[ad_1]

Bitcoin is currently trading at $ 3,623, down 0.09% over the last 24 hours, after trading between a high of $ 3,692 and a low of $ 3,608 since February 10, according to data collected by CoinMarketCap.

Binance Coin is the top winner among the 10 largest market capitalization crypto-currencies, up 5.23% on the date of publication. The rest of the market is mixed with Tron and Stellar up 2.56% and 3.35%, respectively, while the XRP is down 1.5%.

Meanwhile, a key indicator shows that Bitcoin could reach a long-term floor. CoinDesk's Omkar Godbole points to a bullish divergence in the price of the BTC according to the MACD, but a move of more than $ 5,334 is needed to confirm a long-term bullish reversal.

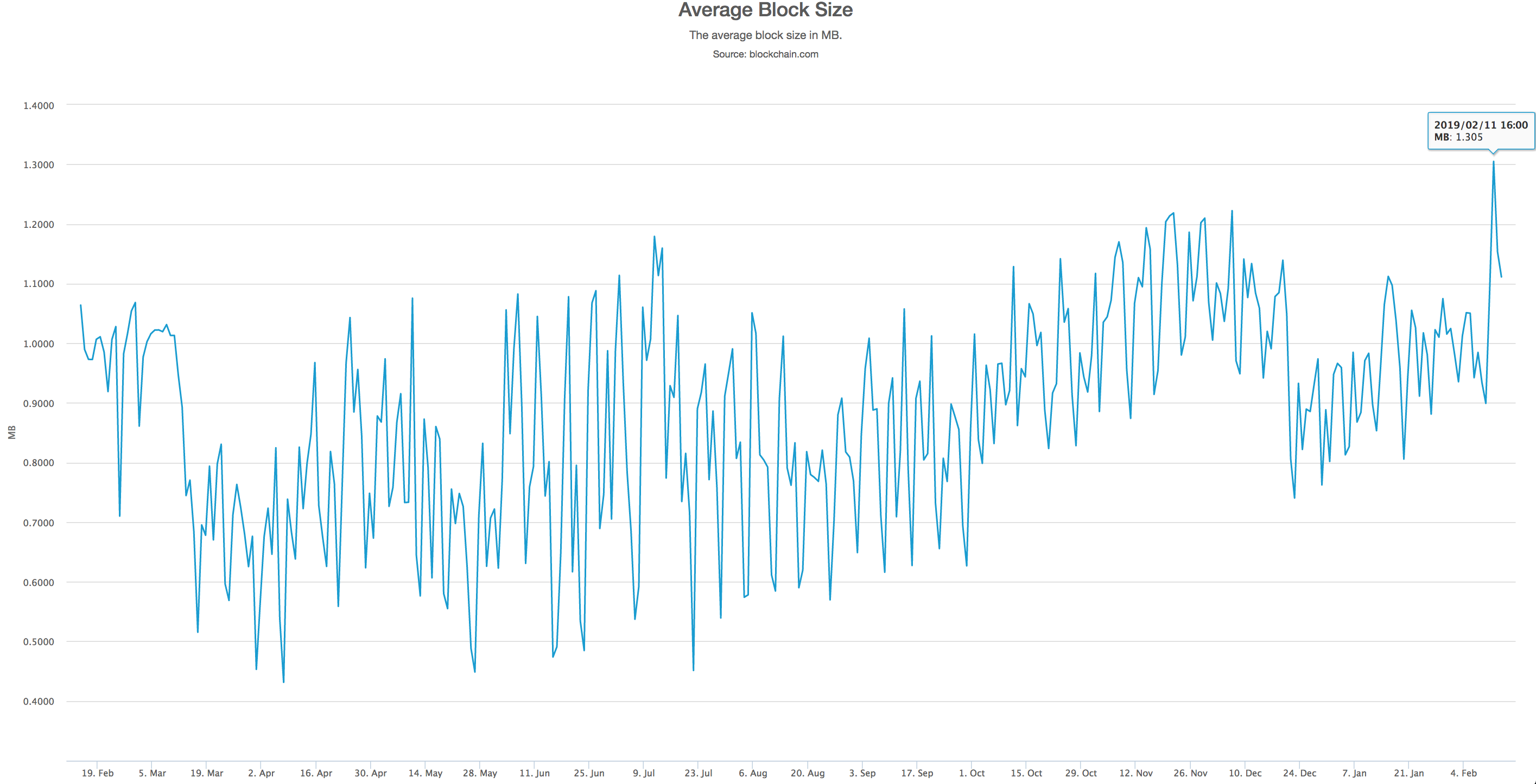

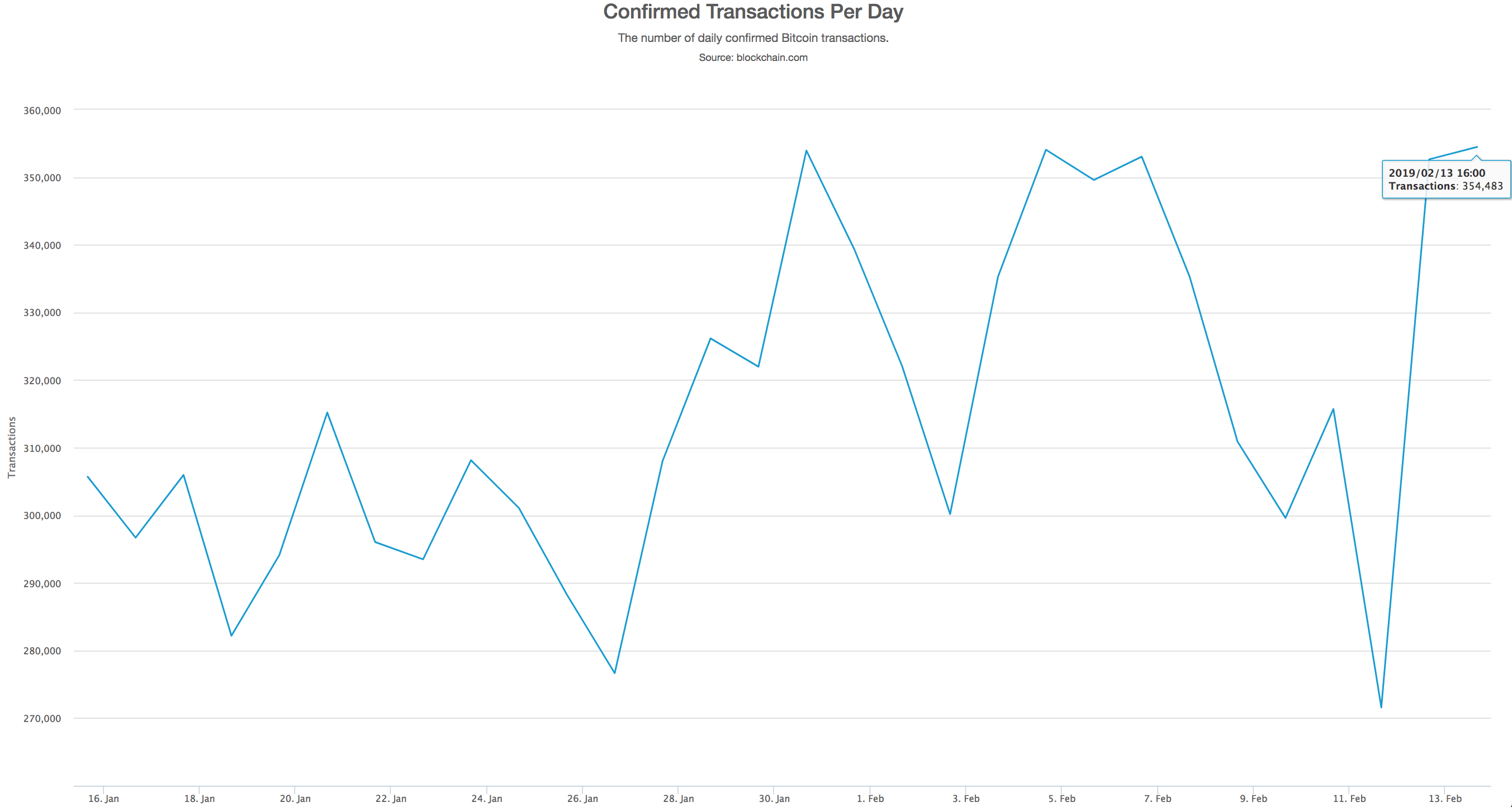

On Monday, the average block size of Bitcoin rose to 1.305 megabytes, exceeding previous records. The increase in block size suggests larger transaction volumes for Bitcoin.

Although the average block size fell to 1.111 MB on Wednesday, Blockchain.com recorded an increasing number of confirmed Bitcoin transactions at 354,483.

Blocks records Bitcoin transactions, which keeps records in the general ledger of the blockchain.

According to the data compiled by transactionfee.info, about 42.1% of Bitcoin transactions use a separate cookie, or SegWit, a sizing solution that reduces block size in the blockchain by reducing data from Bitcoin transactions.

Research published in September 2017 by BitMEX, a cryptocurrency exchange, showed that the implementation of SegWit had allowed the block size to be increased. According to the report, the adoption of SegWit has progressed at a steady pace, coinciding with a significant reduction in transaction fees.

