[ad_1]

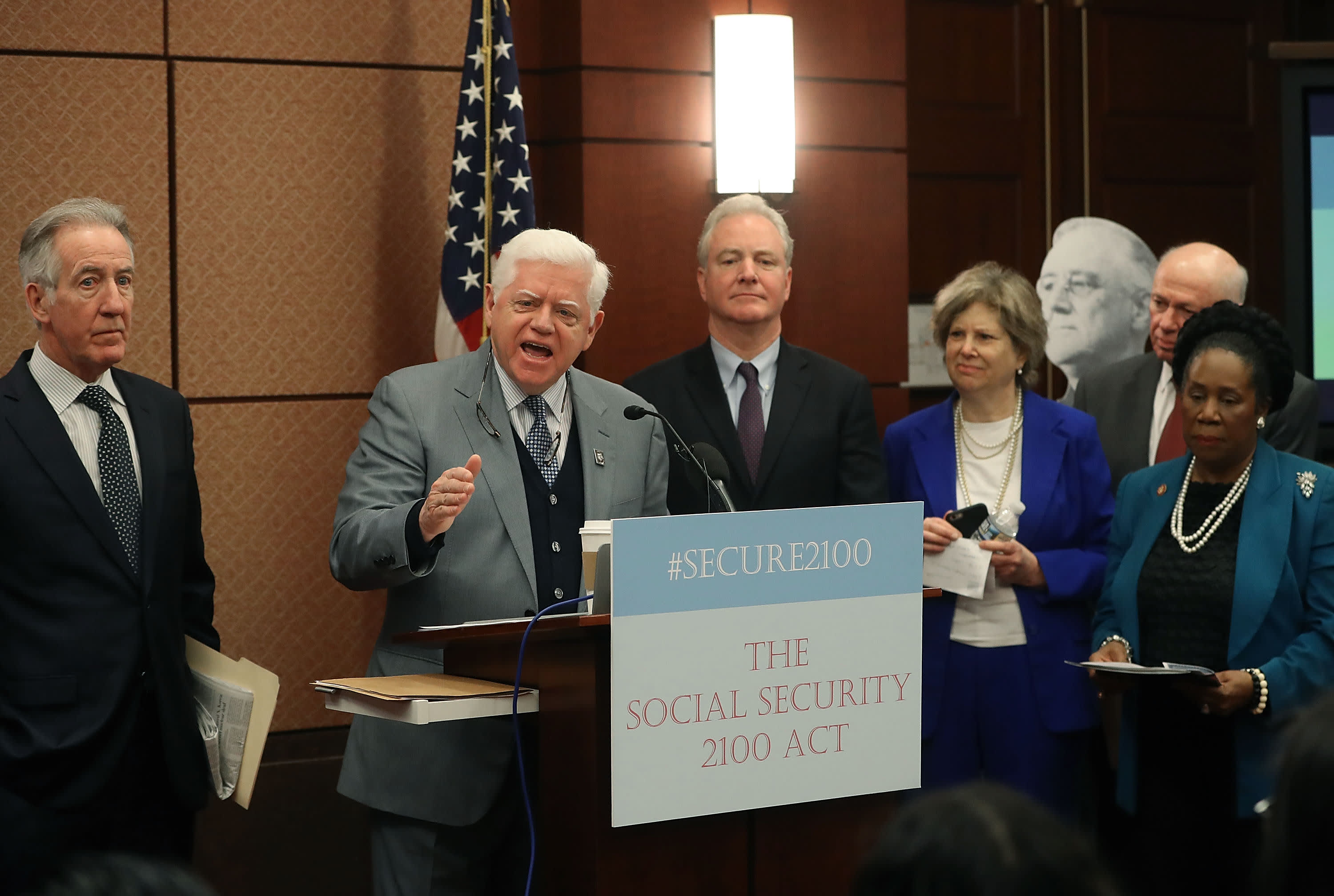

WASHINGTON, DC – Representative John Larson (D-Conn.) Speaks at an event to introduce a bill called Social Security Act 2100. This would increase profits and strengthen the fund during A press conference at Capitol Hill on January 30, 2019 in Washington, DC. (Photo by Mark Wilson / Getty Images)

Mark Wilson | Getty Images News | Getty Images

Most Americans depend on Social Security benefits to earn a living in retirement.

And a big question that haunts them is this: Will these benefits be there for me when I need them?

The Social Security Administration Board announced in April that its reserves would be exhausted in 2035.

This means that if nothing is done up to that point, the system will only be able to pay 80% of the benefits expected for retirees.

