[ad_1]

Regulators are focusing more on bitcoin and its use in the international financial system after the value of the digital currency skyrocketed in a volatile rally that fueled concerns about its lack of strong oversight by the dogs of financial custody.

The UK’s Financial Conduct Authority and the President of the European Central Bank this week highlighted the need for stricter regulatory scrutiny of cryptocurrencies, noting the extreme volatility and criminal activity often associated with the market.

ECB President Christine Lagarde told a conference Wednesday that bitcoin was “a highly speculative asset, which has carried out interesting and totally reprehensible amusing deals and money laundering activities.”

Ms Lagarde’s comments follow a sadly worded warning from the UK regulator, which this week reiterated to consumers that anyone attempting to embark on Bitcoin projects “should be prepared to lose all their money.”

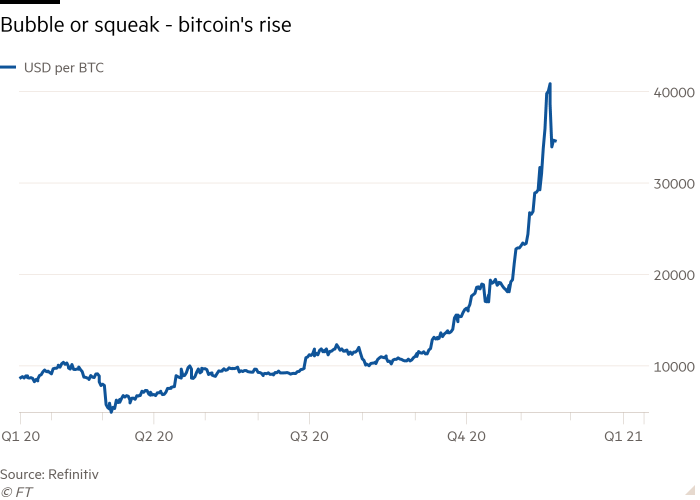

The price of bitcoin climbed over 300% last year and gained another 40% in early January to peak at over $ 40,000. Since then it has fallen 17% without a clear trigger.

This degree of volatility is off-putting for many institutional investors, but hard to ignore for some hedge funds and other private investors.

But Ms Lagarde warned that “criminal investigations” had shown “very clearly” that bitcoin was used in money laundering, and she called for an agreement “on the regulation” of cryptocurrency “on a global level. », Potentially at the level of the G7 or G20 groups. rich countries.

“If there is a breakout, that breakout will be used – if anything shows that global coordination, multilateral action is needed,” she said, adding that the Financial Action Task Force on Money Laundering money increasingly focused on cryptocurrencies.

German police this week shut down an online marketplace that sold large amounts of illegal drugs in exchange for cryptocurrency.

Europol said the site called DarkMarket runs on the hidden part of the internet known as the dark web and has been used by 2,400 vendors to sell drugs worth over 140 million euros using crypto currencies, including bitcoin and monero. The site was the world’s largest illegal dark web marketplace, Europol said, adding that German police arrested a 34-year-old Australian who was the alleged operator of the site over the weekend and seized more than 20 computer servers in Moldova and Ukraine.

In the UK, the FCA said it was concerned about unauthorized investment schemes offering lucrative returns linked to cryptocurrencies as well as the high level of price volatility. Consumers have no recourse to UK regulators for bets on cryptocurrency that go sour.

A person familiar with FCA thinking said she was primarily concerned with advertising practices.

“It’s not because of bitcoin’s price movements. . . but we are aware that price spikes in crypto assets such as bitcoin can increase consumer interest in crypto assets and related investments, ”the person said.

Source link