[ad_1]

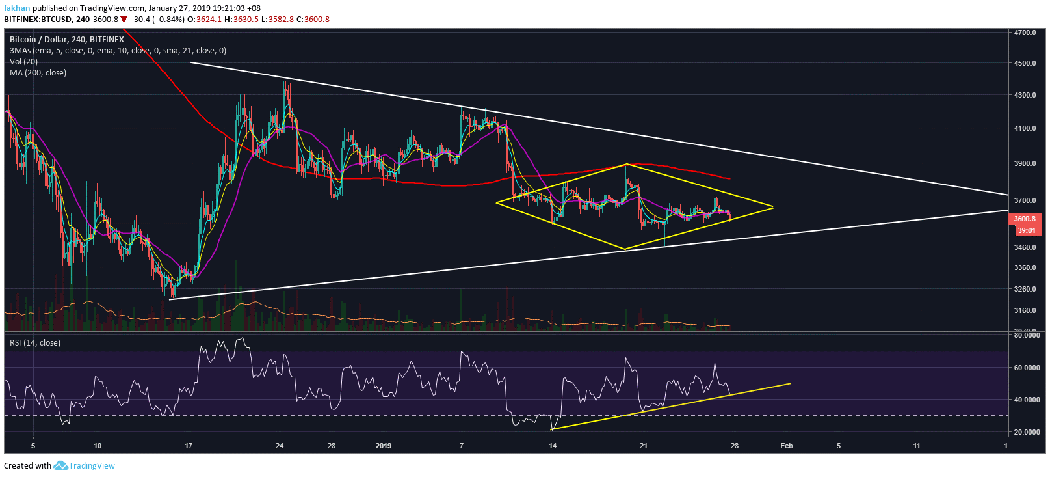

Bitcoin (BTC) has been traded sideways in recent weeks, which has made many investors very worried, because the last time an event like this happened, we witnessed a sharp drop in prices to a new annual low. There are still plenty of badysts and investors waiting for the same thing to happen again, but we have reason to believe that none of this can happen this time. this. Bitcoin (BTC) has been trading inside a symmetrical triangle for a few weeks, but it was hard to see how the price could eventually deteriorate. However, we now have some clarity, as BTC / USD has printed a diamond inversion formation, which has had the effect of bringing the price down or up for most of the time.

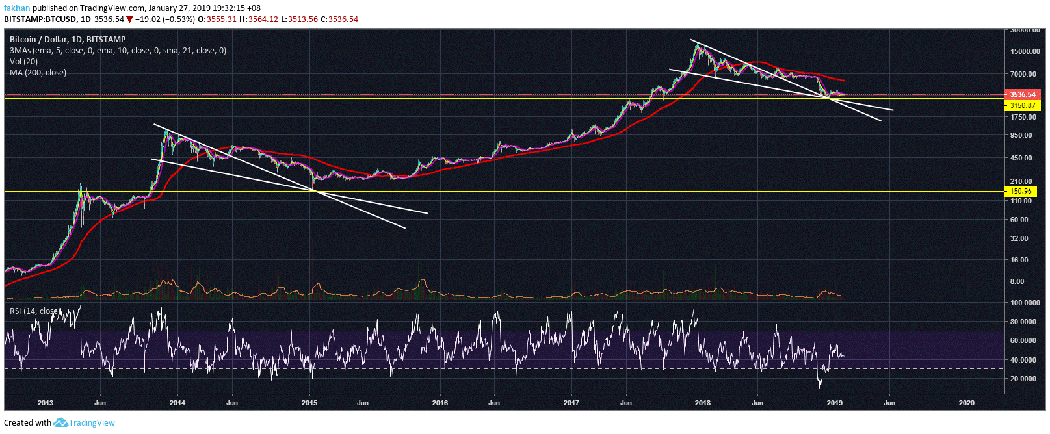

As we have a decline in this case, it means that the price could exceed the diamond and exit the symmetrical triangle at the same time. After that, we think that the course would find support at the top of the symmetrical triangle and consolidate before its next upward move. There are many opinions about our position relative to the 2014 market cycles. Some people think that Bitcoin (BTC) has already found a fund. others think that the price has not yet been lowered to $ 3,000 to find a fund. Whatever the case may be, the price must increase towards the MA 200 or the 21 weeks before being able to fall further. At this point, an upward correction is long overdue and we expect one as early as next week.

The reason we saw a glimmer of hope in BTC / USD for a sudden comeback is that big markets are already confusing and taking decisive action. The volatility index is down about 8% today, as confusion has dissipated and certainty has returned to global markets. The euro has taken action against the US dollar in recent days, which could, in the coming days, lead to a major rebound that will last until July 2019. A weak dollar means a higher price. high bitcoin (BTC) in dollars. If the market had not been handled consistently and no one could have seen in recent weeks in particular, we would have already seen Bitcoin (BTC) react to the rise in the EUR / USD pair.

It is important to note that there are serious manipulations involved. However, it is even more important to observe why this manipulation is at stake. This manipulation is fueled by both fear and greed. . Fear feeds it because there is uncertainty in the major financial markets despite the short-term clarity. Major traders and investors on Wall Street and elsewhere know that this house of cards will eventually collapse. They can save time, but they can not prevent imminent collapse. So, they manipulate the price to save time and accumulate more Bitcoin (BTC) now that they realize it's not an experience or a joke. It is also fueled by greed, as they have seen the gains made by some of their at-risk mates in the previous cycle. They really want some of that in order to keep the price on the ice while they accumulate. However, they can not do it long. The way this month ends will be crucial not just for Bitcoin (BTC), but for most major financial markets.

Source link