[ad_1]

The price of bitcoin has fluctuated in the range of $ 540 during the last 30 days, with a maximum of $ 4,086 and a minimum of $ 3,547. The volatility of the BTC, which is currently trading at around $ 3,595, has reached its lowest level since the end of November.

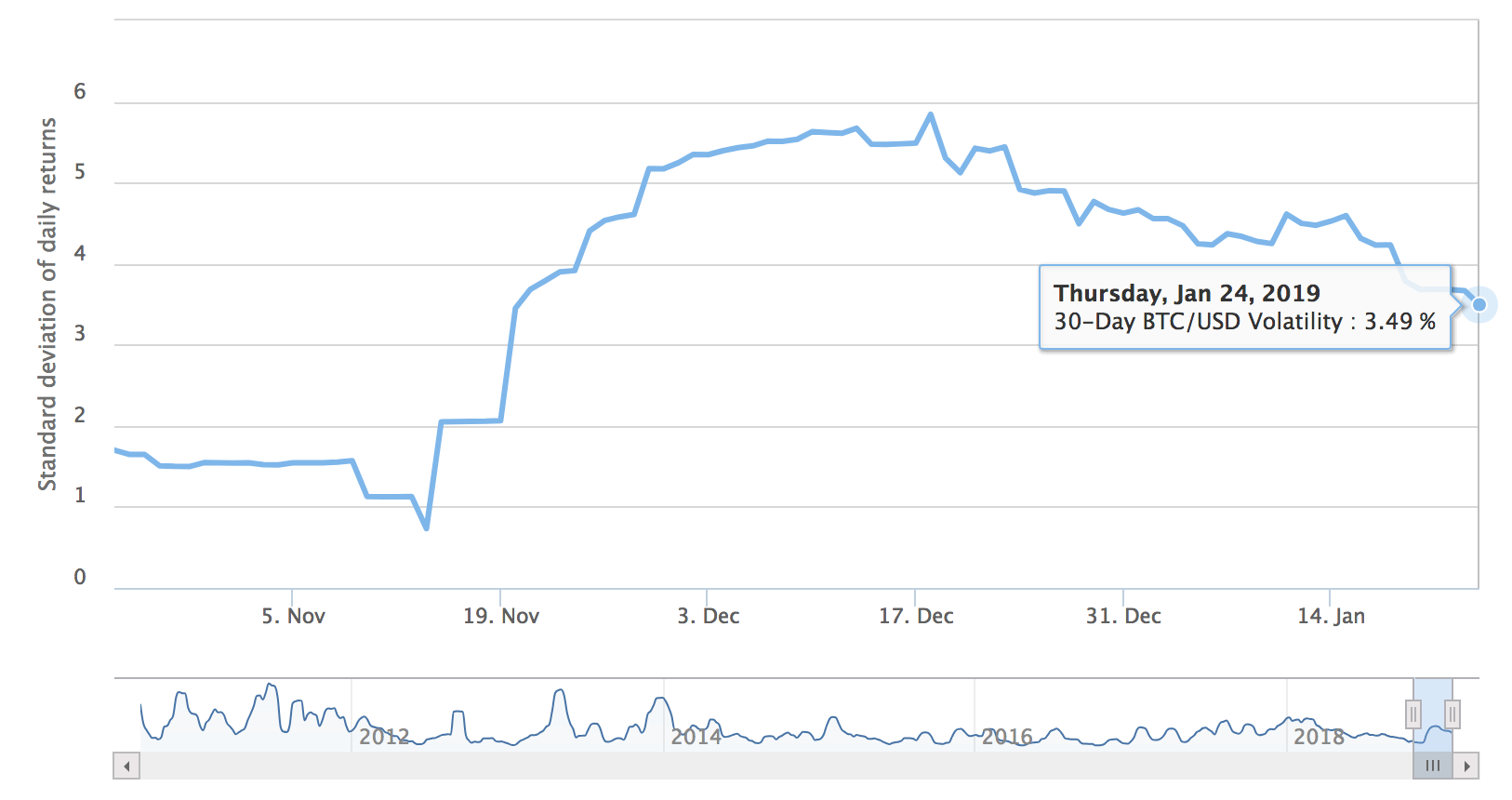

The index shows the most recent 30-day volatility estimate at 3.49% and the most recent 60-day estimate at 4.24%.

Bitcoin volatility index

FX Street reports,

"While the market slumps in narrow ranges, investors need to be vigilant because prolonged periods of low volatility are usually followed by large movements."

Indications of where the markets will go are unclear. There is a range of stories ranging from bullish to bearish.

CNBC reports that, in a note to clients, JP Morgan Chief Executive Officer and Analyst Jan Loeys wrote:

"Even in extreme scenarios such as a recession or a financial crisis, there are more liquid and less complex instruments for transactions, investments and hedging, in part because of the breadth of the legal status of fiduciary money. "

Loeys thinks Bitcoin can be valuable when everything else crumbles, adding,

"We have long been skeptical about the value of cryptocurrencies in most environments other than a dystopian environment characterized by a loss of confidence in all major reserve badets."

Conclusion: Bitcoin could fall to $ 1,260 "if the bear market continues"

Ran NeuNer, host of Crypto Trader on CNBC, suggests that the perception of bitcoin and its inherent value are largely shaped by different narratives, many of which are polarizing. These great cryptographic stories challenge the soundness of technology, test real-life use cases and the speed of adoption, and question the long-term competitive advantages that cryptocurrencies claim to have on the market. fiat and gold.

