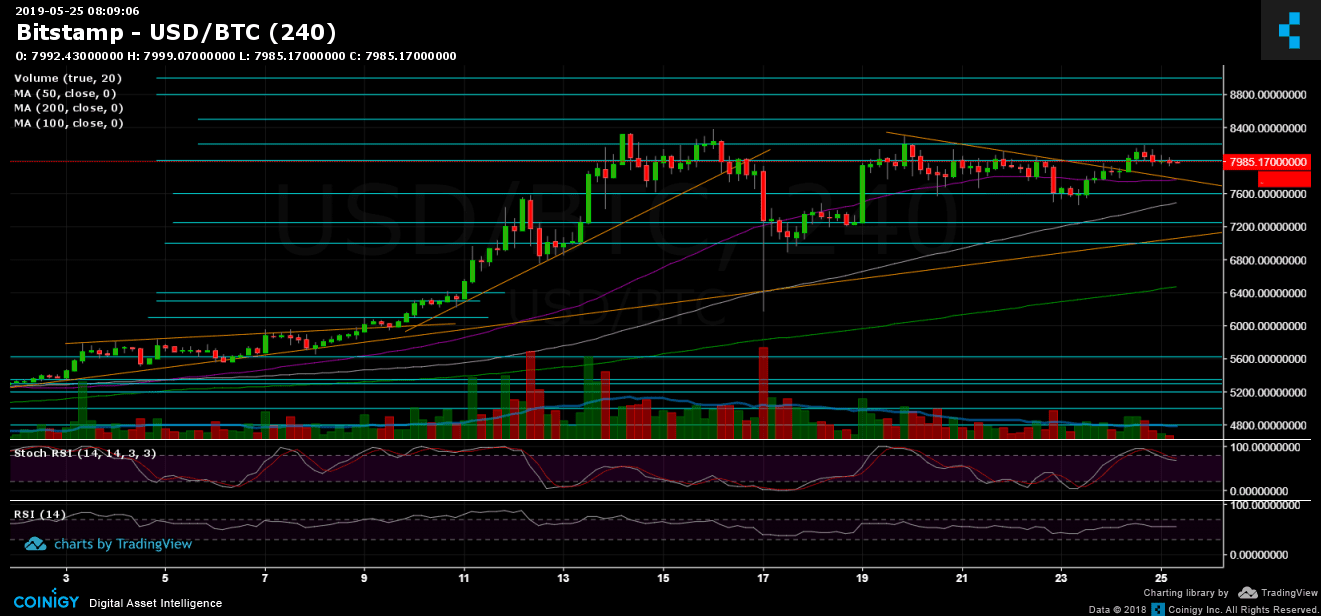

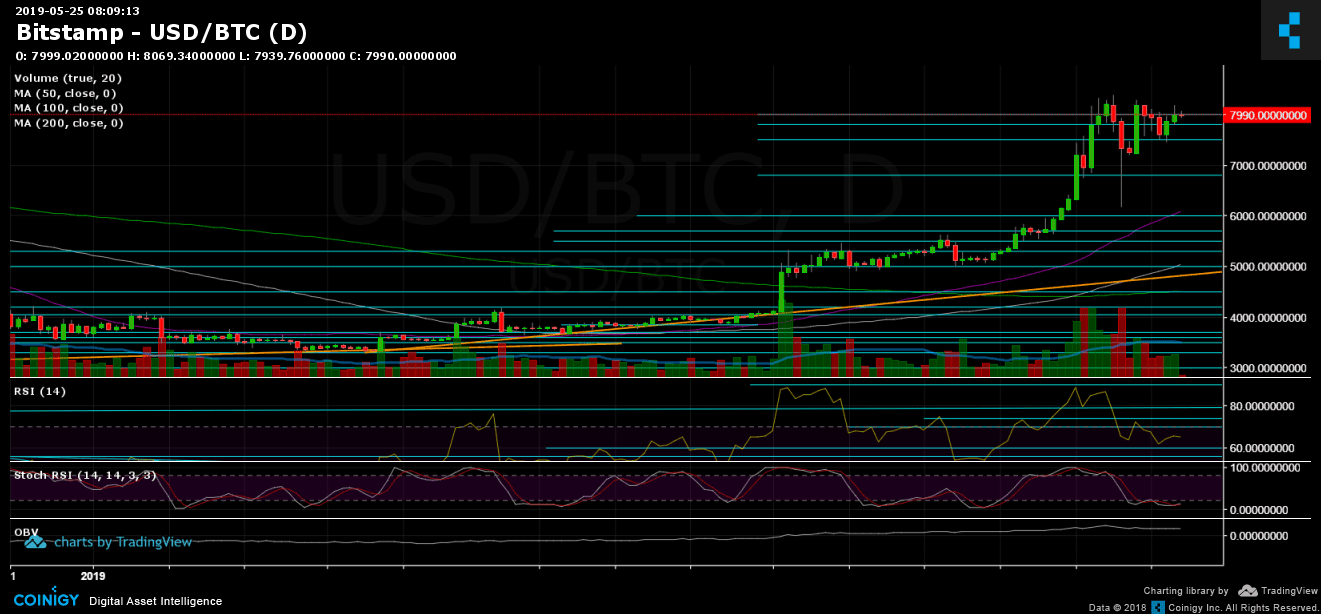

Looking at the 1 day and 4 hour charts

– Support / Resistance:

As mentioned, Bitcoin is trading around the $ 8,000 mark. The $ 8,200 bar then the top of 2019 at $ 8400 (which has been dismissed twice so far). The next goals or possible resistance levels are $ 8500, $ 8800 and $ 9000. Additional resistance is between $ 9,600 and $ 10,000.

From below, the nearest support is at this current price level. Below you'll find the $ 7,800 before going to support $ 7,600. The next major area of support is between $ 7200 and $ 7300. Below is the $ 7,000 zone.

– Trading volume: following the above, we can see that the volume is not significant. The direction for the future had not yet been decided.

– RSI of the daily chart: the fall below USD 7,500 is reflected on the RSI, the indicator having fallen to 60 where he found support. The RSI is now around 64, which is relatively low compared to 2019, but still bullish.

A bullish sign could come from the stochastic oscillator RSI, as it was recently in the oversold zone.

– Open short positions of BitFinex: there are 19 open short positions of BTC.

BitStamp BTC / USD Chart over 4 hours

BTC / USD BitStamp 1 Day Chart

CryptoPotato video channel

[ad_2]

Source link