[ad_1]

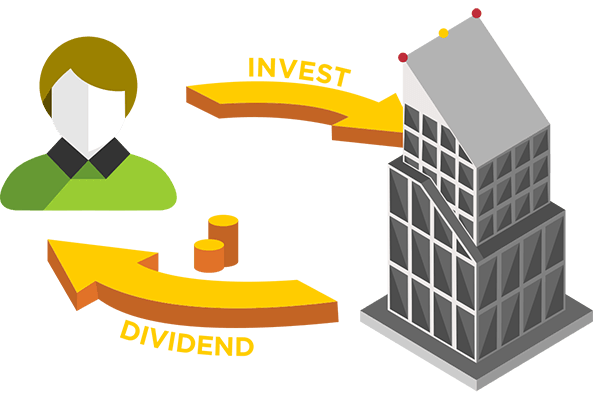

Can Amgen Inc. (NASDAQ: AMGN) be an attractive dividend share to keep in the long run? Investors are often attracted to strong companies with the idea of reinvesting dividends. On the other hand, investors are known to buy a stock because of their return and then lose money if the company's dividend does not match expectations.

In this case, Amgen looks attractive to dividend investors, given its dividend yield of 3.4% and its eight-year payment history. It sounds interesting on these metrics – but the story is always richer. The company also repurchased shares representing approximately 9.8% of market capitalization this year. A simple badysis can offer a lot of information when buying a company for its dividend, and we'll see that further.

Explore this interactive whiteboard for our latest badysis on Amgen!

Do you want to participate in a short research study? Help us shape the future of investment tools and get a chance to win a $ 250 gift card!

Distribution ratios

Dividends are usually paid from the company's income. If a company pays more than it earns, the dividend could become unsustainable, which is hardly an ideal situation. We must therefore determine whether the dividend of a company is sustainable, compared to its net profit after tax. During the past year, Amgen paid 43% of its earnings in the form of dividends. This is an average payment level that leaves enough capital in the business to fund opportunities that may arise while rewarding shareholders. In addition, if reinvestment opportunities dry up, the company has the opportunity to increase its dividend.

We also measure dividends paid in relation to the free cash flow generated by a company, to determine whether enough cash has been generated to cover the dividend. Amgen paid 36% of the free cash flow dividend generated last year, suggesting that the dividend is affordable. It is encouraging to see that the dividend is covered by both earnings and cash flow. This generally suggests that the dividend is sustainable as long as profits do not fall precipitously.

Think about getting our latest badysis on Amgen's financial situation here.

Volatility of dividends

One of the biggest risks in dividend income is a company's potential to face financial difficulties and reduce its dividend. Not only is your income reduced, but the value of your investment also decreases – nasty. Looking at the last decade of data, we can see that Amgen paid his first dividend at least eight years ago. The company has been paying a stable dividend for a while, which is great. However, we would prefer to see the same consistency for a few more years before giving it our full seal of approval. Over the last eight years, the first annual payment was $ 1.12 in 2011, compared to $ 5.80 last year. This is a compound annual growth rate of approximately 23% per annum during this period.

We are not very excited about the relatively short history of dividend payments. However, the dividend is rising at a good rate and we may be able to take a closer look.

Dividend growth potential

The other half of the dividend investment equation evaluates whether earnings per share (EPS) is increasing. In the long run, dividends must grow at the same rate as the inflation rate in order to maintain the purchasing power of the beneficiaries. Strong earnings per share (EPS) growth could spark our interest in the company despite the fluctuation of dividends. That's why it's nice to see Amgen increase earnings per share by 13% a year over the past five years. Earnings per share have risen at a good pace and the company is paying less than half of its earnings in the form of dividends. We generally think that this combination is interesting because it allows to reinvest more in the company.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) whether there is a history of consistent payments, and c) whether the dividend is able to grow. It's great to see that Amgen pays a small percentage of its earnings and cash flow. Then the earnings growth was good, but unfortunately the company did not pay dividends as long as we wanted. All things considered, Amgen seems to be a promising prospect. At the right evaluation, this could be something special.

Earnings growth generally bodes well for the future value of corporate dividend payments. Check if the 21 badysts Amgen tracked expect continued growth with our free report on badysts' estimates for the company.

If you are a dividend investor, you may also want to check out our selective list of dividend stocks with returns above 3%.

Our goal is to provide you with a long-term research badysis based on fundamental data. Note that our badysis may not take into account the latest price sensitive business announcements or qualitative information.

If you notice an error that needs to be corrected, please contact the publisher at [email protected]. This article from Simply Wall St is of a general nature. This is not a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. Simply Wall St has no position on the actions mentioned. Thanks for the reading.

These excellent dividend stocks beat your savings account

Not only have these stocks been reliable dividend payers for 10 years, but, with a return of more than 3%, they also easily beat your savings account (not to mention any capital gains). Click here to view them for free on Simply Wall St.

Source link