[ad_1]

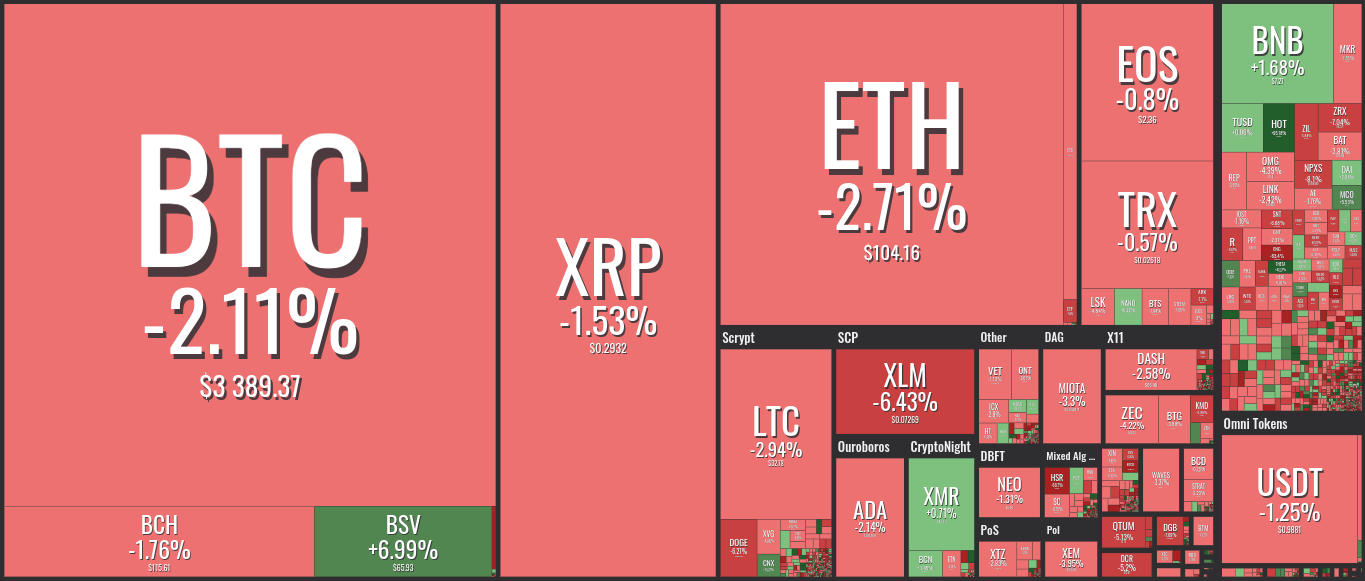

On Wednesday, the crypto market turned red, with Bitcoin, XRP, Ethereum and altcoins witnessing a new round of sales. Bitcoin is down more than 2% to $ 3,389, according to the Coin360 crypto price tracker.

