[ad_1]

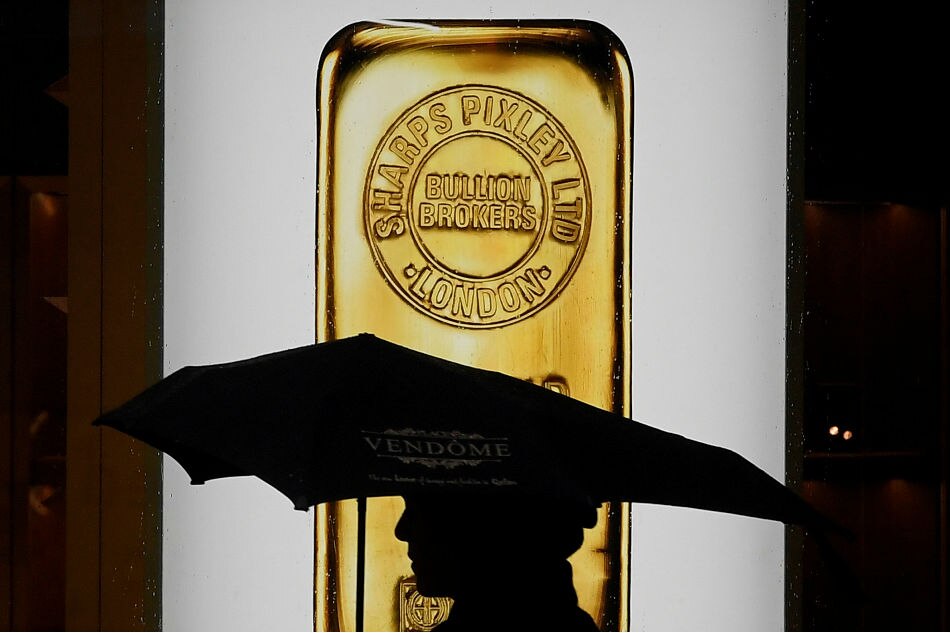

LONDON – Central banks have been buying the most gold for almost 50 years, with the precious metal enjoying its safe haven status, the World Gold Council said Thursday, as economies hit by trade and financial tensions uncertainties related to Brexit.

Banks added 651.5 tonnes to official gold reserves in 2018, an increase of 74% over the previous year and the second highest annual total ever recorded, the WGC said in a statement. its report Trends in Gold Demand.

Total gold demand reached 4,345.1 tons, up 4% from 2017, also due to fears of a slowdown in global economic growth.

"The annual increase was driven by the record number of Central Bank purchases by the Central Bank and by the accelerated investment in bars and coins during the second half of the year. Year, "said the WGC. markets.

The WGC said Thursday that world demand for bullion and coins has increased by 4%, reaching 1 090 tonnes in 2018.

In the UK, investment in bullion and coins jumped 12% to 11.6 tonnes, with investors anticipating March 29, 2019 – the day the UK leaves the EU – with a feeling of apprehension, "the paper said.

The demand for bars and coins in Europe as a whole slipped 11% in 2018.

Alistair Hewitt, head of market intelligence at the WGC, said "his concerns about slowing global growth, heightened geopolitical tensions and volatile financial markets have seen central bank demand its highest level since … 1971 ".

© Agence France-Presse

Source link