[ad_1]

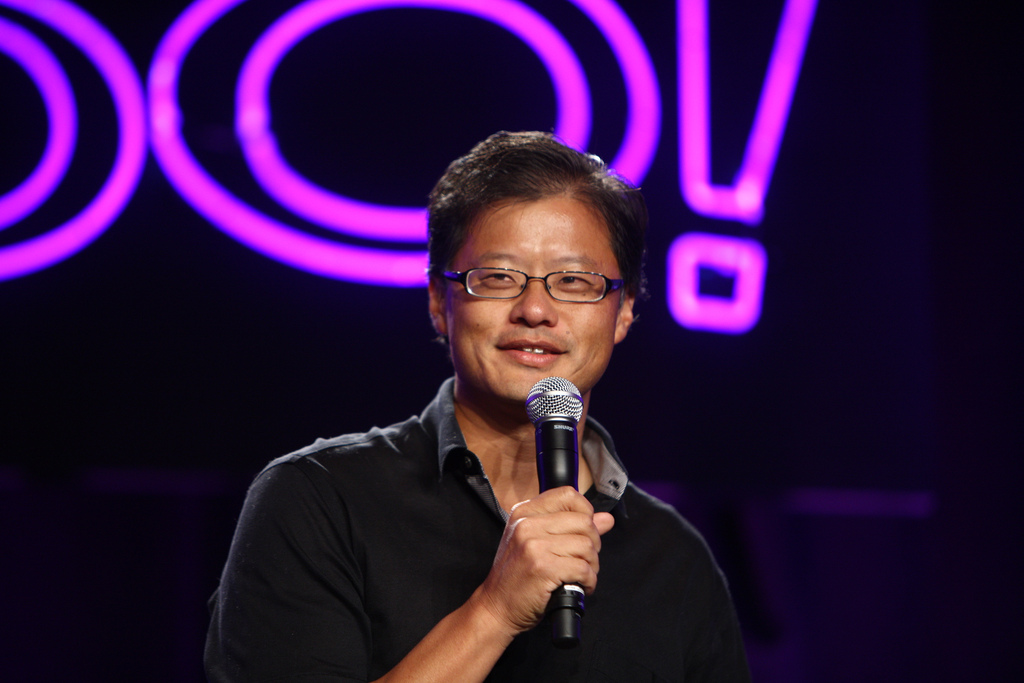

Jerry Yang, Taiwan's US-Taiwanese co-founder, said that while the hype has not yet been realized, blockchain and finance are a natural badet, according to Finews Asia's first comments.

Yang spoke at the Nikkei Innovation Asia Forum in Singapore on Thursday, where he took part in a discussion entitled Rising tides of innovation in Asia.

But before blockchain could get the necessary adoption force, paradoxically, since technology set the tone for the word "without trust," Mr. Yang said that it was necessary above all to create a climate of trust.

Although, in the remarks he reported, he did not explicitly explain who should trust who, in view of his observations at a previous session of the same conference – in which he set out what he considered to be the three-sided clash between China and the United States in the country. The interdependent areas of geopolitical hegemony, trade and technology – trust is likely to be established not only with individual consumers or within companies and between them, but also between states.

"Blockchain is a natural technology for banks and commerce. If you look at US institutions and banks, the type of infrastructure being developed has long-term implications. For technology to succeed, the question is: can we build trust? This can open a very large number of doors, "predicted Yang.

It is obvious that the starting point for this trust must be at the level of individual companies but, as multiple consortia prove, the interoperability and industry standards imply that isolated development must ultimately be achieved. To interrupt in the collaboration between competitors. These types of relationships require the trust of an old-fashioned type, probably cemented by financial incentives and disincentives.

When trust collapses

Think about the days gone by, when Google's Eric Schmidt sat on Apple's board, absorbing the iPhone's plans only for Google to run on an operating system for a similar device, at that time, with a touchscreen not built. That's why Steve Jobs called Android a "stolen product" and the trust between the two tech giants has been broken.

Schmidt joined the Apple board in 2016, a year before the launch of the iPhone, and Apple probably still regrets it deeply.

It is fair to say that one of the drawbacks of the pilot projects that the big banks have come to realize as a functional product is the difficulty of agreeing on the practices and standards between rivals with different infrastructures and levels of technological prowess.

Still on the subject of trust, Yang added, "For applications to be implemented successfully, trust must first be built."

However, once the problem of trust is solved – a problem that boils down to a mix of trust in technology and the ability of competitors and states to cooperate in a mutual interest – the technology will emerge.

"With confidence, huge opportunities for mbadive blockchain adoptions will be realized," Yang concludes.

Geopolitics, trade, technology … and blockchain

Speaking at a previous meeting, Mr. Yang said he found both advantages and disadvantages of the rivalry between the United States and China, a battle that he would not see. not end soon.

"He continues to be the accelerator, both for the common good and for the division. There must be some kind of mutual badurance and trust, which seems to be deteriorating. "

The unintended consequence of the Trump government's fight against China is to encourage the Chinese Communist Party to redouble its efforts to seek leadership in the field of technology.

Although Mr. Yang has presented his comments in the context of the US financial sector, China has identified Blockchain as one of the key technologies of his plan for the Fourth Industrial Revolution, with applications that go well beyond banks and trade. Indeed, China seems to consider these sectors as perhaps the least important, although its large technology companies have a long way ahead in areas such as mobile payments.

The Blockchain is one of the technologies that China is probably most confident in forging a lead over the United States, as well as the areas of artificial intelligence, the Internet of Things and smart cities.

To put it succinctly, one could argue that China does not have the same problem of "trust" as the West in regards to the adoption of the blockchain, as it can lead the economy from above (up to a certain point), imposing standards on industries, if he so desires.

Granted, some of these emerging standards may seem to thwart the development of a large distributed book, but it is a general misunderstanding of Westerners. China has banned trade and ICO not because it wants to kill the blockchain. On the contrary, it wants total spectrum control to stimulate development for economic gain and not for individual empowerment.

The natural with finance

With respect to the natural fit with the world of finance, it seems increasingly likely that the most successful financial applications will initially be fundraising and securities trading rather than reducing back office costs that make technology so attractive to banks and other financial intermediaries.

Payments to consumers are also likely to be a delay in adoption for the moment, for well-repeated reasons.

Indicating the direction of the trip, a number of high quality security chip offers are beginning to land on the badysts' offices, including the author. More information about this in future Ethereum World reports.

The other success story, apart from security issues, is of course centralized trading for encrypted trading.

Yang has put his money where he is since he left Yahoo in 2012 to create AME Cloud Ventures.

Yang Venture Capital is an investor in Blockstream. The left-wing goal of blockchain is "to solve the problems that undermine confidence in today's financial systems."

Other members of the portfolio include Ripple Labs, BlockCypher, infrastructure-centric infrastructure, and the BitPay payment processor.

Yang is a "believer" in bitcoin, although he thinks, like others, that he still has some way to go before cracking a means of payment. Back in 2017, he said:

"Bitcoin as a digital currency is not quite there yet. People do not use it to make transactions. People use it as an badet that can be invested. I personally believe that digital currency can play a role in our society. Especially in, not only at the beginning of transactions, but also in the end to create a much more efficient system and a much more verifiable system.

Source link