[ad_1]

Bitcoin volatility continues. Over the past week, as Bitcoin had lost the significant support level of USD 11,200 and the top uptrend line (shown on the daily chart), Bitcoin has become a volatility machine.

The coin fell to $ 9,800 (50-day moving average line), then corrected to $ 11,000, then to $ 9,000 (the lowest since the start of the parabolic race, a new low already pbaded at the lowest previous, at $ 9,600), just to hit $ 10,000 a few hours later. From there, a great day was reduced to $ 9,200 and from there, the incredible 30-minute green candle that finally reached almost the $ 10,800 resistance level.

After that, Bitcoin has redistributed the $ 10,000 zone, but at the time of writing these words, the coin is trading regularly around the $ 10,600 mark of resistance.

What is happening here? Is Bitcoin bearish or bullish?

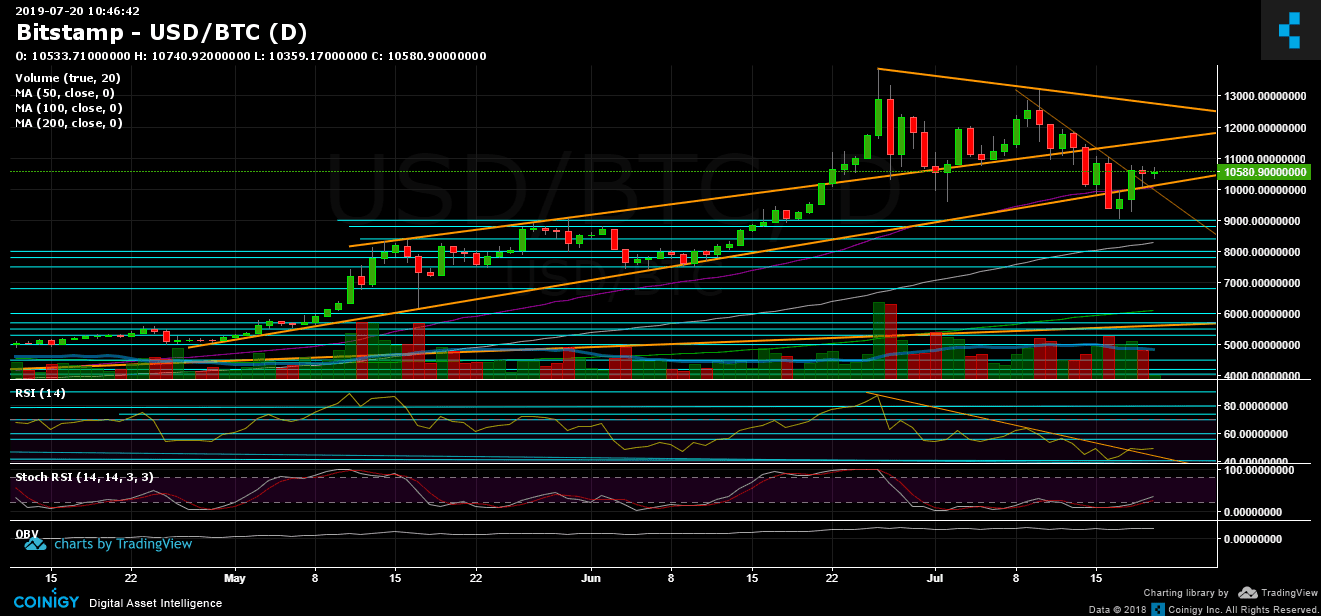

It's a hard question to answer. Looking at the long-term trend line, we can see that Bitcoin has indeed been very bullish since the beginning of 2019.

In the medium term: in the daily chart (in the medium term), we can see that Bitcoin could not beat the supply zone from $ 11,000 to $ 11,200 and until then, it will be difficult to to say that the bulls are in control. Add to that the RSI, which hovers around the 50 levels and goes down in a low and low configuration.

