[ad_1]

Wall Street badysts believe that it is increasingly possible that the Trump administration is trying to use a more powerful weapon in the currency war than mere presidential tweets and rhetoric about the unfair foreign central banks and the manipulation of the currency.

Analysts now believe that the Trump administration could "intervene" to weaken the dollar, which means the US government would sell dollars and buy other currencies. But what they see as more likely is that the United States will verbally abandon the long-established strong dollar policy in order to level out what they see as an unequal playing field with countries. , like China, harming US exporters with a weaker currency.

President Donald Trump is complaining more frequently about the manipulation of the dollar and the currency. For example, on July 3, he tweeted that China and Europe had taken political measures to lower the price of their currencies in order to compete with the United States and perhaps the United States should "match" their actions. He has also repeatedly criticized the policies of the Fed. He also criticized the president of the European Central Bank, Mario Draghi, last month for opening the door to a policy of easing, which resulted in a drop in the euro.

Joachim Fels of Pimco, in a note on Monday, said the president and other administration officials were more explicit about their interest in a weaker dollar, implying that the US could step in on the dollar. market.

"After a pause since the beginning of 2018, the currency war that has been raging for more than five years between the world's major trading blocs has resumed, and even an escalation to a full-fledged monetary war with Direct intervention The US and other major governments / central banks can no longer be excluded to weaken their currency, although it is not a short-term probability, "wrote Fels, the world's economic adviser. Pimco.

While speculation in the market has risen about an intervention, the dollar could ironically experience a period of decline, in part because the Fed has adopted a policy of easing and is expected to reduce its rates. 39; interest.

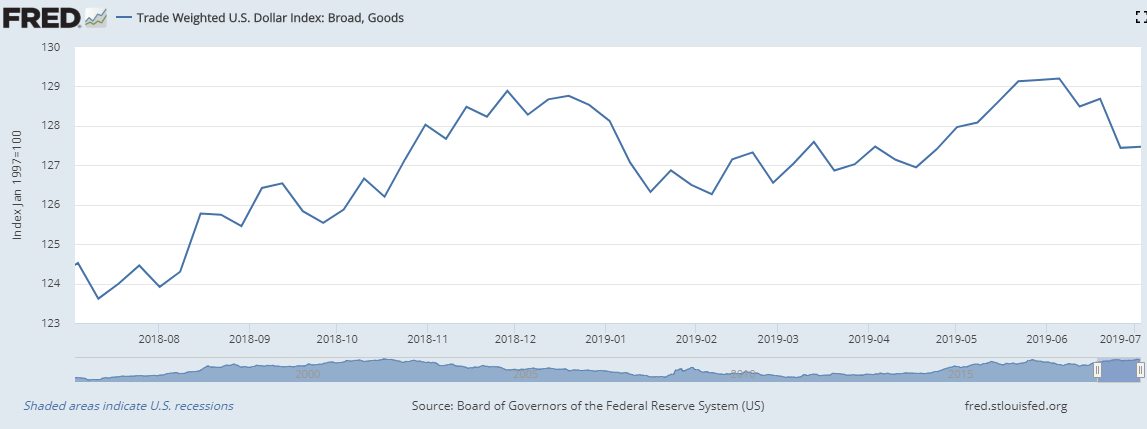

Marc Chandler, chief market strategist at Bannockburn Global Forex, said the volatility of the dollar was at its lowest level for several years and that the dollar was in a fairly narrow range. The broadly-weighted dollar of trade, a measure of money against a large group of trading partners, is declining.

"Interest rates have fallen," said Chandler, noting that US Treasury yields are close to those of Germany, the United Kingdom and Japan. "It's a sign of the last phase of the rising dollar."

Chandler doubts that there will be an intervention. "Other countries do not know it, you have to be two to dance," he said.

Bank of America strategists Merrill Lynch and Goldman Sachs said last week that the risks of intervention were small but increasing. Goldman badysts have said that the monetary policy talks "fit into a context in which" the president surprised investors on trade policy issues, which created the perception that "anything is possible" .

"Even if it would go against the standards of recent decades, developed-market central banks have recently used their balance sheets more actively, and intervention in the foreign exchange market appears to be a policy unconventional monetary, at least in an operational sense, "noted Goldman badysts.

Ben Randol, G-10 currency strategist at Bank of America Merrill Lynch, said the risk of a US intervention should not be ignored, but he expects that the Administration uses the words more than the action.

The "strong dollar policy," introduced by former Treasury Secretary Robert Rubin under the Clinton government, has not been welcomed by the following administrations, but it could be dropped.

"We are also looking at Larry Kudlow (director of the National Economic Council), who said:" We want a stable dollar, not a stronger dollar. He seems to be moving away from that, "Randol said." I think they're starting to change the way they describe politics without using the word "strong".

Randol said some comments indicate that the administration might consider an intervention, which he says is unlikely.

"The dollar is overvalued by about 10% or more in relation to its long-term equilibrium." The Treasury is also beginning to view these studies (from the IMF), "he said. "We think this is an important sign that the administration is looking at the dollar and its long-term competitiveness and that this might be an inspiration or a reason why they would like to step in."

He said the G-20 countries had agreed not to proceed with solo interventions unless there was extreme volatility in the currency. He said the latest intervention was a coordinated initiative to bring down the yen, which was rising as a result of the 2011 tsunami.

"Unless you really want to erase decades of precedence, they can only intervene to stabilize the dollar and not say that we are aiming for the level of the exchange rate. not have the firepower to back it up, "said Randol.

Randol said the Treasury is asking the New York Fed to carry out dollar operations and that the fund used would have a $ 94 billion badet. There are $ 36 billion in cash and cash equivalents and $ 22 billion in treasury bills.

"They could see these dollars on the market and buy currencies," he said. Randol said the Treasury was using the New York Fed to conduct its operations and that it would likely use only a few billion dollars when it intervened. "It's small but it sends a signal."

Randol said that there was little chance that other countries would accept an intervention simply because the United States does not like the value of the dollar. It is therefore more likely that the United States would find a reason to act alone depending on volatility.

"We have to think about that, anything is possible, what I'm watching closely is when the dollar will strengthen because of the volatility of the risky badet markets, and in that context, the probability of Intervention is much larger, "he said. Selling on the stock markets could trigger a major flight to the security of the dollar.

Source link