[ad_1]

US President Donald Trump announces a new proposal for immigration to the White House Rose Garden in Washington on May 16, 2019.

Mandel Ngan | AFP | Getty Images

President Trump's commercial battles cost the US stock market $ 5,000 billion, according to Deutsche Bank.

Given that the bulk of equity returns come from rising stock prices, in an escalating trade war with China and now Mexico, the US is losing billions of dollars in lost returns as markets drop the media headlines, announced Friday the bank.

"In our opinion, the costs of the trade war relate to its indirect impacts," said Deutsche Bank Chief Strategist Binky Chadha in a note to customers. "The trade war has been essential to prevent a resumption of global growth and keep US equities at the fork." US equity returns lost due to higher prices (average annual rate of 12.5%) for 17 months are worth $ 5 trillion. "

This figure would worsen Friday with the decline of more than 280 points of the Dow Jones Industrial Average.

Earlier this month, Trump said that China had come back on a trade deal about to be signed. Trump then increased tariffs on Chinese goods worth $ 200 billion and China responded with tariffs on imports worth $ 60 billion.

On Thursday, Trump tweeted that on June 10, the United States would impose a 5% tariff on all Mexican imports. The president said the levies will remain in place until illegal migrants stop entering Mexico in the United States.

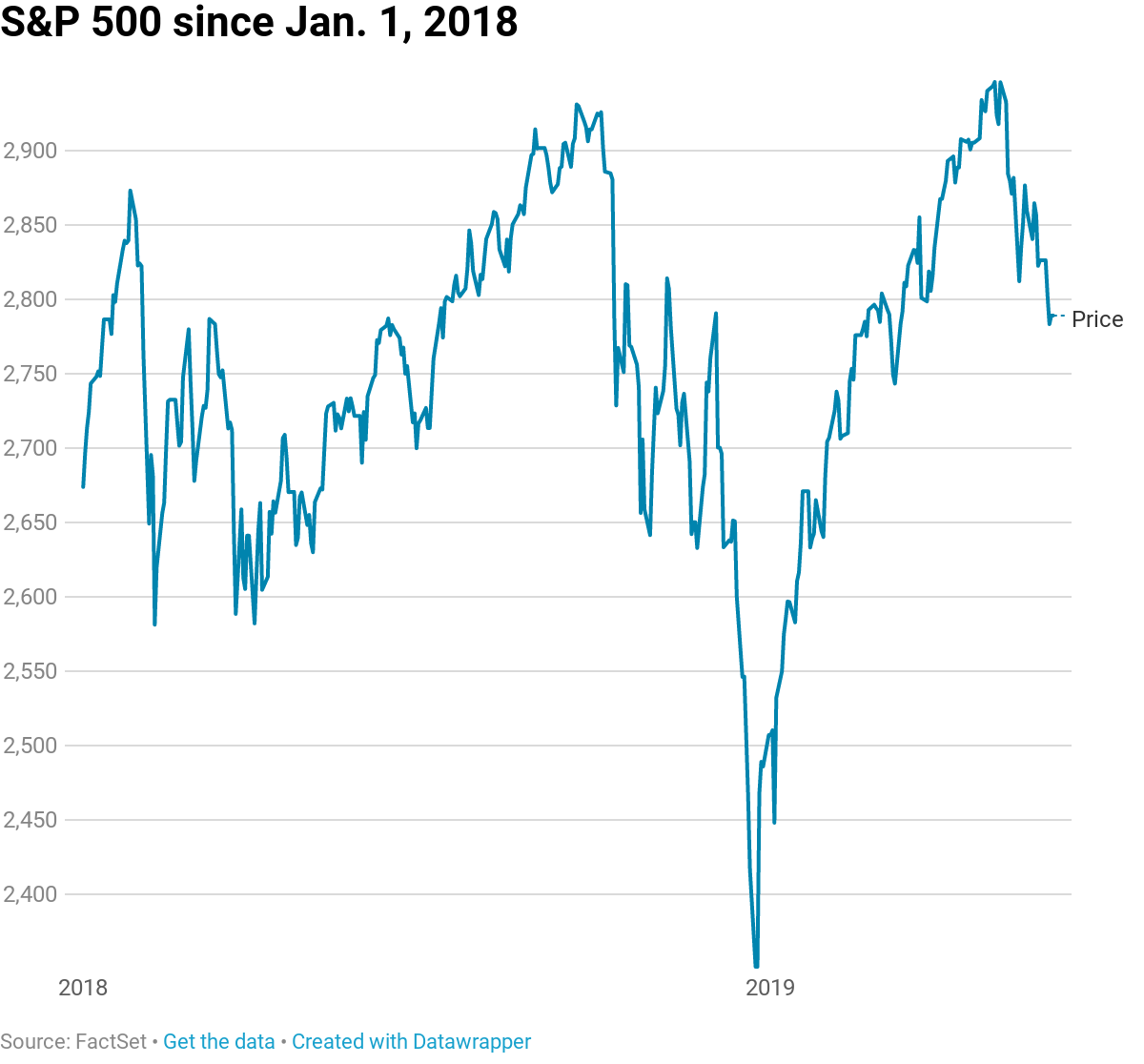

The majority of stock returns resulting from price appreciation range from 75% to 85% and the S & P 500 has shown a clear trend with an annual price appreciation rate of 12.5% since inception from the economic recovery in 2009. However, Mr. Chadha has January 2018, steel and aluminum tariffs, commercial war actions have been linked

"The trade war has played a key role in exacerbating global growth in the manufacturing sector and in preventing a recovery" from factors such as Brexit, the note added.

-Source Deutsche Bank

The S & P 500 is down 5.33% between May and Thursday at close and down 5.6% from its 52-week high.

Chadha said the consequences of the trade war are becoming comparable to the consequences of the European financial crisis and the dollar and oil shocks on US equities.

– With CNBC report Michael Bloom

Source link