[ad_1]

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

A burst of weaker economic data than expected in Germany this morning has heightened fears about the health of the global economy.

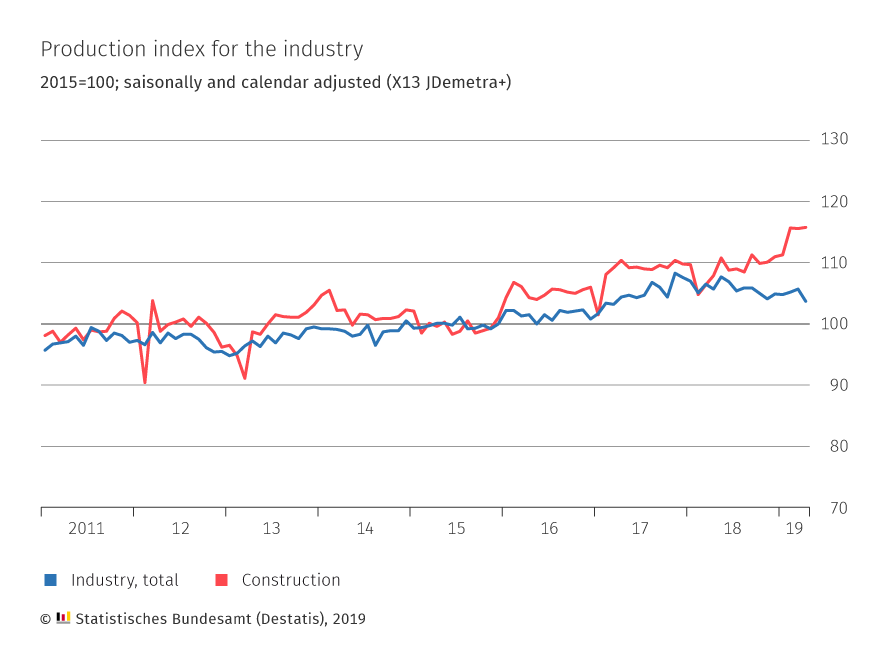

German industrial production fell 1.9% in April, data firm Destatis reports. This is much worse than the 0.5% drop expected by economists.

This means that production was well down 1.8% from that of a year ago, before Germany began to slide into a near-recession.

Demand for capital goods dropped sharply, down 3.3%, a sign that customers were reluctant to engage in expensive new equipment. Production of consumer goods decreased by 0.8% as intermediate goods fell 2.1%. The decline has been generalized.

New Destatis

(@Destatis_news)#Production in April 2019: -1.9% seasonally adjusted compared to the previous month. https://t.co/opIbrUPKAH pic.twitter.com/nq1nA0v5Du

Such a poor performance of Europe's biggest economy is a blow. This partly explains why the European Central Bank appeared rather gloomy on Thursday, as it was committed to leaving interest rates at their current lowest for at least another year.

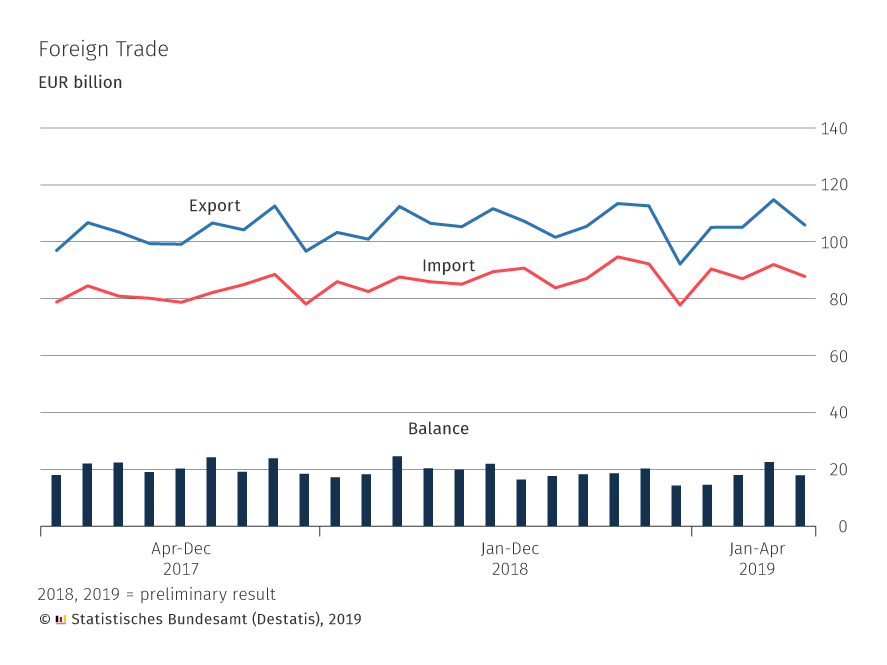

But that's not all! Separate data show that German exports fell by 3.7% in April, which according to Reuters is the biggest drop since August 2015.

Imports also fell by 1.3%, reducing Germany's traditional trade surplus to € 17.9 billion from € 20.4 billion a year ago.

New Destatis

(@Destatis_news)German exports in April 2019: -0.5% in April 2018. https://t.co/RMD97t1sKc #trade pic.twitter.com/NZf0N91MDP

All indications are that the trade war between the United States and China and the slowdown in growth in the euro area in recent quarters continue to weigh on Germany, which is not a problem. a good sign for growth prospects this year.

Reaction to follow!

Also coming today

Investors around the world are waiting for the latest report on unemployment in the United States, to be released in the UK at lunchtime.

May's non-farm payroll is expected to show that 175,000 new jobs were created last month, up from 263,000 in April. The unemployment rate is expected to remain stable at 3.6%, while average hourly earnings are expected to rise slightly to 0.3% m / m from 0.2% in April.

But the NFP is notoriously unstable and difficult to predict. A bad report could exert more pressure to reduce US interest rates, as London Capital Group's Jasper Lawler explains:

The short-term direction for the markets depends on the opening or closing of the gate. If the NFP were to be disappointed, expectations of a reduction from the Fed as soon as June or July could increase.

The FedWatch CME reports that markets are seeing a 22% rise in June and a 55% increase in July.

L & # 39; s calendar

- 8:30 BST: Halifax Real Estate Prices Survey for the UK for May

- 1:30 pm Paris time: US non-agricultural payrolls report for May

[ad_2]

Source link