What we see:

More lightning knots

More adoption

Reduced fees

Several new fast Blockchains

Growing Demand for Blockchain DevelopersWhat they see

No short-term ETF

Bakkt delayed

Eth Constant. delayed

PayPal's CEO is not optimistic about Bitcoin

"Bitcoin can go to zero" on CNBC– Ran NeuNer (@cryptomanran) January 24, 2019

Crypto-vs-fiat narratives also challenge the perception that fiduciary currencies can withstand a changing global economy that favors smartphone adoption, digital content, online payments, millennial spending, and mobile transactions.

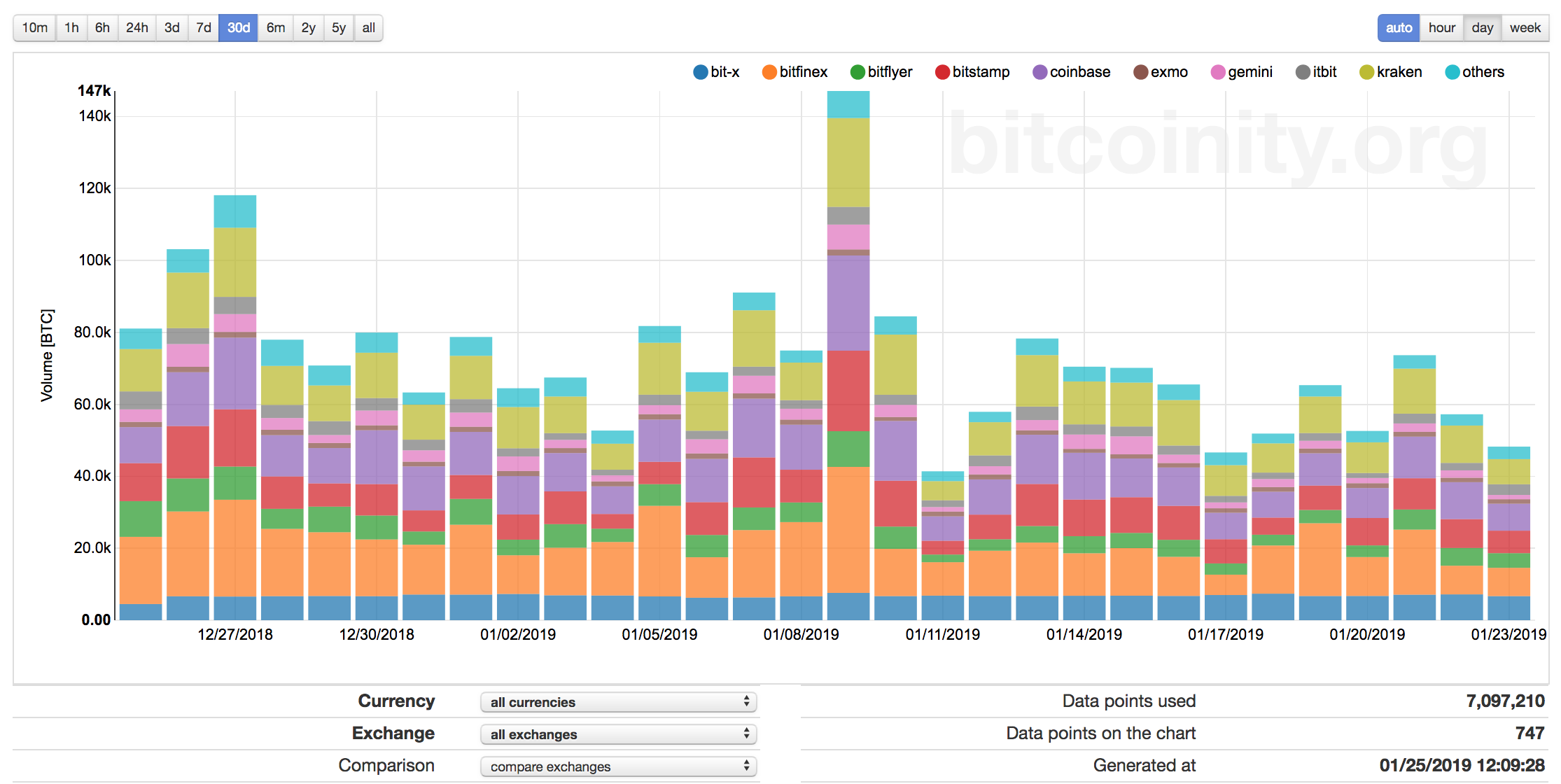

Despite the adoption of crypto, the relatively low volatility of Bitcoin prices and the consolidation of prices, trading volumes are still falling.

The crypto-winter has been very painful for blockchain developers trying to market their products. According to Business Insider, Mike Novogratz, CEO of Galaxy Digital, plans to ease the financial burden by creating a loan fund for crypto and blockchain entrepreneurs who have run out of cash.

According to the report, companies wishing to tap into the new $ 250 million fund to guarantee loans in US dollars will be able to offer real estate and mining equipment, in addition to cryptocurrencies, as collateral. Two people familiar with the launch say that the firm plans to close a first fundraiser in March.

Join us on Telegram

Discover the latest titles

Disclaimer: The opinions expressed in Daily Hodl are not investment advice. Investors should exercise due diligence before making high-risk investments in Bitcoin, Cryptocurrency or digital badets. Please note that your transfers and transactions are at your own risk and that any loss you may incur is your responsibility. The Daily Hodl does not recommend buying or selling crypto-currencies or digital badets, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

[ad_2]

Source link