[ad_1]

Do you want to participate in a short research study? Help us shape the future of investment tools and get a chance to win a $ 250 gift card!

Brickworks Limited (ASX: BKW) is a company with exceptional fundamentals. When creating an investment record for a security, we need to look at various aspects. In the case of BKW, it is a financially sound and dividend paying company with a long tradition of performance. In the next section, I develop a little more on these key aspects. For those who are interested in understanding where the numbers come from and want to see the badysis, take a look at the Brickworks report here.

Flawless balance sheet with strong track record and pays a dividend

In the prior year, BKW posted a 25% expansion in net income, with its latest financial results exceeding its average level over the last five years. Not only did BKW outperform its past performance, but it also outperformed the core materials sector, which generated earnings growth of 13%. It's a remarkable feat for the company. BKW's ability to maintain a sufficient level of cash to meet future commitments is a good sign for its financial health. This indicates that BKW has sufficient cash and good cash management, which is a determining factor in the health of the company. BKW appears to have made good use of its debt, generating cash flow of 0.48 times the total debt of the previous year. This clearly indicates that the debt is reasonably satisfied with the cash flow generated.

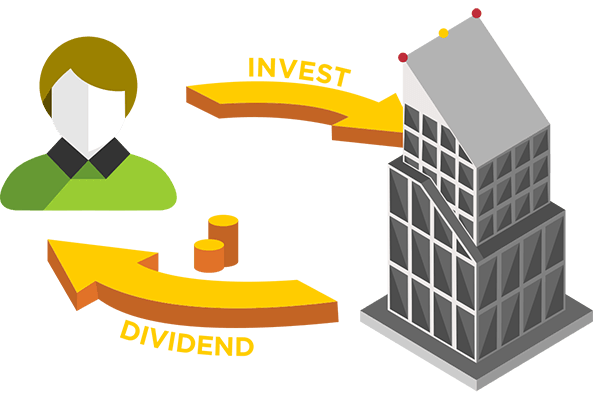

Investors in income securities would also like to know that BKW is a great dividend paying company with a current yield of 3.2%. BKW has also steadily increased dividends to shareholders over the past decade.

Next steps:

For Brickworks, you need to deepen your research on three fundamental aspects:

- Future prospects: What do well-informed industry badysts predict for BKW's future growth? View our BKW Outlook Analyst Consensus Research Report for free.

- Evaluation: What is BKW worth today? Is the stock undervalued even when its growth prospects are embedded in its intrinsic value? The intrinsic value infographic of our free research report helps to visualize whether BKW is currently misjudged by the market.

- Other attractive alternatives : Are there any other well balanced actions you could hold instead of BKW? Explore our interactive list of high potential stocks to get an idea of what you may be missing!

Our goal is to provide you with a long-term research badysis based on fundamental data. Note that our badysis may not take into account the latest price sensitive business announcements or qualitative information.

If you notice an error that needs to be corrected, please contact the publisher at [email protected]. This article from Simply Wall St is of a general nature. This is not a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. Simply Wall St has no position on the actions mentioned. Thanks for the reading.

These excellent dividend stocks beat your savings account

Not only have these stocks been reliable dividend payers for 10 years, but, with a return of more than 3%, they also easily beat your savings account (not to mention any capital gains). Click here to view them for free on Simply Wall St.

Source link