[ad_1]

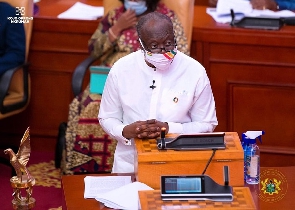

Minister of Finance, Ken Ofori-Atta

Minister of Finance, Ken Ofori-Atta

Fiscal consolidation is needed to address Ghana’s debt sustainability and refinancing risks, the International Monetary Fund (IMF) said.

In a statement on its latest review of the Ghanaian economy as part of the Article IV consultation released on Tuesday, the IMF commended the government for the fiscal adjustment outlined in the 2021 budget.

Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with its members, usually annually, during which the staff team visits the country, collects economic and financial information, and holds discussions with officials. responsible for the development and economic policies of the country.

Back at headquarters, the staff prepare a report, which forms the basis for the Board’s discussion, and after the discussion is concluded, the CEO, as Chairman of the Board, summarizes the views of the Directors, and this summary is transmitted to the authorities of the country.

The IMF said Ghana continued to be classified as a high risk of debt distress.

“While noting that the risks to Ghana’s repayment capacity have increased, Directors agreed that they are still manageable and that Ghana’s capacity to repay the Fund remains adequate,” the IMF said.

He said that while there were encouraging signs of an economic recovery amid the COVID-19 pandemic, it remained uneven across sectors.

“In this context, Directors stressed the importance of anchoring prudent macroeconomic policies, ensuring debt sustainability and pursuing structural reforms to ensure a sustainable, inclusive and green economic recovery,” the IMF said. .

The statement said IMF directors agreed with the BoG’s monetary policy stance and remained broadly appropriate, stressing that stricter policy would be needed if inflationary pressures materialized.

Although gross international reserves are relatively high, the statement said directors stressed the need for the BoG to guard against erosion of the external cushions and remain committed to a flexible exchange rate regime and also encouraged Ghanaian authorities to limit monetary financing of the deficit.

“IMF directors stressed that the authorities’ structural transformation and digitization programs are essential to support the recovery. They noted that structural transformation can be complemented by the ongoing review of the energy sector, tourism diversification and digital transition, which have the potential to reduce corruption, increase tax revenue and improve service delivery. Directors supported continued capacity development efforts in these areas, ”the statement said.

On the banking sector, the IMF said directors noted that cleaning up the financial sector has made the sector more resilient, but stressed that banks’ growing holdings of sovereign debt create risk and crowd out private sector credit.

“In this regard, they took positive note of the ongoing supervisory and regulatory reforms, which are important steps to protect financial stability. Directors also welcomed the improvements made to the AML / CFT framework which allowed Ghana to drop from the “gray list” of the FATF, ”the statement said.

Source link