[ad_1]

The Nasdaq Composite fell on Monday, the first trading day of the month, as investors worried about tougher regulations in the tech sector.

The technology index fell 0.7% as Google's parent alphabet lost more than 6%. This drop has allowed Alphabet to experience its biggest drop in a day since April 30th.

According to Alphabet, the Justice Department is preparing to launch an antitrust investigation on Google. Facebook shares fell by 3.8% as news sparked fears that the social media company would also be hit by tighter regulation.

The enlarged market, however, increased slightly. The Dow Jones Industrial Average rose 73 points, while the S & P 500 index rose 0.2%. But these gains have been contained after the publication of weak data on manufacturing in the United States, while China's rhetoric on US trade relations is intensifying.

US manufacturing activity in the United States fell last month at its slowest pace since October 2016, according to data from the Institute for Supply Management. The pace of expansion has also disappointed economists surveyed by Refinitiv. Inventories fell to their lowest level after the release of the data.

Chinese Vice Minister of Commerce Wang Shouwen said Sunday in a white paper that Washington could not press for a trade deal in Beijing. He also declined to say whether leaders of both countries would meet at the G20 summit to develop an agreement later this month.

Wang added, "The United States has gone back and when you give them an inch, they want a meter."

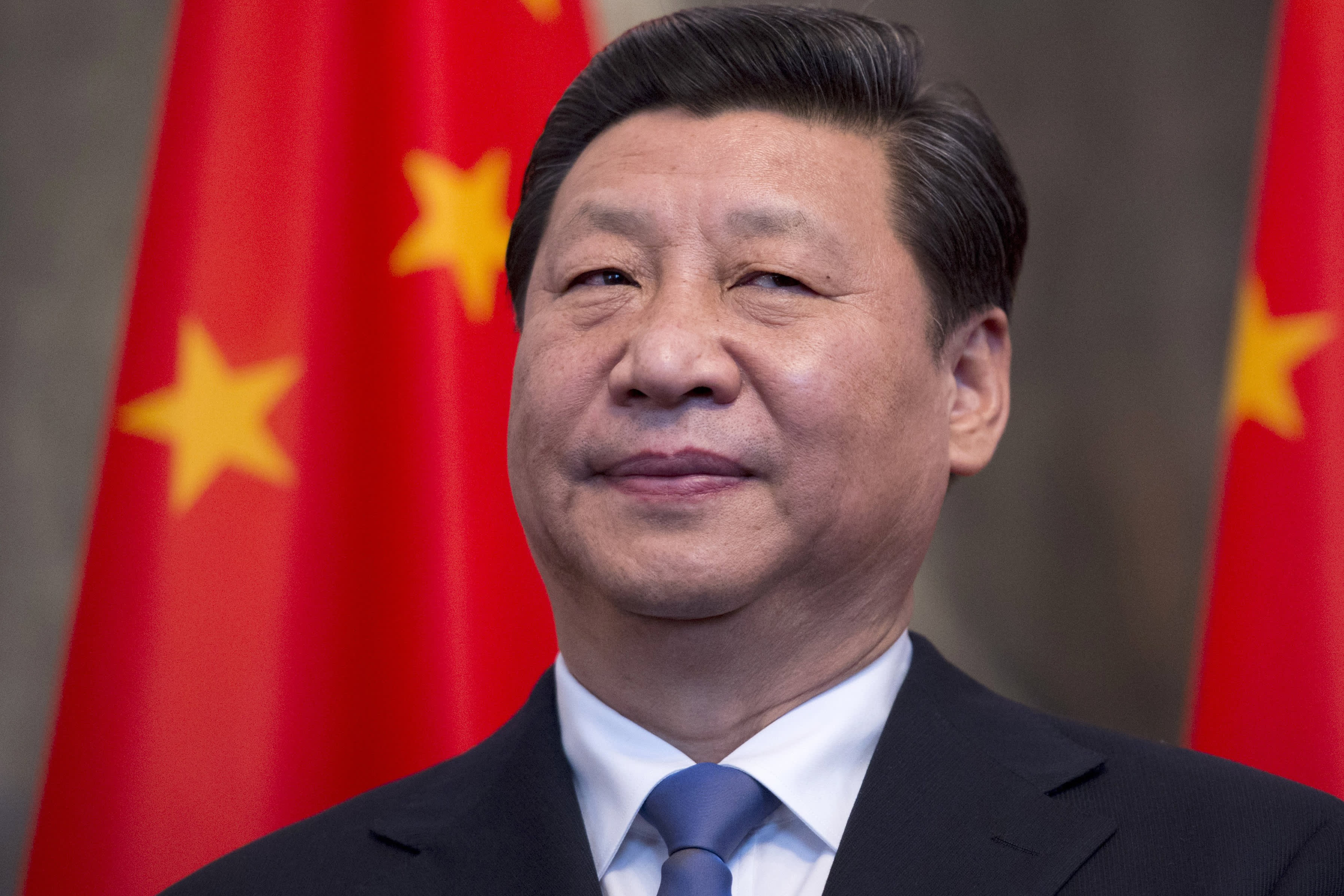

Chinese President Xi Jinping stands in front of national flags.

Johannes Eisele | AFP | Getty Images

Wang's remarks follow a month of increased trade tensions among the world's largest economies. The United States increased tariffs on Chinese goods worth $ 200 billion in May. China has responded by increasing tariffs on imports from the United States.

"This problem with China continues to be the big elephant in the room," said Randy Frederick, vice president of trading and derivatives at Charles Schwab. "If both parties, China and the United States, fail in these negotiations, we could see a correction of 10%, we are already halfway and the talks are not broken yet."

"There are just not many things that stimulate the market, so this issue continues to be the pivot," said Frederick.

Shares of Boeing, a leading global merchant, fell 2.6%.

The benchmark 10-year US yield has fallen to 2.071%, its lowest level since September 2017. The gold price has reached its highest level since late March, exceeding US $ 1,320.

Trade concerns also shook Wall Street last week after President Donald Trump threatened to impose a 5% tax on all imports from Mexico. The threat caused a fall in stocks on Friday.

Major indices fell more than 1% each Friday, ending a torrid month for Wall Street. Inventories recorded their first monthly decline in 2019, breaking with a series of consecutive four-month wins.

-Sam Meredith from CNBC contributed to this report.

Source link