[ad_1]

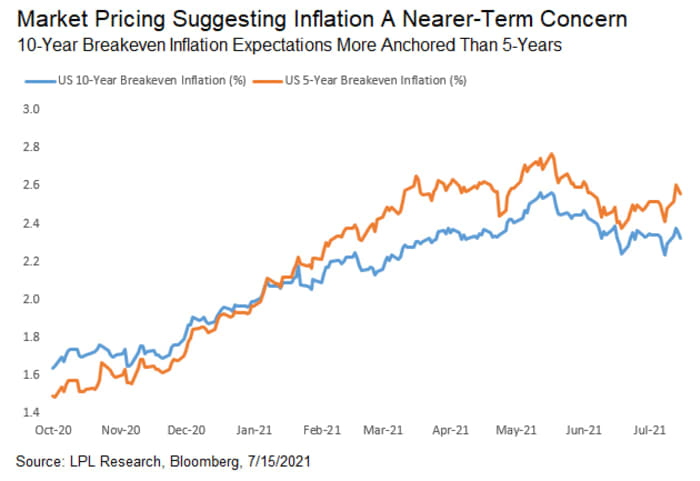

For now, the US government bond market appears to agree with the Federal Reserve’s view that inflation will remain largely under control, even after a few months of stunning results. Beneath the relatively bullish surface, however, there is an underlying worry.

The concern is that the 10-year Treasury returns TMUBMUSD10Y,

currently hovering around 1.30%, as well as equilibrium rates implying expectations of annual price gains of around 2.3% over the next decade, underestimate the risks of a prolonged period of upside inflation in the United States.

And if those risks materialize, pushing long-term yields higher and steepening the yield curve like in the first quarter, “it can lead to volatility across asset classes” as bonds sell, Credit spreads are widening and stocks are falling, said portfolio manager Scott Ruesterholz of Insight Investment, which manages more than $ 1,000 billion.

Recent comments from leading investors like Larry Fink of BlackRock Inc. and Jeffrey Gundlach of DoubleLine Capital only underscore concerns that the market is being too complacent.

Two consecutive months of rise in the consumer price index in the United States at or above 5%, have baffled part of the financial markets. And pointed questions from lawmakers during the biannual testimony of Fed Chairman Jerome Powell to Congress over the past week may have added to fears that the central bank might misjudge continued price pressures. triggered by the pandemic, even as the president admitted “a shock to the system associated with the reopening of the economy.”

A painful journey

“There is definitely a risk that the market is wrong here,” said Mark Heppenstall, chief investment officer of Penn Mutual Asset Management, which manages $ 33 billion in Horsham, Pa. The IOC sees the possibility that consumer price headlines come into play. between 3% and 4% over the next six months as gross domestic product, or GDP, reaches 7% to 8% for the year, pushing the 10-year treasury towards 2%. If higher inflation and slower economic growth occur, on the other hand, it could create “a push-pull momentum in rates that leaves the bond market more difficult to manage.”

The outlook for bond investors depends heavily on the remainder of 2021. Fixed income is the hardest hit of all asset classes by higher inflation, which erodes the fixed value of bonds, and some investors are not able to bear losses for a long time. “There will be some stress in other asset markets,” Heppenstall said in a telephone interview. “But for long-term bond investors, it could be a painful race.”

Another Fed confab looms

Investors are largely looking beyond expected US economic reports for the week ahead – which include housing-related data Monday and Tuesday; weekly jobless claims on Thursdays; and monthly purchasing managers’ indices for manufacturing and services on Friday. Instead, they focus on the Fed’s July 27-28 meeting in Washington, where policymakers are expected to continue their discussions on cutting bond purchases while embracing what Powell calls a more “humble” mindset on inflation.

Fed officials will be in a traditional blackout period for speeches over the coming week leading up to this rally.

Inflation prognosis

Meanwhile, a number of forecasters are already bracing for months of high price readings well above the Fed’s 2% target. Economists at Fannie Mae predict consumer prices will remain around 5% yoy until the end of 2021. Those at Barclays Plc expect the headline CPI to reach 6% yoy in December , while Wells Fargo & Co. expects a 4% rate for the full year, which means readings are expected to continue to be around 5% through the end of December.

Ruesterholz of Insight Investment sees the likelihood that inflation will continue to exceed 3% until the second quarter of next year amid strong US economic growth, before falling back to 2.25% to 2.5% d ‘by the end of 2022. That’s because price pressures from reopening hotels, increasing consumer travel and used car sales are expected to eventually dissipate, while supply chains disturbed will likely “fix themselves,” the New York-based portfolio manager said.

Ruesterholz says Insight invests in “high yielding, growth sensitive assets” that have lower credit quality and collateralized loan obligations, or CLOs, and that it considers Treasury securities to be protected against loss. inflation, or TIPS, as an “interesting” way to play out a higher inflation scenario.

Check: As inflation rises, BlackRock’s iShares investment strategy pro says clients are “baffled by changes in interest rates”

“We need to be aware that the forces keeping inflation high have been much stronger than expected, and we run the risk that the longer this lasts, the more likely inflation is to spill over into other categories. , investor psychology and expectations, ”he said. .

The outlook for equities

Last week, the Nasdaq Composite Index COMP,

ended the week lower for the first time in about a month and the Russell 2000 RUT Small Cap Index,

fell more than 4.5%, marking its worst week since October 30 and its third consecutive weekly decline.

In other words, in absolute terms, neither the growth stocks, highlighted in the tech-charged Nasdaq, nor the value sector, reflected in the Russell, performed well in July.

What works? The biggest of the big ones outperform, so far, with the Nasdaq Composite Index COMP,

up around 1.2% over the month. This dynamic also helps the S&P 500 SPX,

and the Dow Jones Industrial Average DJIA,

recorded gains so far this month.

“The S&P 500 is up 4% since June 3, but around 80% of that move can be attributed to the 5 biggest stocks,” wrote Larry Adam, CIO of Raymond James’ wealth management unit, in a weekly research report.

That said, Adam said he wasn’t too worried about the narrowness of the winning stocks.

“The narrowing in width is a sign of internal weakness and can sometimes precede periods of withdrawal. We are aware of this, but not too worried given the strong medium-term technical background and market propensity.

for late sector rotation, ”he wrote.

Maximum earnings?

According to John Butters of FactSet Research, 85% of S&P 500 companies have reported positive earnings per share for the second quarter so far.

“If 85% is the final percentage, this will mark the second highest percentage of S&P 500 companies reporting positive surprises over BPA since FactSet started tracking this metric in 2008,” he wrote. Friday.

He said the mixed profit growth rate, including actual results and estimates, for the second quarter of 2021 for the S&P 500 is 69.3%, which would mark the strongest year-on-year profit growth. to the other reported by the index since the fourth quarter of 2009 (109.1%), if the numbers hold.

Adam says the better-than-expected quarterly results for US companies are “attributable to the surprising resilience of the US economy; However, as the reopening is fully realized, much of the uncertainty that cloud analysts’ estimates will subside, as will the size of earnings. ”

Raymond James will be seeking more guidance from CEOs and CFOs on how things are going for the next three months and the entire year.

PROFIT REPORTS FROM JULY 19 TO 23

MONDAY: IBM, Tractor Supply, JB Hunt

TUESDAY: Netflix, Chipotle

WEDNESDAY: Coca Cola, United Airlines, Johnson & Johnson, Verizon, Texas Instruments, eBay, Anthem, Baker Hughes

THURSDAY: Intel, Snap, Twitter, American Air, AT&T, Domino’s, Biogen, Abbot, Equifax

FRIDAY: American Express, Schlumberger

Source link