[ad_1]

Discussion points on the New Zealand dollar

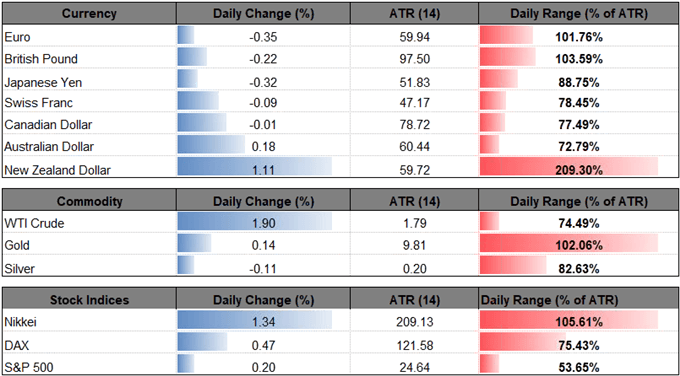

NZD / USD increases faster after Reserve Bank of New Zealand (RBNZ) first meeting for 2019 and the parliament's testimony with the governor Adrian Orr could continue to cause the exchange rate to fluctuate as the central bank modifies its forecast for monetary policy.

NZD / USD Gatherings on Mixed RBNZ Orientation – Orr Testimony Through Magnifying Glbad

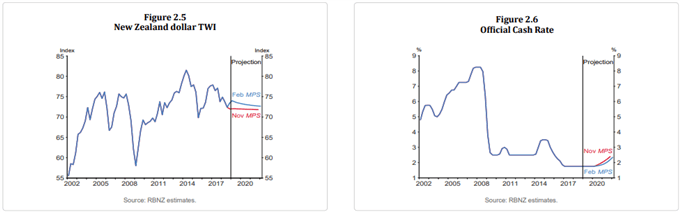

It appears that the RBNZ is in no hurry to raise or reduce the official exchange rate (OCR) of the record lowslowdown in GDP growth and the slowdown in the global economy,"And the central bank could simply try to save time at the next meeting on March 26, even though the statement says that" next OCR move could be up or down. "

In fact, the comments suggest that interest rates will remain unchanged throughout the year, with officials "expecting to keep OCR at this level until 2019 and 2020", and the RBNZ could continue to tame the bets for an imminent rate hike.Many global conditions affect New Zealand through multiple channels. At the same time, there appears to be little or no bargaining for a rate reduction, the RBNZ claiming thathere are the upside and downside risks of these prospectsAnd the central bank could adopt a more balanced tone this year, as "monetary and fiscal stimulus should boost GDP growth in 2019."

Remember that the latest RBNZ update indicates a shallower and longer trajectory for the benchmark interest rate:CPI annual inflation is expected to reach 2% by the end of 2020And Governor Orr could largely subscribe to a wait-and-see attitude before lawmakers, with the head of the central bank having to testify before the finance and spending committee. However, the reaction to RBNZ meeting If Governor Orr was more willing to support the economy, the statistics could come out of the US economy and lead to headwinds for the NZD / USD during the update. US Consumer Price Index (CPI) unexpectedly, the inflation rate remained stable at 2.2% per year in January.

Signs of unstable price growth could call into question the recent shift in the Federal Reserve's forward-looking stance, as the US economy shows little or no signs of a recession, and the another economy. Government judgment can put pressure on the president Jerome Powell & Co will continue to normalize its monetary policy in 2019 as Fed officials continue to forecast a longer-term interest rate of 2.75% to 3.00%. In addition, it remains to be seen whether the Federal Open Market Committee (FOMC) will reduce the $ 50 billion quantitative tightening (QT) because the 304 KB represents the non-farm payroll of the United States (NFP), which which suggests the possibility of further improving the labor market, and the FOMC may be struggling to defend the adjustment of the outlook for monetary policy as Fed officials pledge to "depend on Datas".

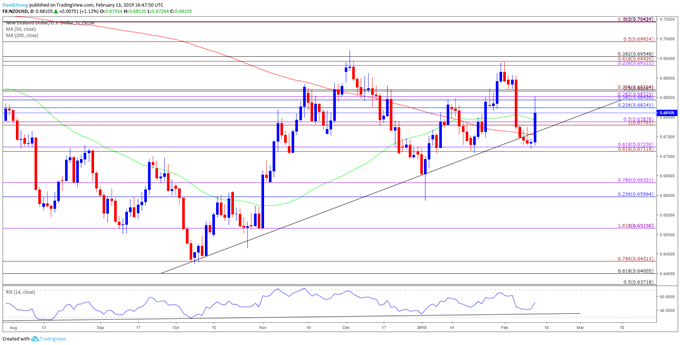

Do not forget that the broader outlook for the New Zealand dollar on the US dollar remains optimistic, as both the price and the Relative Strength Index (RSI) still follow the upward trends seen since 2018 and that the increase from the 2019 trough (0.6586) could continue to evolve over the next few years. Governor Orr says that changes to lower rates have not increased. Register and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss possible business configurations.

Daily chart NZD / USD

- Recent price developments bring the high-level targets on the radar for the NZD / USD, the 0.6710 (61.8% expansion) to 0.6720 (61.8% expansion) appearing to play a supporting role.

- Need a break above the Fibonacci overlap of about 0.6820 (23.6% retracement) to 0.6870 (78.6% extension) to open the area of interest. next interest around 0.6930 (23.6% extension) to 0.6960 (38.2% retracement), which corresponds to the highest monthly (0.6942).

- A break above the December peak (0.6969) opens the threshold of 0.6990 (50% expansion), with the next region of interest around 0.7040 (50% retracement).

Additional trading resources

Are you looking to improve your business approach? Review the & # 39;Traits of a successful trader'Series on how to use leverage effectively as well as other best practices that any trader can follow.

Want to know what other currency pairs are being monitored by the DailyFX team? Download and read again Main trading opportunities for 2019

— Written by David Song, Currency Analyst

Follow me on Twitter @DavidJSong.

Source link