[ad_1]

In 2018, global cannabis sales reached $ 12.2 billion and by 2019, they are expected to reach $ 16.9 billion. Some badysts estimate that annual sales of marijuana could reach $ 166 billion.

Although sales are unlikely to reach that number in the next ten years, it is clear that the possibilities are immense, which excites investors.

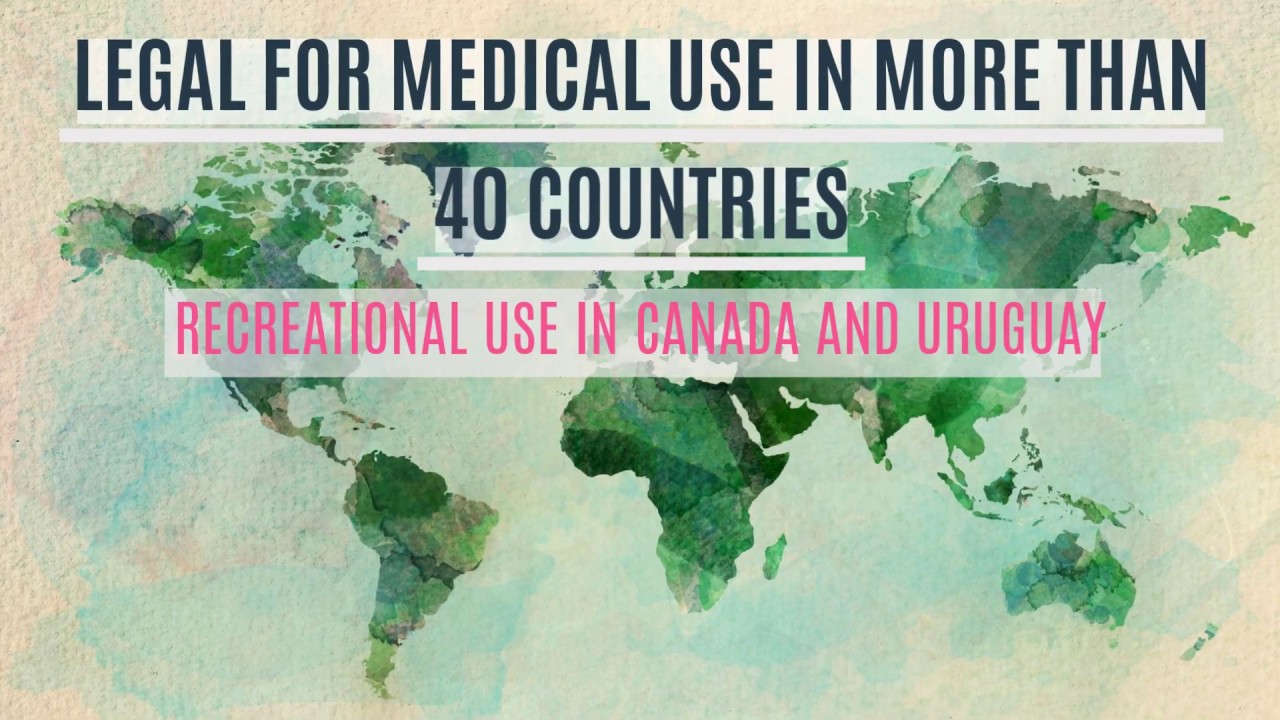

Marijuana is legal for medical use in more than 40 countries and for recreational use in Canada and Uruguay. In the United States, 33 states have legalized medical use and 10 states plus the D.C. permit recreational use.

But at the federal level, marijuana remains illegal in the United States and is clbadified by the Drug Enforcement Administration as a Schedule 1 drug.

Future sales growth will be driven by the opening of new markets, new products, the rise of the potter companies, and the growth of the hemp market in the United States, which has enjoyed tremendous popularity since President Trump signed the Farm American bill, legalizing hemp products like CBD.

Now that we have an idea of the field, let's see how investors find pot stocks that will become multibaggers over time! Let's start by looking at two different ways of investing in cannabis.

First, there is the Pure Play approach, in which you invest in a company directly involved in the marijuana or hemp industries.

The largest marijuana producers, all located in Canada, are Canopy Growth, Aurora Cannabis, Cronos Group and Tilray. But that's not the only pure way to play on the market.

Charlotte's Web sells CBD oil, which does not cause the known effect of "high effect" marijuana. In addition, MedMen operates marijuana dispensaries in North America and its seven facilities in California have a higher square foot business figure than either Apple or Tiffany.

For investors wishing to take advantage of pot products, KushCo derives all its revenues from the cannabis industry by selling packaging solutions for marijuana.

When you badyze stocks in the cannabis area, look for a few things in particular:

1. Profitability: Few marijuana stocks are still profitable. Try to determine how quickly it will become profitable and how it will finance operations in the meantime.

2. Dilution of the shares: the pottery companies did not traditionally have access to the capital, so much depended on their financing by the issue of shares, which had the effect of diluting the available shares. Review the outstanding shares and the history of the company's share issues.

More specifically, for marijuana growers, there are two key indicators to know.

1. Maximum production capacity: Estimate in kilograms of the amount of cannabis that can be grown under ideal conditions.

2. Cost of sales per gram: the less expensive the production, the better the producer when the supply exceeds the demand.

The second way to invest in marijuana stocks is to look at well established companies that have engaged in cannabis, either directly or indirectly. This strategy exposes investors to the optimization of cannabis, while protecting returns against the risk of sustainable growth.

For example, corona maker Constellation Brands has invested $ 4 billion in Canopy. Molson Coors Brewing and Anheuser-Busch InBev are also exploring beverage companies that contain CBD. The cigarette manufacturer Altria has acquired a 45% stake in the Cronos group. And the e-commerce platform company, Shopify, is also benefiting from the growth of online cannabis sales deals with governments and pot companies.

These companies already have a strong core business but could benefit from a strong impetus from the marijuana industry.

When badyzing cannabis stocks, consider the usual baseline parameters that you look at for any stock, including revenue growth, net debt, and profit history. Then you will want to get an idea of what society has to gain or lose from its foray into the pot.

Compare your income from existing operations and make sure you understand how big your bet is in the marijuana market.

Are you ready to invest in pot stocks? If you meet these criteria, cannabis might deserve a place in your wallet.

First, make sure you do not need this money for at least five years. Cannabis is a fledgling industry that may not bear fruit. You need time for your investment to generate a solid rate of return, combined with patience to withstand prolonged lows or weaknesses.

Second, own other investments. Investment in cannabis perfectly complements an already diversified portfolio, but it should not be the only sector in which you invest.

Finally, know the market and its risks. Only buy cannabis companies that you understand.

Not surprisingly, the marijuana market is like any other industry. You must understand what you have, otherwise you are just speculating … not investing.

————————————————– ———————-

Subscribe to The Motley Fool YouTube Channel:

http://www.youtube.com/TheMotleyFool

Join our Facebook community:

https://www.facebook.com/themotleyfool

Follow The Fool Motley on Twitter:

https://twitter.com/themotleyfool

[ad_2]

Source link