[ad_1]

GameStop Corp.’s retailer-powered short squeeze and other so-called stocks caused a sharp decline in short positions in US stocks, according to data from S&P Global Market Intelligence. The trend is likely to continue as some hedge funds now view short selling as increasingly risky.

“I think a lot of hedge funds are going backwards until the euphoria in trading subsides,” Pauline Bell, equity analyst at CFRA Research, said in an interview. “Hedge funds are on the prowl. They don’t want to get burned.”

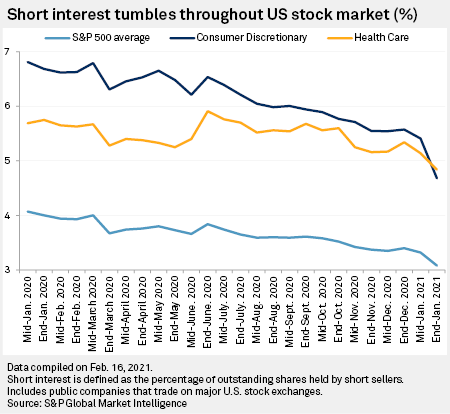

At the end of January, the percentage of outstanding shares of S&P 500 constituent companies held by short sellers averaged 3.08%, down from 4.07% a year earlier, according to the latest data from S&P Global Market Intelligence. Short sellers borrow stocks and sell them in anticipation of replacing them later at a lower cost if the stock price falls. If their games are successful, short sellers profit from the difference between the price at which they sell the stock and the price at which they redeem.

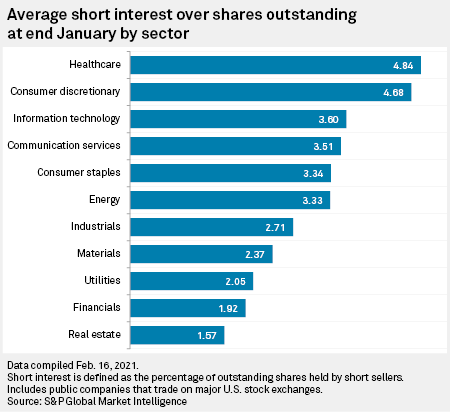

Short interest in the consumer discretionary sector, the shortest of the 11 sectors of the S&P 500 in 2020, fell to 4.68% at the end of January, from 5.41% in mid-month and 6.68% at the end. January 2020 Short interest in consumer discretionary stocks remained high throughout 2020 amid expectations that rising coronavirus cases and stalling government stimulus measures would hamper U.S. consumer spending.

Healthcare was the most short-circuited sector at the end of January, the first time in over a year that consumer discretionary was not the most short-circuited. But short interest in healthcare stocks, as with all sectors of the index, also fell, to 4.84% at the end of January, from 5.14% in mid-January and 5. , 61% at the end of January 2020. Healthcare stocks continue to attract relatively high near-term interest as the sector has underperformed the market in general and questions remain about the way forward for the pandemic, including including efficacy and distribution of vaccines.

“Playing stocks on the short side has always come with inherent risks and that’s before you even consider the costs of borrowing stocks,” Michael Hewson, chief market analyst at CMC Markets, said in an interview. “In light of recent events, it makes sense – along with sound risk management – to reduce risk at a time when the focus has been on overexposure versus positioning. “

The practice of short selling has angered thousands of retail traders who have campaigned on Reddit and other online platforms to buy distressed stocks. The clash between retail traders and institutional investors has driven many actions frequently targeted by short sellers to record highs. The most notable of these was GameStop, which traded just above $ 17 a share in early 2020, but was pushed to an intraday high of $ 483 on January 28, inflicting losses on short sellers. before retail investors pull back. GameStop action closed at $ 45.94 on February 17.

The vast majority of these stocks have seen their short interest sharply reduced.

GameStop, for example, had a short float percentage interest of 132% as of February 8, meaning there was more short interest than the company had shares. That percentage had fallen to 46% as of February 16, according to an analysis by CFRA Research. During the same period, soft drink maker National Beverage Corp. saw its short-term interest drop from 83% to 46%, while department store operator Dillard’s Inc. fell from 72% to 38%. Short-term interest in home furnishings retailer Bed Bath & Beyond Inc. rose from 69% to 29%.

While the GameStop saga may have changed Wall Street’s speculative strategies, it was also the proverbial ‘shot’ for a subset of hedge funds focused on short selling, said Matt Weller, global head market studies at GAIN Capital. “After a year of growing losses on their short books, many large investors seem to be throwing in the towel on their short books,” Weller said in an interview. “Whether this turns out to be a prudent risk management decision or a perfect counter-tide indicator remains to be seen.”

Short interest as a percentage of outstanding shares is declining, but the amount of short interest positions appears to be increasing, according to an analysis by Ihor Dusaniwsky, Managing Director of S3 Partners. Dusaniwsky Analysis found that the short interest in the Russell 3000 Index, as a percentage of the free float, fell from 7.2% on December 29, 2020 to 5.83% on February 16, 2021, but that the amount of short positions d Interest in the index jumped about 4.1% over the same period.

Dusaniwsky equated this to a blackjack player on a winning streak, betting higher value chips as the profits accumulate. “If an observer just looked at the number of chips you were betting on, he would assume that you were reducing your bets, but an observer looking at the dollar value of your bets would understand that your bet size was increasing,” Dusaniwsky said in an interview.

Source link