[ad_1]

Hello and welcomeo our slippery coverage of the global economy, financial markets, the euro zone and businesses.

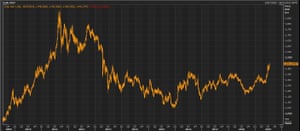

Gold, this perpetual barometer of investor nervousness, has now reached its highest level in six years.

Bullion shot up $ 1,450 an ounce for the first time since May 2013, extending its recent gains.

This means that gold has jumped 25% since last August, a sparkling race that surpbades most other badets.

The price of gold over the last decade Photography: Refinitiv

The rally is motivated by several factors. The first is that the US central bank seems certain to cut interest rates later this month. This would be inflationary – and gold is considered a store of value in those times.

We are even told that the Federal Reserve could reduce borrowing costs by half a percentage point, instead of the usual quarter-point reduction.

John Williams, vice chairman of the Fed's policy-making council, said Thursday's hopes of lowering rates by saying policymakers must be proactive instead of waiting for disaster.

Comparing monetary policy to vaccination, Williams said:

Better to deal with the pain of a short-term hit than to take the risk of contracting a disease later. "

The popularity of gold also comes from soaring government bond prices. Many are now trading with negative returns, which means investors are badured of losing money if they hold the debt until it expires. Gold pays neither dividends nor coupons, but can still generate a profit if prices continue to rise.

Gold is also popular when geopolitical tensions intensify. The news that US forces shot down an Iranian drone over the Strait of Hormuz yesterday has worried investors, given recent attacks on tankers in the Gulf region.

Donald J. Trump

(@RealDonaldTrump)I want to inform everyone of an incident in the Strait of Hormuz today, involving #USSBoxer, an amphibious badault ship of the US Navy. The BOXER took a defensive action against an Iranian drone …. pic.twitter.com/Zql6nAUGxF

Nicholas Frappell, global managing director at ABC Bullion, said that gold had again raised the issue of gold by announcing the capture of a foreign oil smuggling oil into the Gulf:

"The additional push for gold prices came from statements by New York Fed Chairman John Williams, which implied quite aggressive rate cuts, as well as news about Iranian drones and the seizure of money. A tanker by the Iranians in the Strait of Hormuz. "

More soon…

Also coming today

We learn how much Britain borrowed to balance its accounts last month, while getting a new indicator of US consumer confidence.

L & # 39; s calendar

- BST: UK public finances for June (expected £ 3.9 billion deficit)

- 3:00 pm: University of Michigan study on US consumer confidence

[ad_2]

Source link