[ad_1]

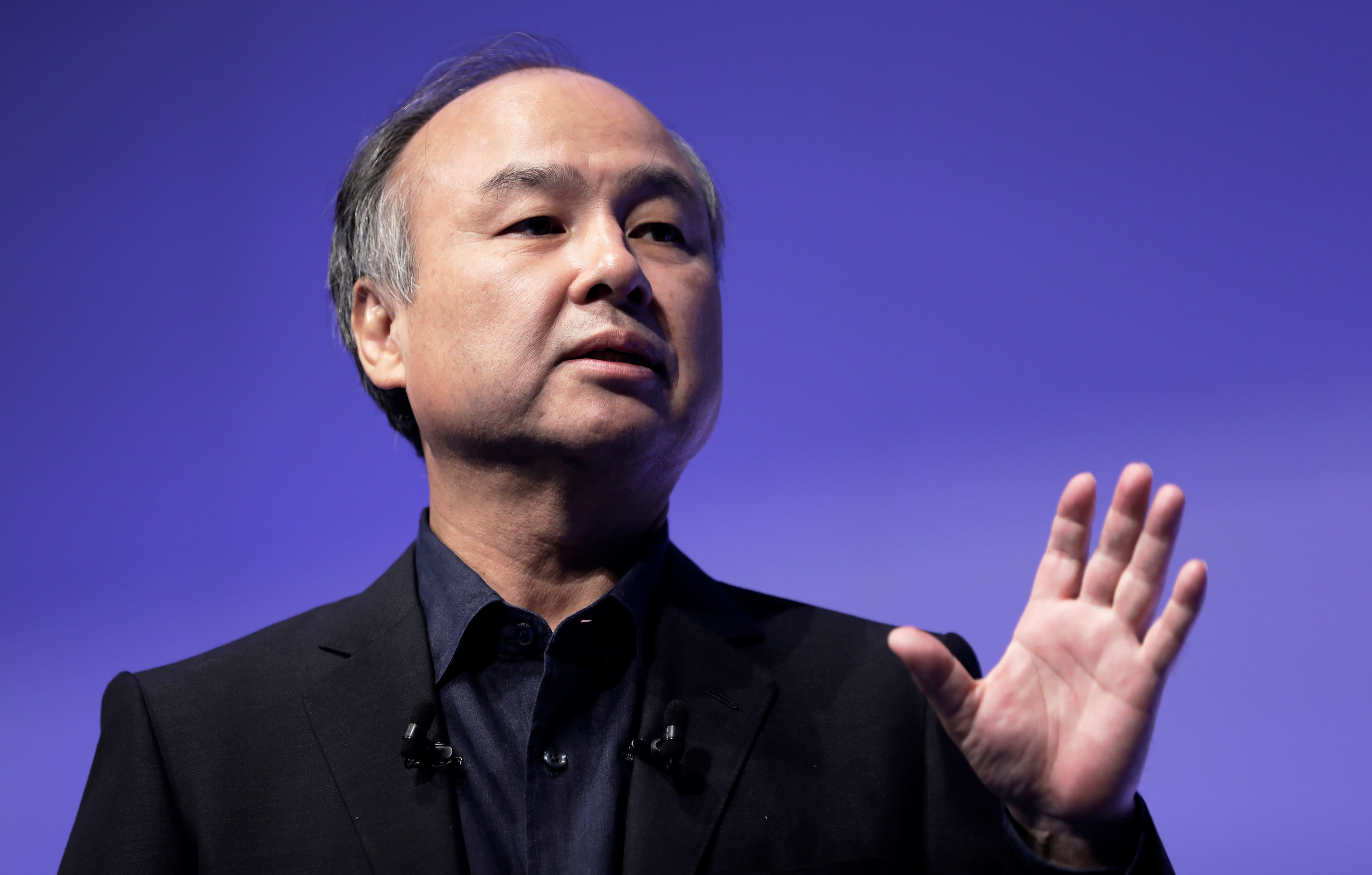

Masayoshi Son, President and CEO of the SoftBank Group at the 2018 SoftBank World event in Tokyo, Japan.

Kiyoshi Ota | Bloomberg | Getty Images

The Japanese conglomerate SoftBank is expected to invest $ 40 billion in its second mega-fund focused on technology, the Wall Street Journal reported Wednesday night.

SoftBank's board of directors is due to meet on Thursday to approve the funding, according to the newspaper, citing people close to the case.

According to the newspaper, the continuation of the first $ 100 billion Vision Fund, would have unlikely lenders, including Apple, Goldman Sachs and Standard Chartered. Goldman hopes to find work for IPOs when the fund's portfolio companies are finally made public.

SoftBank, Apple, Goldman Sachs and Standard Chartered did not immediately respond to CNBC's requests for comment.

The second fund also aims to raise $ 100 billion, SoftBank said in May.

The first fund was financed by the sovereign wealth funds of Saudi Arabia and Abu Dhabi, as well as by technology companies such as Apple, Qualcomm and the Taiwanese group Foxconn, formerly known as the Hon Hai Precision Industry. The first fund provided partners with a rate of return of approximately 45%, net of expenses, based on net equity.

The paper said in its report that unnamed sources said that Saudi Arabia and Abu Dhabi have indicated that they would probably invest again, but Riyadh's commitment will be below 45 billion. dollars invested in the first fund.

Vision Fund I is known for investing billions of dollars in global technology and telecommunication companies around the world. These include Uber, Slack, The We Company, formerly WeWork, of the Indian company One97 Communications, which owns the online payment service company Paytm, and the e-commerce company Flipkart.

In March, SoftBank CEO Masayoshi Son told David Faber of CNBC that the fund had already invested about $ 70 billion.

Read the full report of the SoftBank Projects Review about the Vision Fund suite here.

Source link