[ad_1]

By Robert Ross

Dear reader,

One of my favorite reads to start a new year is Byron Wien’s Top 10 List, which he published for 36 years.

While I could spend an entire article debating each point on his 2021 list, today I want to tackle the last part of # 8:

“The equity market is expanding. Equities beyond health and technology contribute to the rise in prices …

“Large-cap tech… stocks are lagging for the year.”

The big technologies lagging behind the big markets this year would indeed come as a surprise. But I make the opposite bet – that technology will be the best performing sector of the year.

Today I’m going to tell you which stocks I believe will lead the industry… and the markets… higher.

Big Tech is about to get much bigger

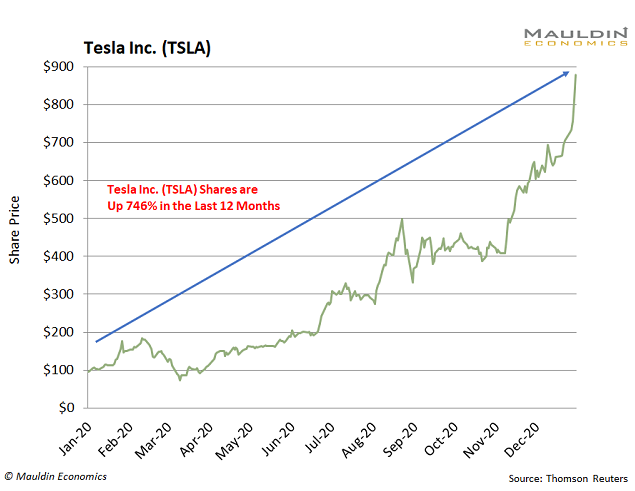

I can hear you now: “But Robert, tech stocks are so expensive! You did not see Tesla (TSLA)? “

Yes, some tech stocks are overvalued. But if you compare current tech stock prices to their March 2000 highs, they are actually reasonably priced.

The top five tech stocks are 20% cheaper than they were in March 2000.

And that’s with the simplest monetary policy in US history from the Federal Reserve.

The Fed continues to lend a hand to the market

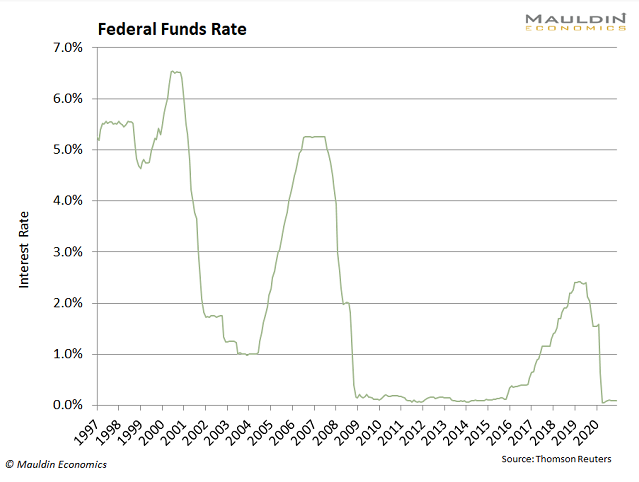

Remember the good old days when you could earn 5% in a bank savings account?

The Federal Reserve’s easy monetary policies that push people out of “safe” investments (i.e. money market funds and bonds) and into riskier assets (i.e. actions) put an end to this.

Fun fact: The Fed’s easy money policy wasn’t almost this easy return to the era of the tech bubble.

That’s why, although tech stock valuations are approaching the highs seen in March 2000, the historically low Fed Funds rate means that valuations are likely to be lower. a lot higher than Tech Bubble 1.0.

No bubble here: Smart Money expects technology to leap higher

A recent Bank of America survey showed that hedge fund managers were more exposed to equities than at any time in the past 18 months.

Analysts also see more benefits. Potentially a lot more.

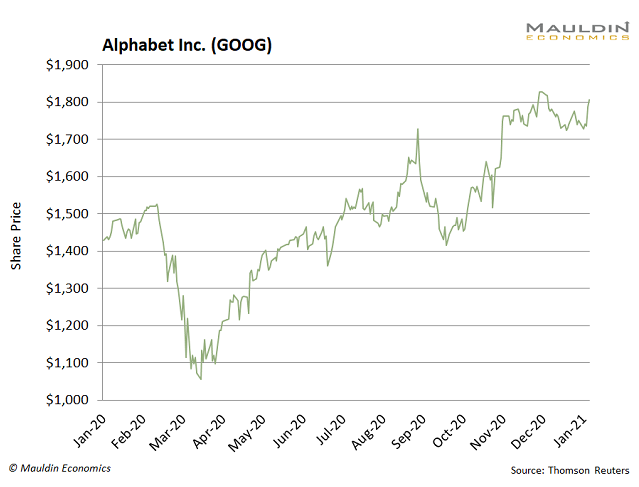

For example, Goldman Sachs has just raised its price target on Alphabet (GOOG) at $ 2250:

That’s around 25% pop from its recent price of $ 1,797.

There are also plenty of opportunities for dividend-paying tech stocks. Such an enterprise is Oracle (ORCL).

The IT giant generates more than 80% of its sales from cloud-related products. Oracle has also secured an offer to become the “trusted technology partner” for TikTok, the hugely popular social media app that has been in the news lately.

Oracle is a trusted name in another key way: it pays a solid 1.7% dividend yield. Plus it earns a perfect 100/100 score on my owner Dividend Sustainability Index (DSI), so you can rest assured that this dividend is secure.

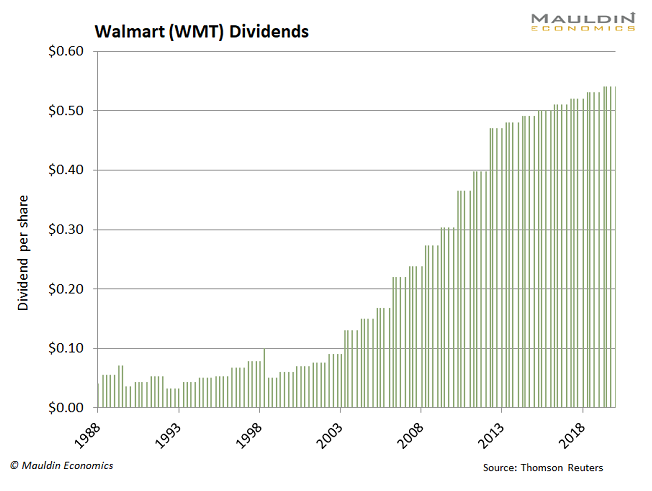

The same can be said of a surprise tech stock: Walmart (WMT).

Don’t be one of those people who doesn’t think of Walmart as a tech company. This retail empire of Bentonville, Ark., Owns the second largest e-commerce platform in the United States.

Walmart has increased its online sales by 74% in the past year. This even applies From Amazon (AMZN) robust growth of 48%.

And when it comes to dividend payers, Walmart is hard to beat. This dividend aristocrat has increased his dividend for 31 consecutive years:

The company pays a modest dividend yield of 1.7%, which according to my DSI system is safe AND ready to grow over the long term.

Bottom line: While tech stocks are on an incredible run, I think this is just the start.

So expect continued outperformance from some of the world’s biggest tech companies over the coming year. To see how I invest otherwise, read my top three forecasts for 2021 here.

Robert Ross is a senior equity analyst at Mauldin Economics. He is the editor of the Yield Shark letter focused on investing in income and the free ezine. Weekly profit.

Originally posted by Mauldin Economics

Source link