[ad_1]

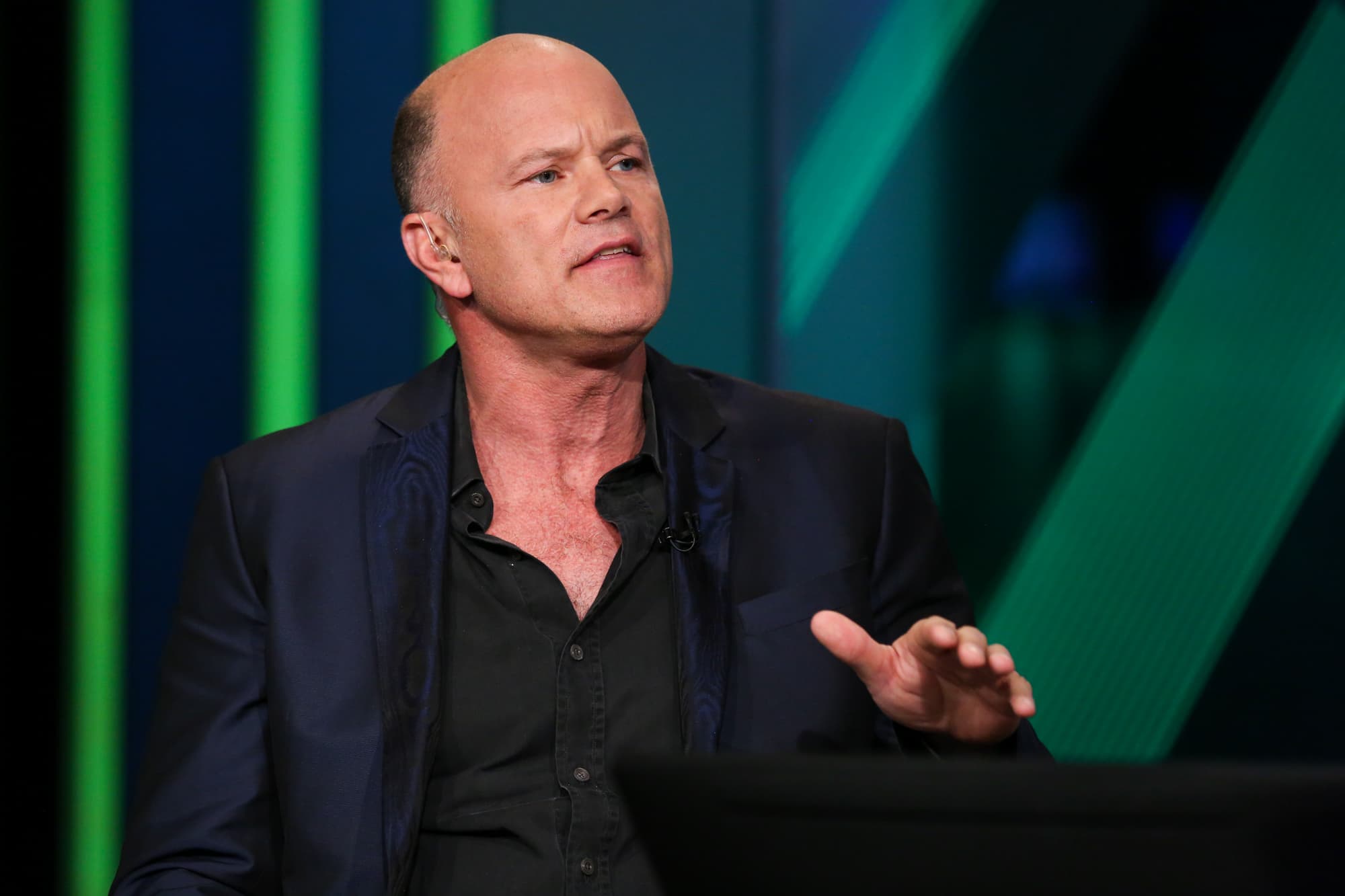

Bitcoin barely flinched after the Trump administration proposed new cryptocurrency regulations a week ago, a telltale sign of investor sentiment toward the digital coin, Galaxy Digital Founder and CEO Michael said Thursday. Novogratz on CNBC.

“It shows you how powerful this bull market is,” he said on “Squawk Box”. “They run lots on the system, and it doesn’t really have an impact.”

The Financial Crimes Enforcement Network, a division of the Treasury Department known as FinCEN, on Friday revealed new disclosure rules affecting private wallets and financial institutions aimed at cracking down on criminal activity involving cryptocurrency. Since then, the price of bitcoin has generally maintained its position above $ 23,000, according to data from Coin Metrics, despite the potential risk.

In hopes of increasing transparency, the guidelines require customers to be identified on transactions over $ 3,000 on self-hosted crypto wallets. Crypto platforms would be required to report transactions on non-hosted wallets that exceed $ 10,000 within 15 days.

Although bitcoin is not the direct target and Galaxy does not expect to be affected by the changes, Novogratz said it reflects a common theme in the way the Trump administration governs. He also warned that it could cast a cloud over the crypto industry.

“I hope, you know – we’ll get a change of the guard in 20 days – hopefully we can get more open-minded regulators,” Novogratz said, referring to Biden’s new administration.

Novogratz is a former hedge fund manager and billionaire philanthropist. He’s a frequent donor to Democratic politicians, including a $ 200,000 donation to the Biden Action Fund in June.

The proposal was brought forward by the Treasury Department about a month before the Trump administration left the White House. He provided a 15-day comment period on the potential changes, which has been criticized for being rushed, including by Novogratz, who is arguing for a 60-day period.

“It’s kind of rampant that the Trump administration is trying to block legislation, and frankly there are a lot of unintended consequences,” he said. “It’s anti-dollar … and it’s anti-innovation. It’s going to push a lot of cool things happening in crypto offshore.”

The continued rise in bitcoin is being fueled by a wave of institutional investors, a driving force of the market, who are betting on cryptocurrency. Novogratz said he sees “no slowdown” in Bitcoin adoption among Galaxy customers. Since falling below $ 5,000 in the historic coronavirus-induced asset collapse, bitcoin has crossed $ 20,000 for the first time last week.

Earlier this month, Novogratz said there had been a shift in ownership of crypto from individual investors to the deep end. In 2017, he noted, almost all transactions were carried out by individual owners. He expects to see less volatility from digital coins as more institutional investors enter the market, helping to take bitcoin to around $ 60,000 next year, more than double current levels.

Novogratz hopes, however, that this will not come at the expense of innovation.

“A lot of these crypto companies both onshore and offshore are willing to push regulation and create great innovation,” he said. “I would love an administration, I would love a regulatory framework that encompasses that, not that combats that.”

Source link