[ad_1]

The Wall Street Journal reports that banks will recast their mortgages. With the changes in US Federal Reserve policy, it is currently cheaper for banks to obtain loans than for some time. The other effect of a reduced LIBOR rate seems to be a drop in mortgage rates. Rates have been falling for decades. Depending on when you opened a new mortgage in 2018, it would have been among the lowest historically available rates.

More disposable income = growing economy / investment in retail

Although there is no direct correlation between mortgage rates and the overall stock market, the fixed cost of mortgages is money that is not immediately available to invest or spend. Lower rates, especially for the most qualified buyers, may therefore equate to additional capital available for investment.

Mortgage-backed securities are not only focused on the success of loans, but also on the sale of new mortgages. Lower rates are clearly an increase in sales. All of these factors can contribute to a more optimistic market situation. MBG replicates "as closely as possible" the returns and returns of the Barclays Capital US MBS Index (the Index). The Index measures the performance of the US Agency's Mortgage Bonds segment in the US high-quality bond market. "

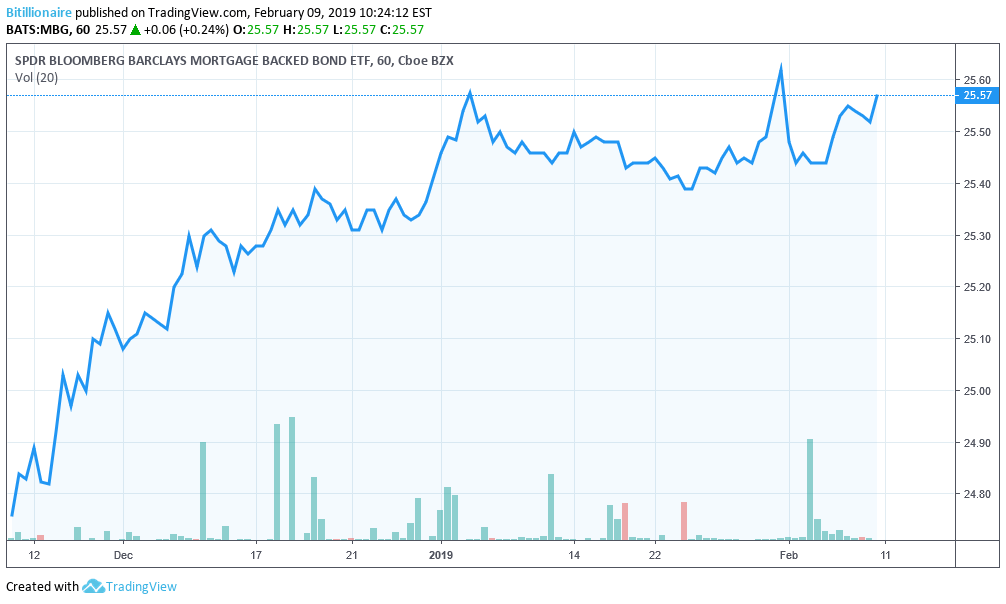

MBG is getting closer to its highest level in three months.

