[ad_1]

The US stock market seems poised for poor entry in the first trading session of the week following the presidents' holiday on Monday, as the Dow and its related indexes all predict a drop to the opening bell. The price of bitcoin, on the other hand, has erupted after a long period of stagnation and many investors are wondering if cryptocurrency is at the forefront of a new bull market.

Dow Futures Point South

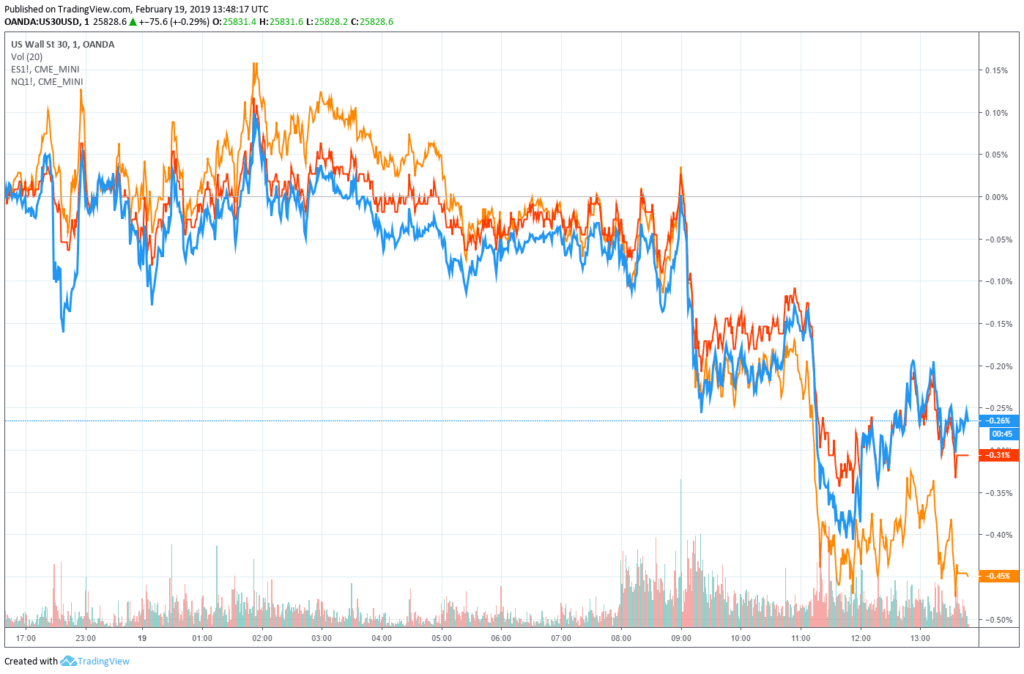

At 8:55, the Dow Jones Industrial Average futures contracts had lost 58 points, or 0.22%, or a loss of 46.25 points at the opening. S & P 500 futures dropped 0.32% and Nasdaq futures dropped 0.29%, completing the weak session before stock markets closed.

The Dow Jones Industrial Average (blue), S & P 500 (red) and Nasdaq (orange) futures all fell before Tuesday's opening.

Walmart was an exception to the sluggish trading session, which denied badysts' estimates following a 43% increase in online sales. Walmart shares climbed 3.45% ahead of Tuesday's bell.

Analyst Adam Kobeissi predicts that the stock market rally will collide with a wall

On Friday, the Dow Jones gained 443.86 points, up 1.74% to close the week at 25,883.25. The S & P 500 and Nasdaq also ended the day in the green, rising 1.09% to 2,775.6% and 0.61% to 7,472.41%.

The Dow has now risen for eight consecutive weeks, as stock markets continued to pound the table after the imminent end of the recovery. Here's an example, courtesy of Kobeissi Letter Editor Adam Kobeissi. Highlighting the S & P 500's inability to outpace the resistance at 2,800 – even after surpbading its 200-day moving average – it predicted that the overall consumption index could fall by more than 225 points in the past year. the next few weeks, as the stock market enters a period of slowdown.

"For the future, we believe that the upside is limited and that the purchase of shares now has a risk / reward ratio that is very unfavorable, because the expected return has decreased with the recent rise in forecasts, "he said. "We are maintaining our target at 2,550 on the S & P 500 and believe short equity positions are set for a few exceptional weeks."

US-China trade talks take place in Washington

On Tuesday, however, Wall Street was cautiously watching negotiations between US and Chinese negotiators in Washington, just days after the return of US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin, without reaching an agreement end to the trade war. .

