[ad_1]

While other economic signs may weaken, Americans still have confidence in their job prospects.

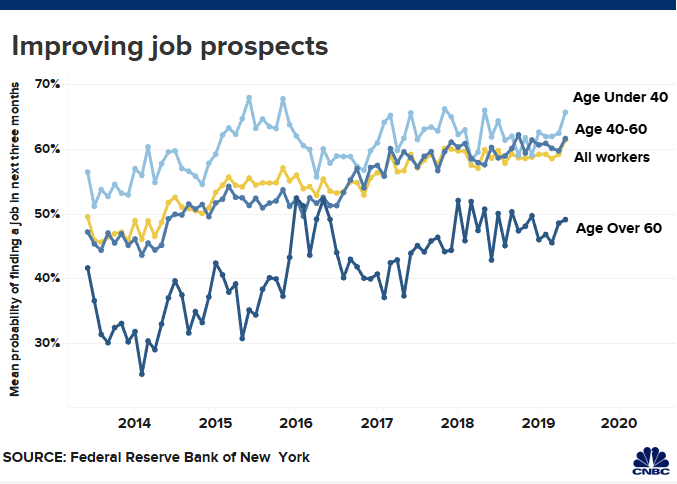

A recent survey of consumer expectations from the New York Federal Reserve showed that workers' confidence in looking for a new job after losing their current job was 61.5% in May, an increase compared to 59.3% in April and the highest level since the central bank started following 2013.

In addition, the increase in confidence was better for people with incomes below $ 50,000, a key cohort as policymakers seek to bridge the wealth gap that opened up after the financial crisis. .

Earnings growth forecasts also increased, increasing by one-tenth of a point to 2.5% and the average probability that respondents voluntarily leave their jobs in the next 12 months – another sign of worker confidence – has pbaded. from 20.3% to 21.2%.

The numbers came in the middle of a cascade of conflicting data.

Manufacturing numbers have recently been low, and May's non-farm payroll has also been disappointing. Consumer spending has meanwhile strengthened, but the number of economists forecasting a recession over the next few years has continued to grow.

The Federal Reserve is struggling with cross currents as it prepares this week to signal the direction that interest rates are going to take.

"Historically, economists never see turning points – at turning points you get conflicting data," said Joe LaVorgna, Chief Economist for the Americas at Natixis. "When the economy is booming, it's not uncommon that some [data] series to move to the south and other series to move northward ".

The Federal Open Market Committee on Policies is expected to keep rates steady at the two-day meeting that will end on Wednesday, but could announce future rate cuts. Markets are expected to decline by a quarter point in July followed by another in September and possibly a third move as early as December.

Low inflation is one of the reasons the Fed could soften its policy.

The New York Fed's consumer survey showed that three-month inflation expectations were 2.6% and 2.5% year-on-year, the two lowest since late 2017. The bond market is also looking for low inflation and a possible period of negative growth somewhere In the near term, short-term government bond yields now outweigh those of extreme rates, a phenomenon known as the inverse yield curve. , which is a reliable indicator of the recession.

"The markets are sending you an end-of-the-cycle message, not just in the yield curve, but also if you look at what drove the IPO," LaVorgna said, citing the outperformance of defensive stocks.

Source link