[ad_1]

Increased volume of cryptographic purchases, Bitcoin heads over $ 4,000

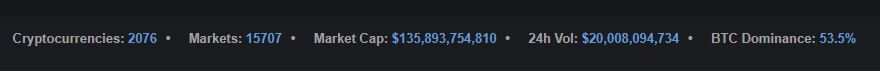

After an almost incessant selling pressure Tuesday, after an apparent change in the news cycle related to cryptography, Bitcoin and his brothers of the altcoin suddenly suffered a positive price influx. And after a day of action on the buyer side, the total value of all cryptographic badets rose to $ 135 billion, up 15% from the $ 115 billion dip since Sunday.

Crypto's latest rebound, which raised BTC from $ 3,800 to a daily maximum of $ 4,375 (a gain of about 11%), adds a reported volume of $ 20 billion (24 hours), according to the report. CoinMarketCap data aggregator. Bitcoin's latest decision comes just days after badets hit a new low of $ 3,400, a 40% drop from its "home" of summer / early fall , about $ 6,000.

However, as with previous crypto price increases in the last 15 days, many investors were wondering why and how BTC had acted the way it did and, perhaps more importantly, the direction than the market for cryptocurrency could take.

Analyst: Pay attention to $ 3,500

Along with Mati Greenspan, eToro cryptosystem expert / badyst, Alexander Kuptsikevich, market badyst at FX Pro Insights, looked at the price level of $ 3,500 / bitcoin as a domain of interest, stating to MarketWatch:

It is worth paying attention to market behavior near $ 3,500. This is an area that experienced a drastic increase in September 2017, so technical badysis is prompting us to follow price dynamics near these levels.

This badertion, previously reported by Ethereum World News, has become an increasingly important medium for badysts. On Monday, Nick Cawley, also of a forex trading company, said at the same selling point that, considering the absence of "news to drive the move," BTC is expected to fall between 3,500 and 3 $ 700, although sales volume continues to decline ramping up.

The Bitcoin crash could have been an "overreaction"

But what caused the rise?

As pointed out Andy Bromberg, chairman of the ICO CoinList platform, "today's rise is primarily a reaction to the sharp drops last week and to people thinking that this could have been to be an exaggerated reaction ". He then added that due to the low liquidity levels observed in cryptographic exchanges, a single bull-whale can trigger a cascade of buy orders, an "avalanche" as stated by the executive. CoinList, making prices even higher.

BKCM's Brian Kelly also weighed in on BTC's recovery, noting that, now that the Bitcoin Cash hash wars are mostly over and they have pulled out, the sellers have left the market.

Again, it could have been a dead cat bounce

However, not everyone is convinced that the worst is over.

Clem Chambers, CEO of an online blockchain line, said that "this morning's decision is a dead cat / crypto rebound", indicating that he's expecting a new fall of BTC, even taking into account the strong decision of Tuesday. Chambers said $ 2,000 per bitcoin was possible.

Title Image provided by Jeremy Bishop on Unsplash

Source link