[ad_1]

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

The dollar edged up early on Monday as markets rallied during another holiday week. Asian stocks looked set to start muted.

The greenback saw modest gains against the yen and the New Zealand dollar. Japanese equity futures were little changed. US stocks edged higher in Thursday’s abridged session to President Donald Trump refused to approve a $ 900 billion bipartisan coronavirus stimulus package. Treasury bills were stable. Oil and gold ended last week on the rise.

Alibaba Group Holding Ltd. will be at the center of his concerns after hislisted shares was most affected by concerns over China’s investigation into the e-commerce company’s alleged monopoly practices. Chinese regulators ordered a subsidiary over the weekend Ant Group Co. to return to its roots as a payment service provider, a development that threatens to dampen its growth.

Elsewhere, the pound fell after the UK struck a landmark Brexit trade deal with the European Union last week.

Delayed stimulus in the United States may undermine some of the optimism that has driven global stocks to a record high this month. Unemployment benefits have started expiring for millions of Americans and a possible government shutdown looms after President Donald Trump refused to sign the bipartisan US pandemic control and government funding bill. Trump has asked Congress to increase stimulus checks to $ 2,000 from $ 600. The votes are expected Monday to try to break the deadlock.

On the coronavirus front, more restrictions are being imposed to combat the spread of the new, more infectious strain. Japan is among the latest to act, barring the entry of most foreigners until the end of January. Meanwhile, the European Union launched a continent-wide vaccination campaign less than a week after eliminating a shot developed by Pfizer Inc. and BioNTech SE.

In cryptocurrencies, Bitcoin continued to rally during the festive hiatus, topping $ 28,000 for the first time before retreating.

Here are some key upcoming events:

- President Donald Trump has until late Monday to sign the combined relief and funding bill to avoid the start of a partial government shutdown.

- Pending home sales in the United States and data on the goods trade balance are due Wednesday.

- The first figures for jobless claims in the United States are released on Thursday.

- Most of the world’s stock markets are closed on Fridays for New Years Day.

Here are the main movements in the markets:

Stocks

- The S&P 500 Index rose 0.4% on Thursday.

- Nikkei 225 futures have not changed much.

Currencies

- The Bloomberg Dollar Spot Index was little changed on Thursday.

- The yen dipped 0.1% to 103.55 per dollar.

- The euro was stable at $ 1.2190.

- The pound fell 0.1% to $ 1.3553.

- The offshore yuan was at 6.5175 to the dollar, down 0.1%.

- The Aussie was little changed at 76.02 cents US.

Obligations

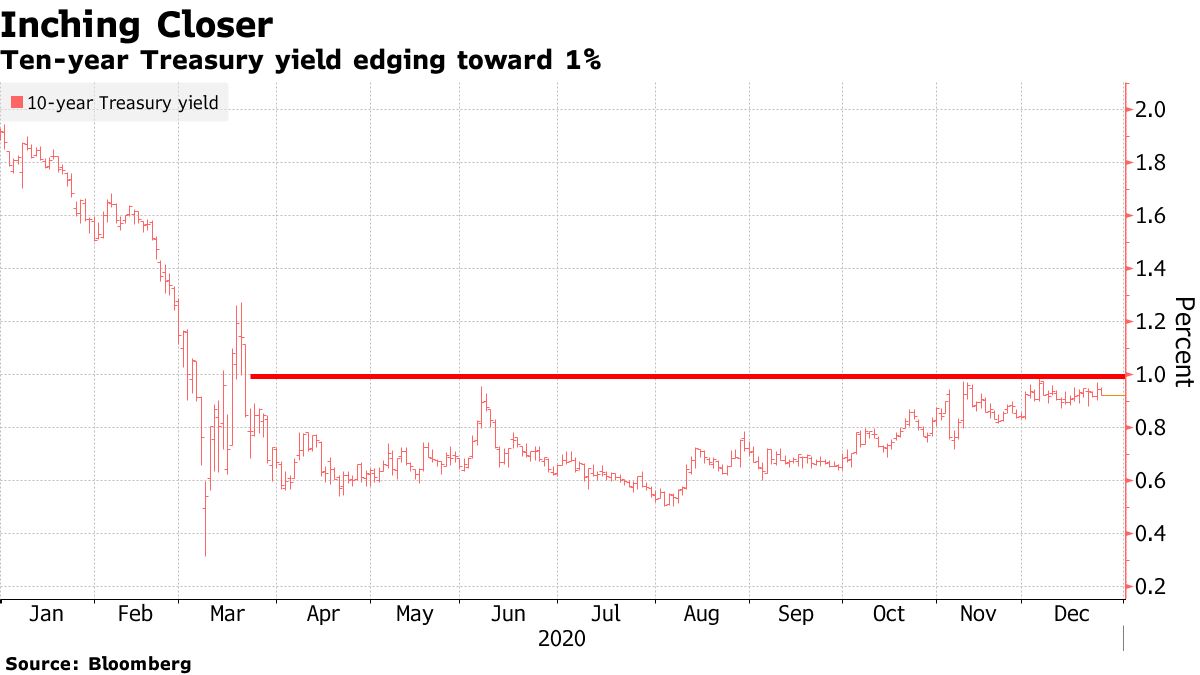

- The yield on 10-year Treasuries fell two basis points to 0.92% on Thursday.

Basic products

- West Texas Intermediate crude rose 0.2% to $ 48.23 per barrel on Thursday.

- Gold rose 0.4% to $ 1,879 an ounce on Thursday.

Source link