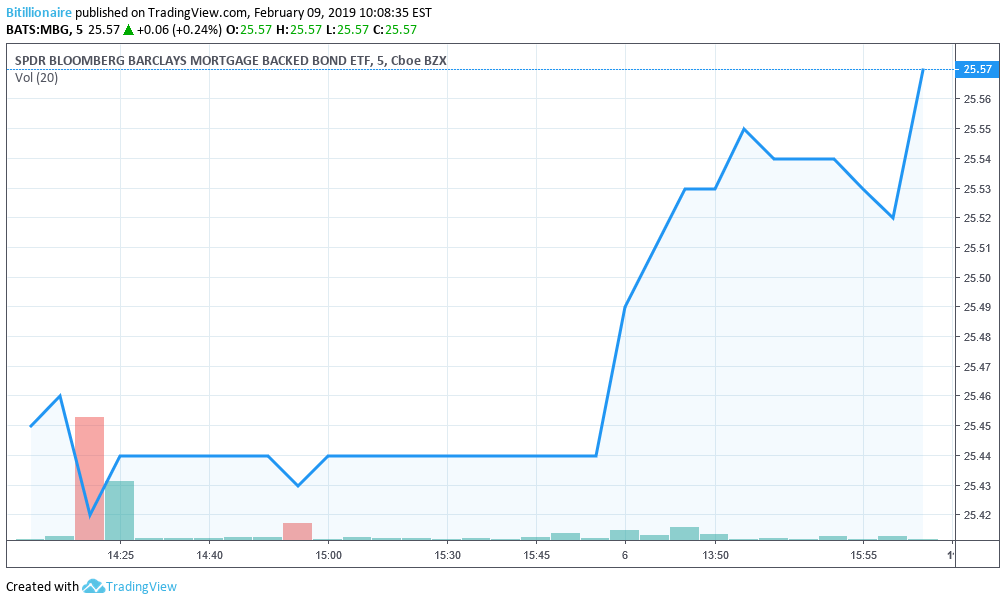

MBG is currently working to exceed its three-month high at $ 25.61. Friday's trading pushed up to $ 25.57. The volume was heavier by the beginning of the week. MBG is one of many good indicators for investigating the health of the mortgage market. Here is this 3-month chart:

The highest in the last three months was only a few cents higher than the closing on Friday for MBG.

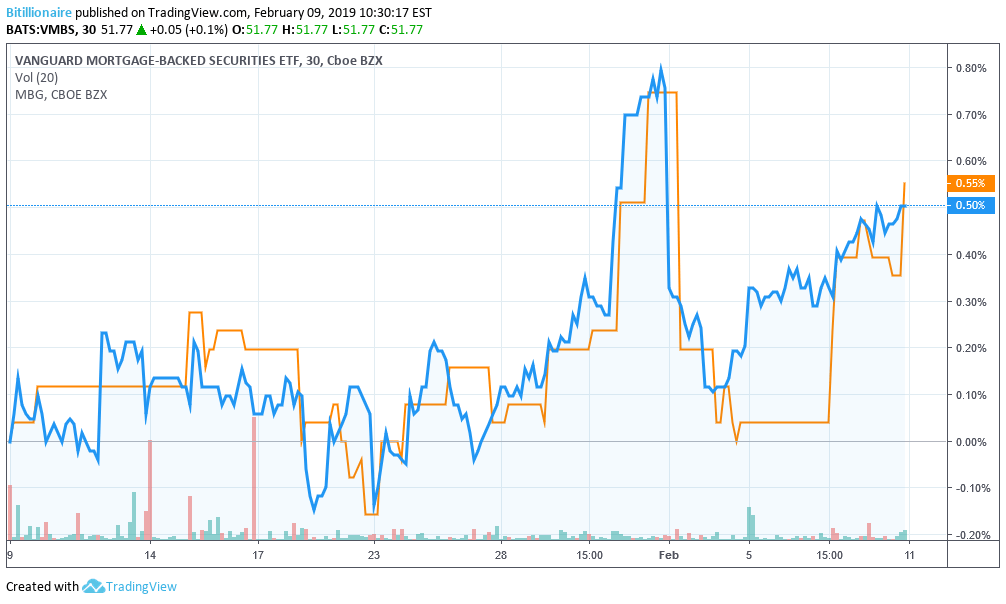

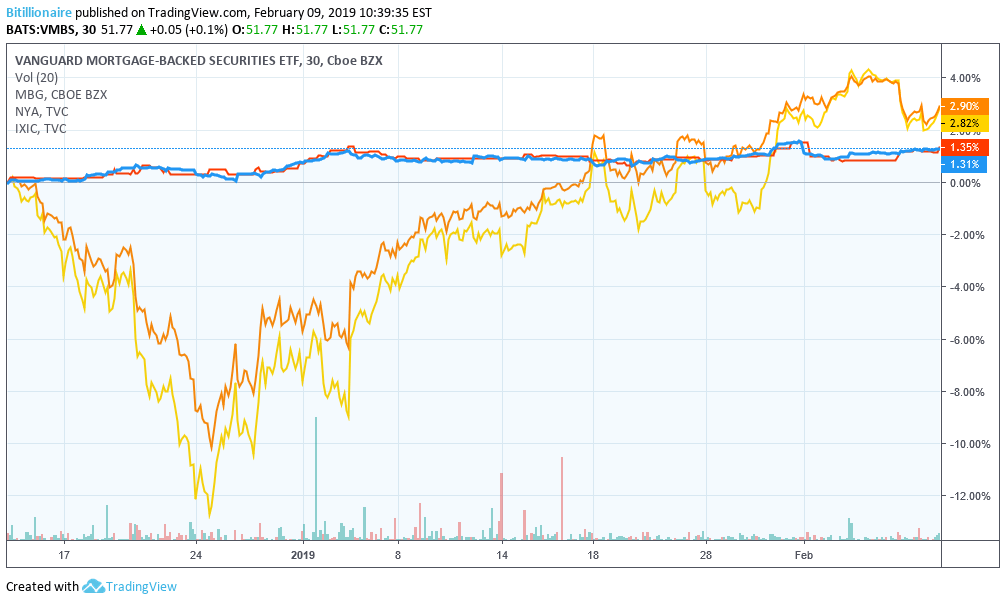

MBG is not the only one to create a dynamic. The Vanguard Mortgage-Backed Securities ETF has grown at about the same pace.

