[ad_1]

Oil prices have been crushed by concerns over weak demand and the slowdown in the global economy, but the market could begin to take on larger geopolitical risks if there is more from attacks like that of a tanker on the oil tanker Thursday in the Gulf of Oman.

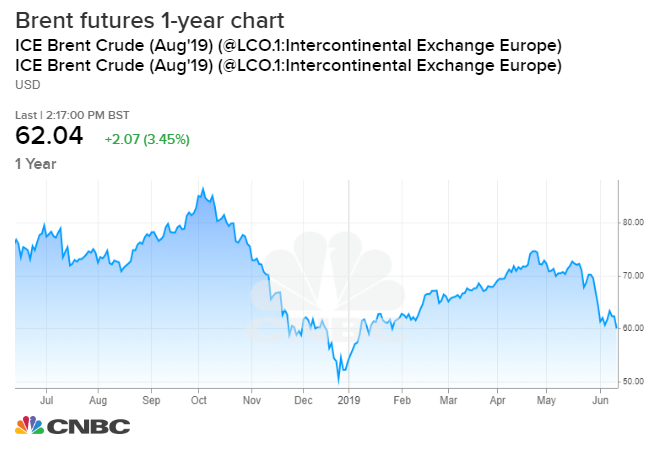

Even though badysts say that oil could rise because of tensions in the Middle East, they could also fall to a range of 50 to 80 dollars for Brent, if fears of trade war darken economic prospects of oil buyers.

"I would not say we're already at a tripwire, but we're getting there," said John Kilduff, a partner with Again Capital. Kilduff said the oil would hit $ 50, until the announcement of the attack. It was also expected that if the situation in the Middle East intensified, the price of crude oil could reach $ 100.

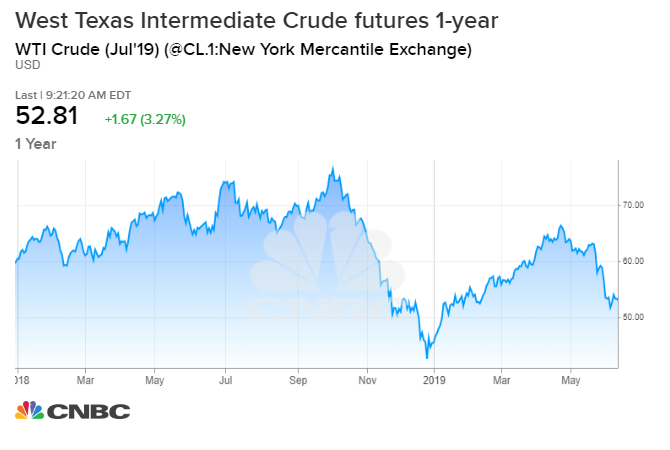

After losing 4% Wednesday as a result of concerns over oversupply, the crude oil futures contracts rebounded 2% on Thursday, signaling that oil tankers had suffered significant fire-related damage in the United States. the gulf of Oman. It's the second attack of this type in a month or so. It is unclear who attacked the ships near the entrance to the Strait of Hormuz, the busiest oil transportation routes in the world. West Texas Intermediate crude futures were trading at $ 56.25 a barrel and Brent crude prices in May at $ 61.13.

"You are in the years at $ 60 or $ 80. If the economy is based on trade wars, the economy is in free fall," said Helima Croft, head of global strategy for commodities at RBC. "It's the binary nature of this market." According to her, a major geopolitical incident could raise the price of Brent to $ 80, especially if business concerns disappear.

A good meeting between President Donald Trump and Chinese President Xi Jinping at the G-20 later in the month could also be good for oil, if that indicates a trade agreement, she said.

"I think oil traders do not know how to handle the Iranian risk, but they know how to conceptualize a trade war that destroys demand." In the Middle East, they can not distinguish between noise and the edge. a shooting war, "she said. "The summer is going to be this: what war will dominate the market? A trade war or a deadly war?"

US Secretary of State Mike Pompeo said Iran was behind Thursday's attack and other attacks in the region. The two ships that were Kokuka Courageous, a loaded chemical tanker in Saudi Arabia, were en route to Singapore and the Altair Front. The Altair Front carried a cargo of naphtha, a petrochemical raw material, from the Persian Gulf to Japan.

The geopolitical premium has also become a less important factor in the market, since oil production in the United States has become a dominant force in the global market. The United States is now the world's largest oil producer, producing 12.3 million barrels a day last week, about 1.5 million barrels a day more than last year.

"Procurement in the United States has become a firewall against geopolitical events," said Kilduff.

But badysts say the market has ignored the potential for further attacks on oil badets in the Middle East, even as US sanctions undermine the Iranian economy and limit its ability to sell oil. Despite this, Brent is down about 18% since the end of April.

"This is a factor that the sale of the market has ignored," said Morse. "The world is relatively fragile and we could see an increased likelihood of a decline in production generated by political events rather than economic tensions, and this could be Iran. It could be Libya, it could be Nigeria It could be Venezuela. "

Morse said that these factors could push up the rise in oil this summer and in the fall. He also said that sentiment would count and that negative news about the trade war could weigh on the market.

"[Brent] Oil is expected to reach $ 75 before reaching $ 50, "said Morse.Brent should be more sensitive to geopolitical concerns than WTI, which reflects the US market and where stocks are being built visibly in the data. The price of Brent and WTI prices may continue to expand temporarily.

A number of other attacks have recently occurred, including a missile attack on Wednesday that hit the arrival hall of an airport in southwestern Saudi Arabia, making 26 wounded. Houthi rebels would be behind this attack and others. Last month, a drone attacked a Saudi oil pipeline, temporarily putting it out of service. The Houthis, who would be backed by Iran, fought against Saudi Arabia in Yemen after chasing the Yemeni government in 2015.

"We will have more … As long as we have put in place crippling sanctions that, in their opinion, are intended to cause economic collapse and regime change, they will not back down, I think it's going to be a hot summer. "Croft said.

Croft said it would be important to see if European leaders are able to work with Tehran to find a way to mitigate the impact of US sanctions and prevent it from giving up nuclear agreement with the United States and five other countries. The Trump administration dropped the deal, calling it unilateral and reinstating sanctions against Iran last year.

Iran threatened to go away, though there was no resolution by 7 July. It could then go back to enriching uranium, to levels closer to the quality of the weaponry.

"The question is: will it be a nuclear summer?" said Croft.

The incident occurred while Japanese Prime Minister Shinzo Abe was in Tehran to conduct talks aimed at easing tensions between Iran and the United States.

"Abe is in Tehran to try to get a ramp out and a Japanese tanker is hit, for me it shows at least the challenges of finding a diplomatic solution, as long as the United States is pushing coercive diplomacy, "says Croft.

Morse said that the offer outside the United States is restricted. He added that the world market is particularly poor in high quality crude produced by Iran and Venezuela, both subject to US sanctions. More than 1 million barrels of Iranian oil were removed from the market by US sanctions.

"There are two differences, one is the discrepancy between the physical side and the demand, and there is a divergence between the American side and the rest of the world," he said. The United States added 53 million more barrels of commercial storage than at the same time last year.

"In the meantime, OPEC Plus has decided not to put more oil on the market," Morse said. OPEC, plus Russia, should maintain its agreement to curb production.

Source link