[ad_1]

Mexican bonds are another investment strategist because they are trading at their lowest level in almost 10 years.

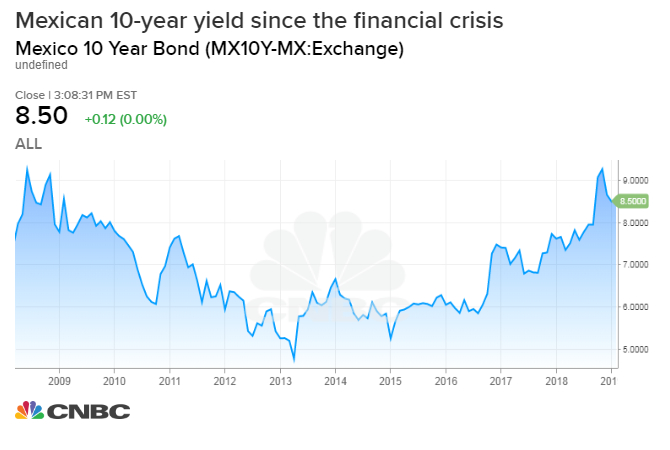

Mexico's 10-year yield exceeded 9% for the first time since the November financial crisis. On Tuesday, the benchmark return was traded around 8.50%.

"Mexican bonds are underestimated and prices are in the worst case scenario," said Amr Abdel Khalek, emerging markets strategist at MRB Partners. "We do not consider peso bonds to be the strongest outperformance in a universe of bonds denominated in local currencies, but the combination of underestimation of the peso and relatively rich yields means that they can outperform the benchmark on a 6 to 12 month basis. "

Investors worry about some tax measures from President Andres Manuel Lopez Obrador, including the closure of a new, partially built airport of $ 13 in Mexico City. Lopez Obrador, better known by his initials AMLO, also announced last week that he would announce measures in favor of Pemex, a giant oil company.

AMLO did not provide details in its comments last Tuesday, leaving investors worried about the scope of its proposals. AMLO's comments come after the rating agency Fitch reduced Pemex's rating to BBB-, the lowest credit rating, from BBB +.

Still according to Paolini, Pictet Asset Management, Mexican bonds remain attractive given their valuation. "If you look at Mexican bonds, unless you expect something serious to happen on the political front, that's a real value."

Source link