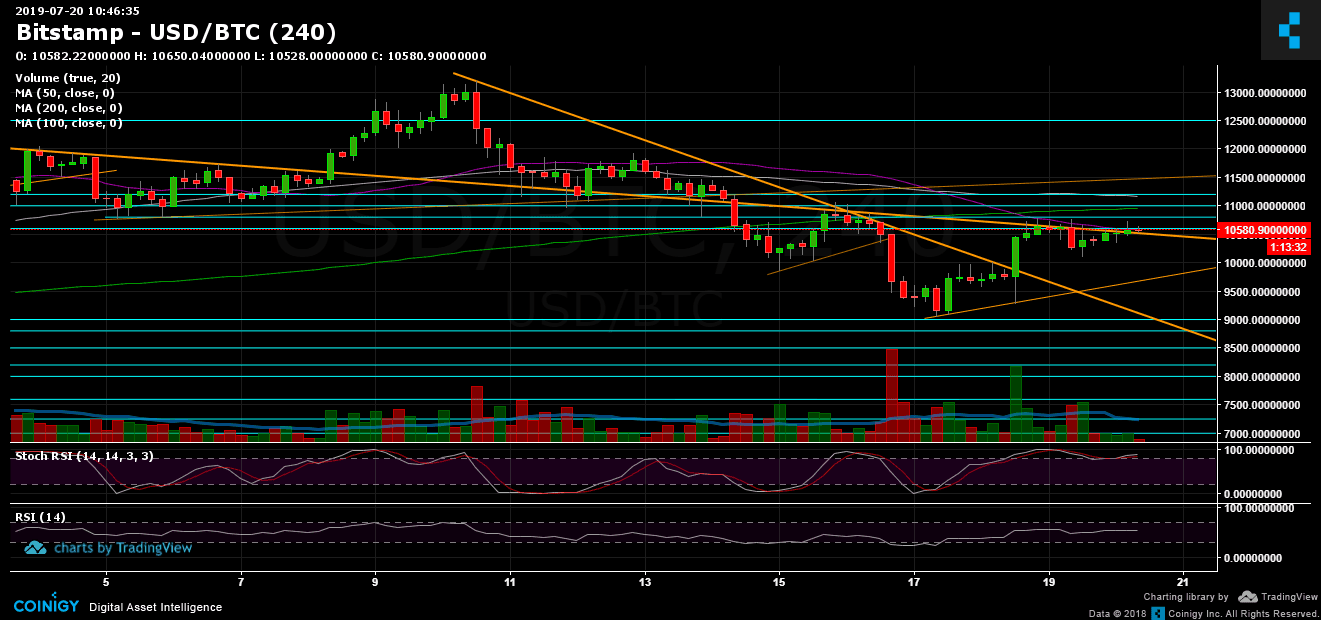

Looking at the 4 hour chart, which is the short-term badysis, we can see that Bitcoin is producing higher lows and is forming a bullish triangle with an opportunity of more than 10,800 USD breakout and a possible goal of $ 12,500.

Adding to this, for traders, such market conditions are difficult to trade. Management could change at any time, with extreme volatility.

Total market capitalization: $ 288 billion

Market capitalization of Bitcoin: $ 188 billion

Dominance index BTC: 65.4%

* Data by CoinGecko

Key levels to watch

– Support / Resistance:

As mentioned above, Bitcoin is now facing a resistance of $ 10,600. The breakup and next level is $ 10,800 before reaching $ 11,000 and $ 11,200. The mid-term upward trend line (which began to form in May 2019) and the large area between $ 11,500 and $ 11,600 are also above. The last and next levels are at $ 12,000, $ 12,200 and $ 12,500.

From below, the nearest support is $ 10,300. Below is the $ 10,000 region and the 50-day moving average line (in purple). $ 9,800, $ 9,600 and $ 9,400. Before reaching the lows last week, between $ 9,000 and $ 9,200.

– RSI of the daily chart: see above. The stochastic RSI oscillator recently generated the expected crossover in the oversold zone and is now entering bullish territory. It can be a bullish indicator of game change for Bitcoin.

– Volume of transactions: The past week has been followed by huge volatility in both directions. Right now, it's hard to tell which candles are the biggest – buyers or sellers.

BitStamp BTC / USD Chart over 4 hours

BTC / USD BitStamp 1 Day Chart

[ad_2]

Source link