"Directors recommend that legislators quickly address the projected shortfalls in trust funds to gradually incorporate the necessary changes and give workers and recipients time to adapt to them," said Nancy A. Berryhill. , Acting Commissioner for Social Security, statement.

There are proposals to strengthen the system, including the Social Security Act 2100, led by US Representative John Larson (D-Conn.). But some are wondering if the Congress currently has the appetite to make the necessary changes.

It would be really a bit devastating for the economy, the country if social security disappeared, disappeared

Jamie Hopkins

Director of Retirement Research at Carson Group

This is happening even as legislators may be on the verge of adopting the most important law on pension reform since 2006. This new law, called the Secure Act, would change the distribution rules of the IRA and make pension plans 401 (k) more accessible for some American workers.

Proposed changes

The Social Security Act 2100 extend the solvency of the program to the next century. At present, the bill has more than 200 co-authors.

This is one of the many proposals that have been made over the past five years to address social security and health insurance, according to Jamie Hopkins, director of retirement research at Carson. Group.

"The Social Security Act 2100 is probably the only one really attracting attention and support," Hopkins said.

The proposal would give those who receive or receive benefits a salary increase equivalent to 2% of the average benefit. This would change the formula on which annual cost of living adjustments are calculated, instead using the consumer price index for seniors as an indicator of retiree spending. This would also set the new minimum benefit at 25% above the poverty line.

Weekly tips on managing your money

Receive this in your inbox and more information about our products and services.

By subscribing to newsletters, you agree to our Terms of Use and Privacy Policy.

The plan would also increase the limit for non-social security income before benefits begin to be taxed. The new limits would reach $ 50,000 for individuals and $ 100,000 for couples, up from the current thresholds of $ 25,000 and $ 32,000.

In order to pay for these changes, the bill provides for an increase in payroll taxes on salaries over $ 400,000. Salaries of up to $ 132,900 are currently taxed.

It also calls for an increase in the social contributions of workers and employers. This rate would increase from 6.2% to 7.4% and be phased in from 2020 to 2043. For the average worker, this would cost about 50 cents more per week.

The plan is supported by advocates for social security reform, including the National Committee for the Preservation of Social Security and Medicare.

"We really support many of the ideas that have been incorporated into the bill for quite some time," said Max Richtman, president and chief executive officer of the organization.

Obstacles to progress

The House Ways and Means Committee held hearings on social security this year.

Richtman, who testified before the committee, said he hoped to get a full committee vote on this before the parliamentary recess. From there, he would go to the House and, hopefully, be picked up by the Senate.

Senators Richard Blumenthal (D-Conn.) And Chris Van Hollen (D-Md.) Are supporters. Senator Bernie Sanders (I-Vt.) And Representative Peter DeFazio (D-Ore.) Also introduced their own separate social security bill earlier this year.

Hopkins said he saw a difficult challenge for lawmakers trying to enact these changes. This is due to the fact that there are not enough cuts in the system, he said, such as benefit ceilings or tax cuts that would be needed to support Republicans.

More Personal Finance:

Bipartisan pension bill clears House and moves closer to law

The expected deficit of social security will not be an obstacle to expansion, say defenders

Are you afraid of running out of money at retirement? This score can help badess your risk

"It could be pbaded in the House this year," Hopkins said. "But at least in the current composition, he would die in the Senate without adding features."

The other challenge is to bring Congress to make the necessary radical changes, according to C. Eugene Steuerle, a member of the Institute and president of Richard B. Fisher at the Urban Institute.

For example, the main cost element of the Secure Act is raising the age requirement for the required minimum distributions, which will eventually total about $ 1 billion a year, Steuerle said.

Meanwhile, social security costs are expected to increase by about $ 500 billion, from $ 1 trillion in 2019 to $ 1.5 trillion in 2029.

"Right now, there is this refusal to deal with the problem as a whole," said Steuerle. "It's going to take a crisis, and even in a crisis, we'll have to show leadership."

& # 39; Too big to fail & # 39;

This brings us back to the question: Will social security benefits still be available to retirees?

The experts said that the answer to this question is a definitive yes, although they will be reduced unless some reform.

"Social security and health insurance will be at the rendezvous, it is simply that the promised growth rate in these systems is unsustainable," said Steuerle.

For about one-third of pensioners, social security is their only source of income. And for about two-thirds of retirees, social security accounts for more than half of their income.

"It would be really a bit devastating for the economy, the country, if social security disappeared, disappeared," Hopkins said.

Social security, the government's biggest public spending from year to year, is too heavy to fail, he said.

"It needs to be updated, but otherwise it works extremely well," said Hopkins. "He has never missed payment in 80 years of existence."

Source link