[ad_1]

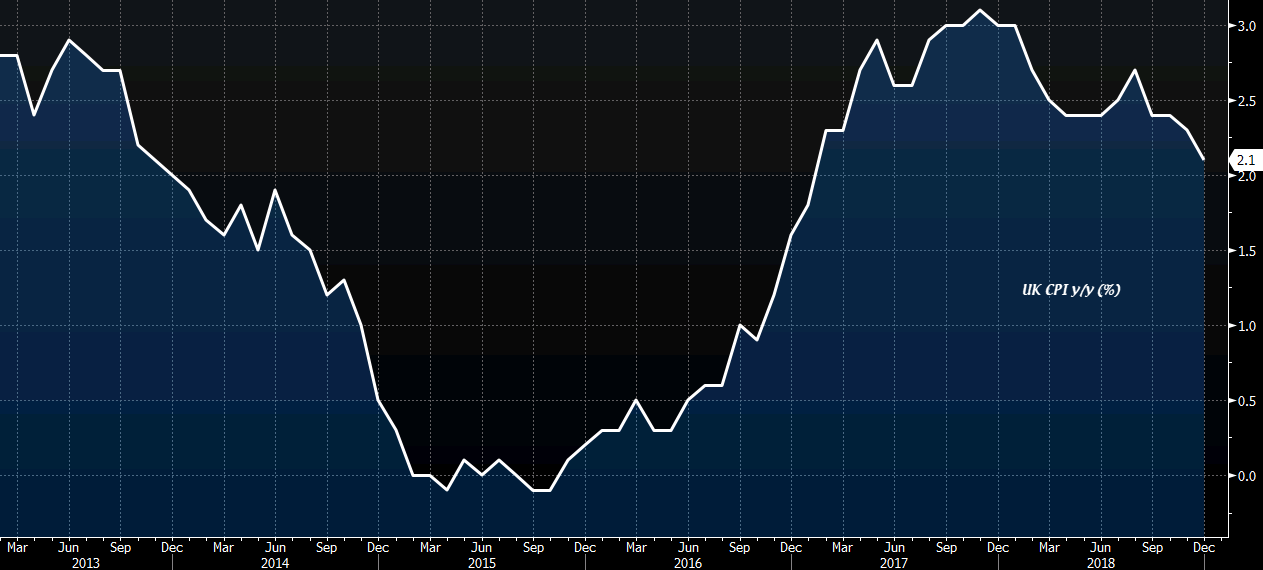

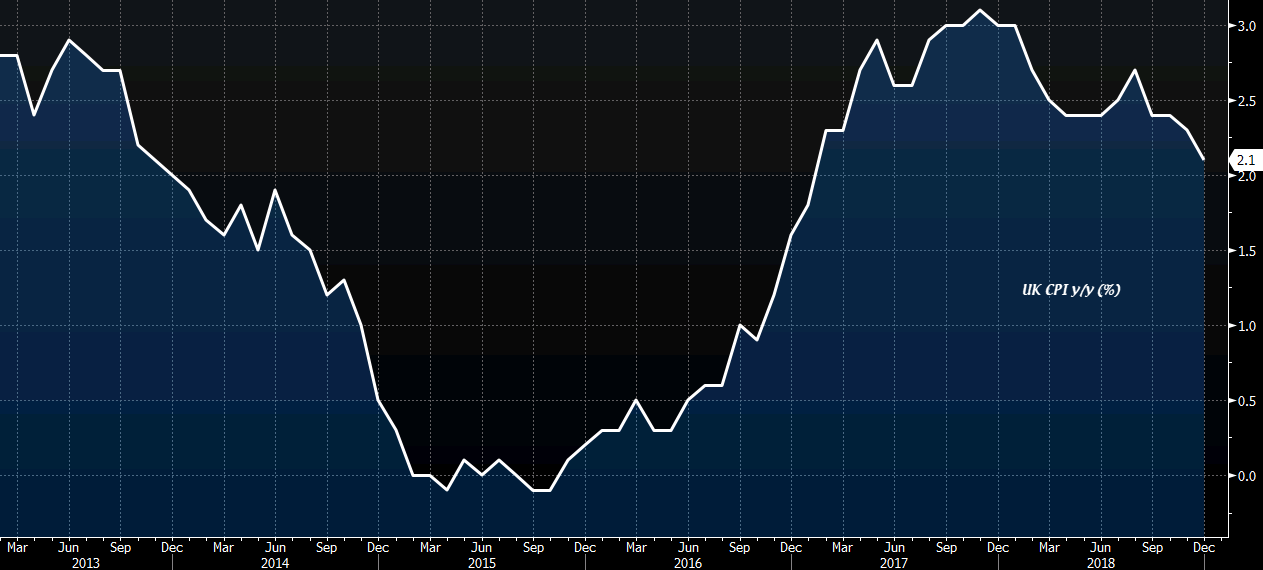

Total inflation is expected to slow down further

ForexLive

The posted share is expected to fall to + 1.9% year-on-year last month, following the + 2.1% rise in December (see above). However, core inflation should remain stable at + 1.9% year-on-year.

A fall below the 2% threshold for inflation statements would highlight less room for maneuver for the BOE in terms of rate hikes, so that the pound could be under a bit of pressure if actual records were down.

However, being always focused on Brexit, we should not expect a significant change in the price of the BOE (see the report below) (not like there is much to do to make the price actually in / out), no matter the outcome / beat on expectations.

And even if the report meets expectations, I would expect titles to focus on lowering the reading of titles, which could lead to minor sales in the pound. However, as was the case for last week's BOE and Q4 GDP on Monday, do not expect these events to have a lasting effect. Everything revolves around Brexit, Brexit, Brexit.

Source link