[ad_1]

On February 14, JPMorgan, the $ 340 billion banking giant, launched a business fund called JPM Coin. Industry experts predict the long-term stability of Ripple and its XRP cryptocurrency.

Joe Weisenthal, co-host of Bloomberg, What'd You Miss? m said:

If it turns out that the Blockchain / Coin box turns out to be a good choice for banks that transfer money, then the JPM Coin should absolutely clear Ripple.

Think about it, say you are transferring money. Why would you badume the risk of exchange rate volatility badociated with the use of Ripple as a bridge currency, while you could have a fiat warrant guaranteed by JPMorgan. No thought.

JPM Coin, a so-called stable coin that JPMorgan plans to use its customers for cross-border payments, may pose a direct threat to one of the most visible blockchain companies: Ripple https://t.co/P41kO6iTJu pic.twitter.com/it9ZJrgTbm

– Bloomberg Crypto (@crypto) February 14, 2019

Leaders of large cryptocurrency investment companies, such as Multicoin Capital, have raised a similar problem for the XRP.

Could the price of ripple (XRP) fall due to JPMorgan crypto?

The Ripple Block Chain Network is a payment infrastructure for cross-border transactions that banks and financial institutions can use to send and receive low-cost payments with faster reconciliation times.

RippleNet and XRP are the primary tools in the Ripple Block Chain Network that allows financial institutions to clear transactions that use the blockchain.

The value of any settlement network comes from its liquidity and on a banking network, liquidity comes from the number of banks present on the network.

Ripple, the company, has for years been committed to partnering with banks and financial technology service providers primarily to improve network liquidity.

Industry officials and experts at XRP's long-term growth trend fear that if JPMorgan uses JPM Coin to settle payments between its customers, the bank will put XRP in direct competition with JPM Coin.

S addressing CNBC, Umar Farooq, blockchain project manager at JPMorgan, said JPM Coin will have three main usage scenarios, the main one being international payments to businesses.

"The first is international payments for big business, which is typically done by wire transfer between financial institutions over decades-old networks such as Swift," said CNBC.

The problem is that this is exactly why Ripple was designed and the company has the same vision as JPM Coin: go beyond SWIFT and establish a global blockchain network for financial institutions.

In November 2018, Brad Garlinghouse, CEO of Ripple, said in an interview with Bloomberg:

The technologies currently used by banks, developed by Swift decades ago, have not evolved or tracked the market. Swift said it was not so long ago that they did not consider the blockchain as a solution for correspondent banks. More than 100 of their clients disagreed.

JPM Coin and Ripple have essentially the same use case, target the same market and both aim to go beyond the SWIFT network.

Tushar Jain, a general partner at Multicoin Capital, said JPMorgan "will hit the floor with Ripple," noting that banks would instead use technology developed by banks rather than a company outside the traditional financial sector.

Banks will obviously never use the XRP for settlements and enrich Ripple Inc. (which owns more than half of the XRP). They prefer to enrich instead!

Congratulations to JPM for being first. They will wipe the floor with Ripple. https://t.co/Jkfkvr7BnE

– Tushar Jain (@TusharJain_) February 14, 2019

XRP in trouble?

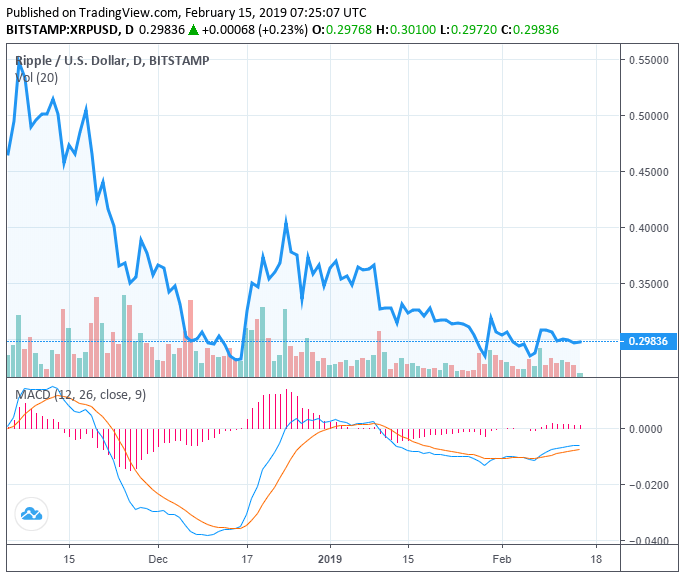

Over the last three months, the price of XRP has risen from $ 0.565 to $ 0.298, a decline of more than 47%.

The decline in the XRP was accelerated by the inability of the cryptocurrency market to maintain the momentum created in the last quarter of last year.

However, compared to other high-performance crypto-currencies such as Binance Coin and Bitcoin, XRP underperformed.

It remains to be seen whether increasing competition in the blockchain sector and in the cross-border transaction market will directly result in lower XRP prices.

Concerns about the long-term growth of XRP lie in the difficult environment that follows the publication of JPM Coin to secure banking partners.

Click here for a real-time Ripple price chart.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link