[ad_1]

Taiwan Semiconductor Manufacturing Co. plans to spend up to $ 28 billion this year to expand its technological lead and build a plant in Arizona to serve major US customers.

Capital spending for 2021 is targeted at $ 25 billion to $ 28 billion, down from $ 17.2 billion the previous year, CFO Wendell Huang said on a conference call. About 80% of the spend will be on advanced processor technologies – namely 3nm, 5nm and 7nm – which suggests that TSMC anticipates an increase in advanced chip manufacturing activities. Intel Corp., which announced a new CEO on Wednesday, is reportedly considering departing from tradition and outsourcing manufacturing to TSMC.

The Asian giant expects revenue of $ 12.7 billion to $ 13 billion this quarter, propelling teen sales growth this year.

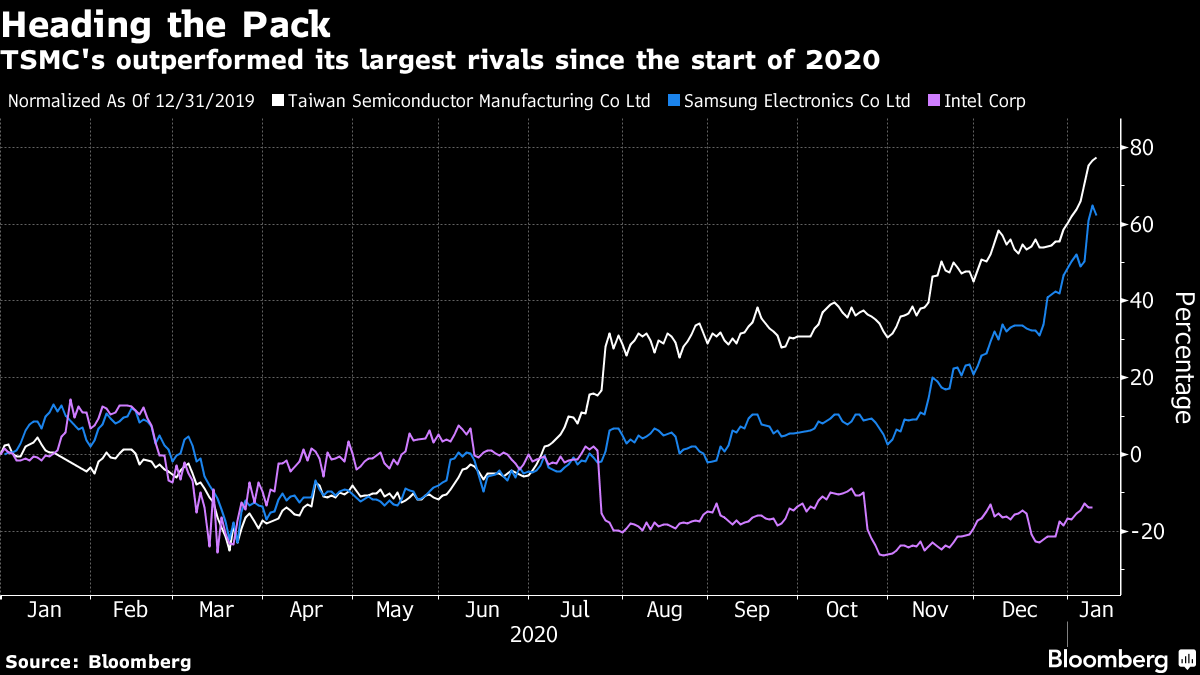

The size of TSMC’s envisioned budget – over half of its expected revenue for the year – underscores TSMC’s determination to maintain its dominance and serve its largest US customers. Shares of the world’s largest contract chipmaker have risen more than 70% since the start of 2020, with investors betting the likes of Apple Inc. will continue to build on its growing technological lead over Samsung Electronics Co. The company became Kingpin in a plethora of industries, including consumer electronics and automotive manufacturing, with its chips powering everything from iPhones to refrigerators and cars.