Although we are far from the real estate bubble that contributed to the global financial crisis, it certainly seems that the market is optimistic about mortgages and the bonds badociated with them.

VMBS, a mortgage-backed securities ETF, is closely monitoring MBG's progress.

The crypto market versus mortgage securities

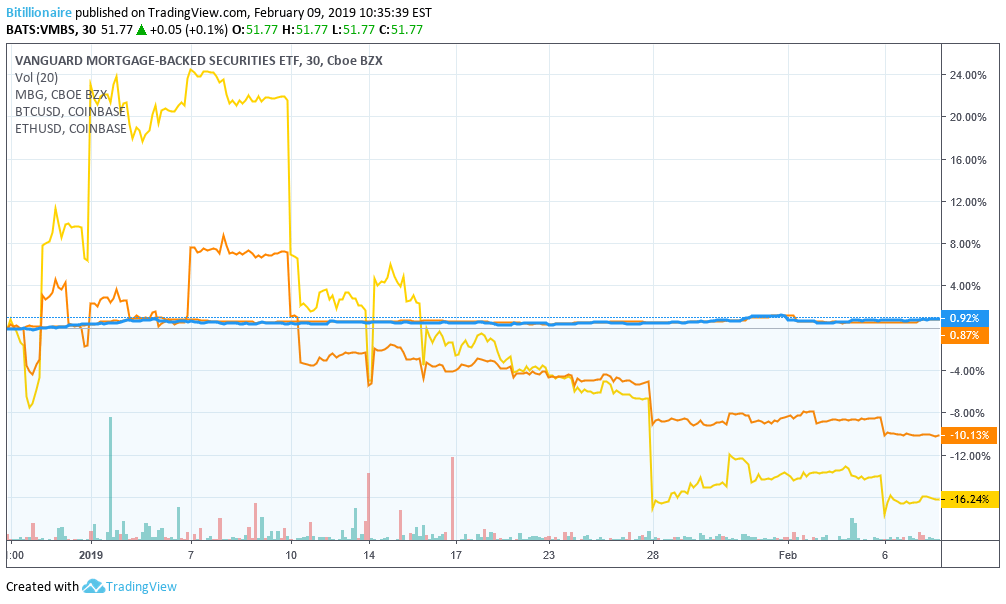

However, there is another aspect of lower mortgage rates to explore. At the macro level, they also increase the funds available to invest in cryptocurrencies. Let's add Ethereum and Bitcoin performances to this table over the same period, to see what happens.

MBG and VMBS would have been a safer haven in terms of money than the main badets of Bitcoin and other recent cryptographic badets.

Ethereum and Bitcoin both lost, while the mortgage markets posted modest but steady gains. The short-term graphs of these mortgage symbols show some chaos. But investing the same amounts in mortgages would have brought you a tangible return in the meantime, since neither ETH nor BTC have yet recovered their December levels.

Too much reading of this table could give the impression that people were selling their cryptos and buying mortgages. This is probably an exotic case study.

Now, how do larger markets position themselves relative to these mortgage-backed securities?

Note that when the stock market dipped, mortgages held up.

What we are seeing here is that, when larger markets are doing poorly, the performance of mortgage collateral is largely unaffected. These securities are more influenced by government policy and loan performance, which do not generally depend on the performance of the stock market.

Lower mortgage rates mean stronger markets

However, when stock markets start to show an upward trend, or vice versa, the same goes for mortgage markets. The correlation is about double the percentage gain: NYA and IXIC gained about 3% over the same period as MBG and VBMS gained about 1.5%.

Lower mortgage rates are only a bad thing if you are looking to pay for your home sooner. The 15-year rates are always lower. It seems that, according to the market, the more banks will have to lend at a cheaper rate, the better the market will be. Not only because real estate investors have a capital surplus to generate business in other departments, but also because Americans then have more money in their pockets to spend it immediately, in order to generate favorable earnings appeals – or to speculate at the very beginning. great race of cryptocurrency.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link