"After upgrading to SegWit in August 2017, although in a much slower way than many had hoped, the old 1 MB block size limit is slowly starting to fade,"

Despite the low cost benefits, upgrading to SegWit is a major modernization for some cryptographic companies.

Tyler Winklevoss, co-founder of the Gemini Crypto Exchange, recently explained why his team had delayed the deployment of SegWit for Bitcoin.

"Our Bitcoin wallet was made before Segwit was a wink in Pieter Wuille's eye. [Bitcoin Core developer aka SegWit lead]. It would be very difficult to modernize Segwit in this country. So we created a new dynamic portfolio, fully integrating Segwit support, transaction batch processing, Bech32 addresses and more. We used this new system for Zcash, Litecoin and Bitcoin Cash. That's why we are already using Segwit for Litecoin native and encapsulated in P2SH. We are working on the migration of Bitcoin to the new system, and this should be done in the first quarter. "

Developers continue to work on other Bitcoin scaling solutions, such as Lightning Network, to encourage mbadive adoption and allow users to spend Bitcoin as money.

Join us on Telegram

Discover the latest titles

Disclaimer: Daily Hodl's advice is not investment advice. Investors should exercise due diligence before making high-risk investments in Bitcoin, Cryptocurrency or digital badets. Please note that your transfers and transactions are at your own risk and that any loss you may incur is your responsibility. The Daily Hodl does not recommend buying or selling crypto-currencies or digital badets, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Source link