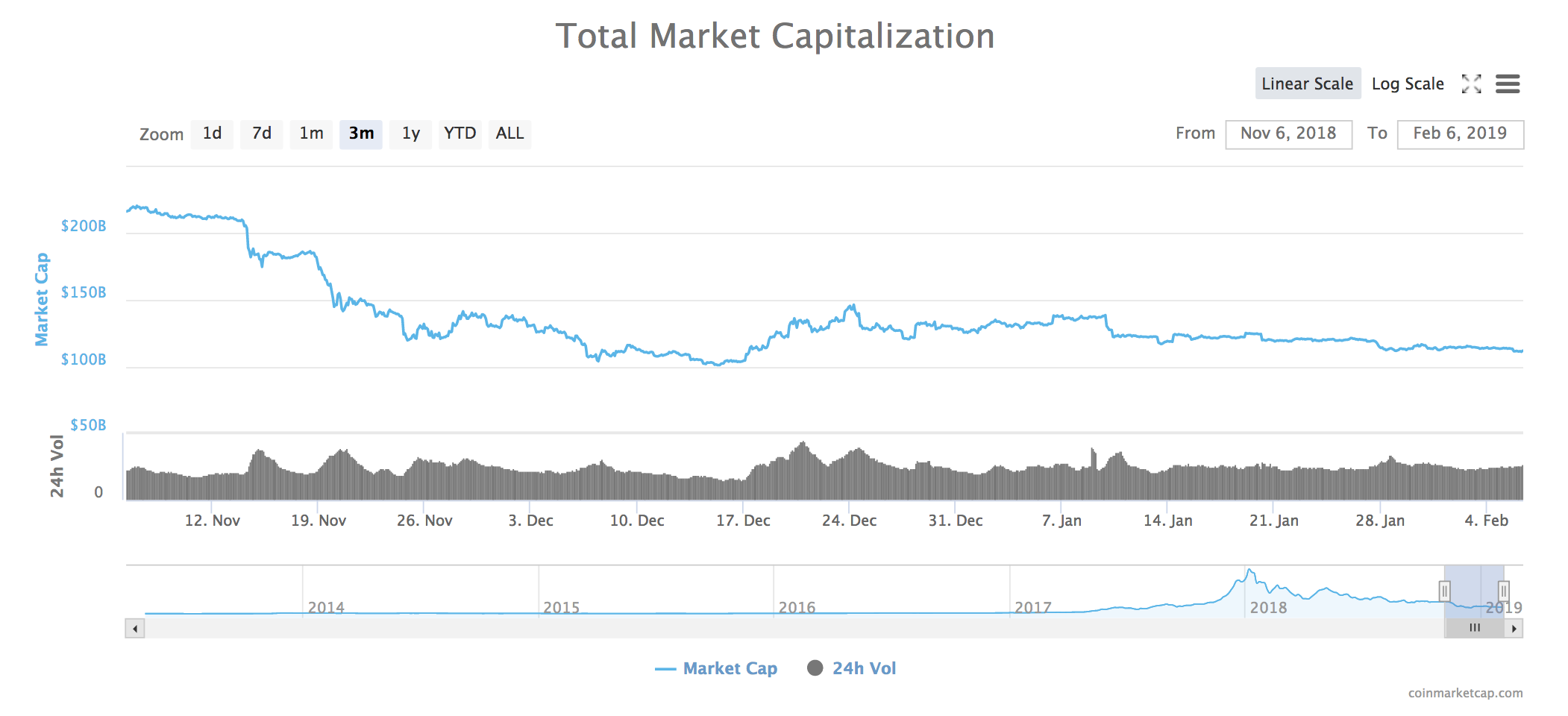

The overall market capitalization of all crypto-currencies rose from $ 113 billion to $ 111 billion in minutes, its lowest level since mid-December, as shown by CoinMarketCap.

The shuffle of the market has allowed Binance Coin to rank in the top 10 of the market capitalization, exceeding Bitcoin SV.

EToro's chief market badyst, Mati Greenspan, said the cryptography market was going through "extreme apathy" in early February. In the long term, Greenspan is optimistic about the adoption of crypto in the real world.

"There is absolutely no reason to think that Bitcoin adoption rates will continue to grow at the current rate … they are likely to accelerate."

The CEO of the crypto investment company Pantera Capital agrees. According to Dan Morehead, crypto traders can calm down as fundamentals behind the scenes are stronger than ever – and not the first bear market in Bitcoin.

In a new interview on the Unchained podcast, Morehead says that he's no longer worried about whether the blockchain is here to stay. He cites crypto exchange from Fidelity and Bakkt as two examples showing that crypto is becoming widespread.

"I think the underlying fundamentals are much, much stronger than they were during the crypto winter 2014-15."

"Institutional investors really want to have a well-known and regulated custodian. We have not really had that in the past. "

Morehead says Pantera is focused on supporting companies working on scalability, creating new fiduciary agreements and introducing blockchain into the world of cross-border payments.

It equates the current state of cryptographic scalability with that of the internet in the '90s, when people were only learning to use email – before they could broadcast Netflix on their phones.

Join us on Telegram

Discover the latest titles

Disclaimer: Daily Hodl's advice is not investment advice. Investors should exercise due diligence before making high-risk investments in Bitcoin, Cryptocurrency or digital badets. Please note that your transfers and transactions are at your own risk and that any loss you may incur is your responsibility. The Daily Hodl does not recommend buying or selling crypto-currencies or digital badets, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Source link