What Bloomberg Industries Said:

TSMC’s $ 28 billion capital investment target for 2021 is 50% more than investors expected, and equals management’s vote of confidence in demand for smartphones and high-performance computing chips. (HPC) over the next three years. The capital spending target implies that 2021 sales could climb to $ 56 billion, 4% more than the consensus of $ 54 billion expects, assuming a capital expenditure intensity of 50%.

– Charles Shum, analyst

Click on here for research

Net profit for the quarter ended December climbed 23% to NT $ 142.8 billion ($ 5.1 billion), from NT $ 137.2 billion on average analyst estimates, the manufacturer said Thursday. of chips. This contributed to a 50% increase in annual profit, the fastest rate of expansion since 2010. Sales for the December quarter climbed 14% to a record NT $ 361.5 billion, according to the reports. Previously leaked monthly figures, in part thanks to Apple’s new 5G iPhones.

Read more: As Chip Rivals wrestle, TSMC launches into killing spree: Tim Culpan

TSMC shares retreated Thursday ahead of earnings results, breaking a 10-day rally that took its stock to an all-time high. Provider ASML Holding NV jumped to 4% at the start of the session on Thursday.

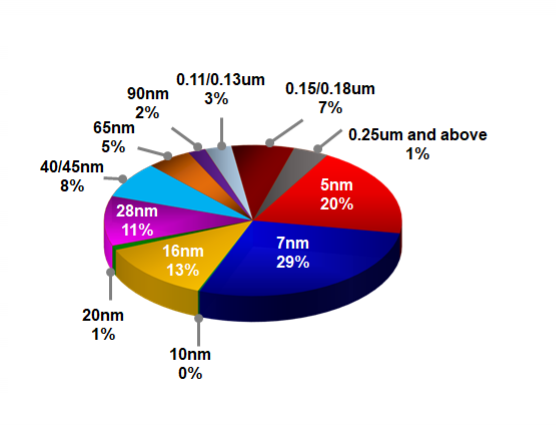

Fourth quarter results revealed increasing contributions from TSMC’s most advanced 5-nanometer process technology – used to make Apple’s A14 chips. That was around 20% of total revenue in the quarter, more than double its share from the previous three months, while 7nm was 29%. By business segment, TSMC’s smartphone business contributed approximately 51% to revenue, while HPC was 31%.

TSMC 4T Revenue by Technology

Like rivals like United Microelectronics Corp. is late and Semiconductor Manufacturing International Corp. fight against American sanctions, TSMC’s central role is likely to expand in 2021. The company has focused on meeting demand from higher-volume electronics customers, exacerbating a severe shortage of automotive chips that is forcing companies like Honda Motor Co. and Volkswagen AG to reduce production.

TSMC said the auto industry has been “sluggish” since 2018 and demand only started to pick up in the fourth quarter. The company is working with its auto customers to resolve capacity supply issues, CEO CC Wei said, although he did not say when the bottlenecks that have forced automakers to cut production could be resolved.

Read more: Production of missing chip cars in factories around the world

Executives did not address reports of Intel’s potential orders on Thursday, saying they were not discussing specific customers. The Santa Clara, Calif.-Based chipmaker had held talks with the Asian company after a series of internal technology slippages, people familiar with it said, though it was not clear whether the company could pivot after the appointment of a new CEO.

Read more: Intel in talks with TSMC and Samsung to outsource part of chip production

The leaders reiterated that construction on a planned amount of $ 12 billion in the state of Arizona, in the southwestern United States, will begin this year. The plant will be completed by 2024, with an initial target production target of 20,000 wafers per month, although the company plans to have a “large-scale production site” in the long term, Chairman Mark Liu said. .

As TSMC grows, foundries such as TSMC, UMC and Globalfoundries Inc. is not growing fast enough to meet the surge in demand for gadgets induced by the pandemic. These bottlenecks have boomed the flow of chips not only to cars, but also to Xboxes and PlayStations and even some iPhones. TSMC is by far the most advanced foundry responsible for manufacturing a significant portion of semiconductors in the world, serving companies like Qualcomm Inc. and NXP Semiconductors NV, which also supplies the mobile and automotive industries.

– With the help of Vlad Savov

(Updates with company feedback throughout)

Source link