Few badysts expected the talks to end in a formal deal, but the stock market is increasingly agitated ahead of US President Donald Trump's deadline for trade deals on 1 March. March. If this deadline is exceeded and Trump fails to announce an extension, the United States would increase tariffs on Chinese goods worth $ 200 billion. This move would not only intensify the ongoing trade war between the United States and China, but would also threaten to further the relations between the two largest economies in the world.

Bitcoin price: $ 4,000; is the bear market over?

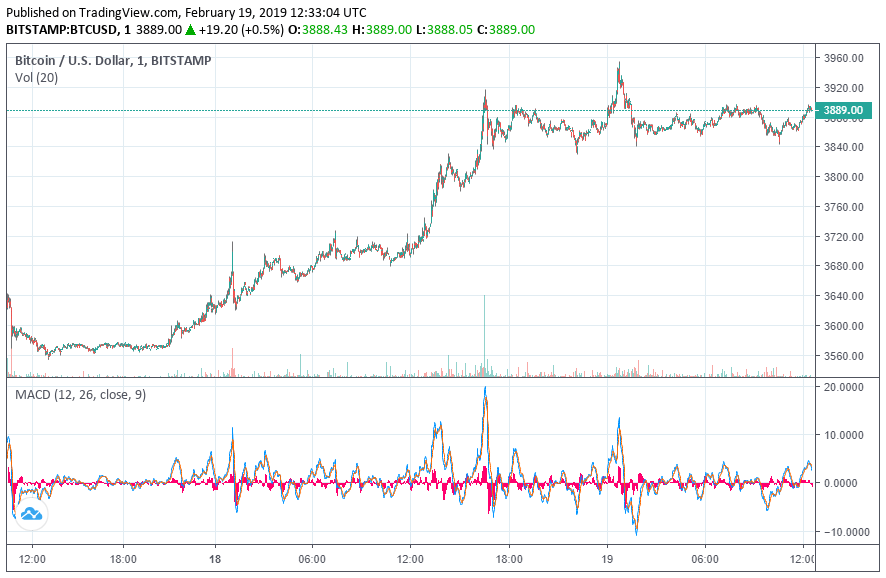

The cryptocurrency market, on the other hand, had already risen sharply before Wall Street woke up from its long weekend.

Bitcoin is now testing $ 4,000 on most exchanges.

On Bitstamp, the price of bitcoin climbed to $ 3,955, although it failed to break the $ 4,000 level before falling back to a current value of $ 3,889. Despite this, the flagship cryptocurrency retains a net gain of 4.29% over 24 hours.

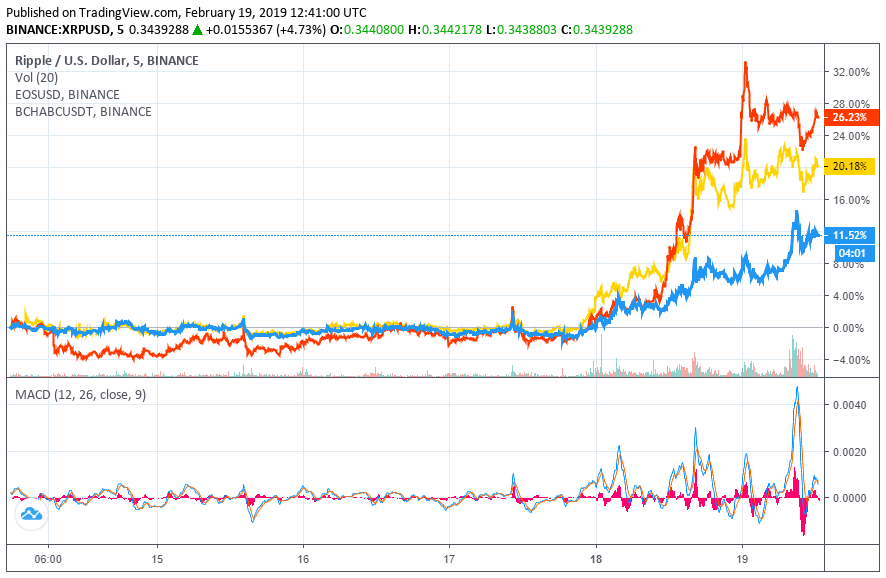

Nevertheless, the most significant action was carried out on the markets of altcoin. The redemption price (XRP) increased by 7.9%, while that of bitcoins jumped 12.18% to $ 146. The big-cap growth index was the EOS, which jumped 17.23% over the last 24 hours and is now trading at $ 3.66.

Ripple (XRP), EOS and Bitcoin Cash all organized major rallies.

Today's remarkable gathering has naturally sparked the enthusiasm of long-term investors for crypto-currencies who might be tempted to wonder if bitcoin has started to raise the bar since its record high, at around $ 20,000 – maybe even more.

However, Mati Greenspan, senior market badyst at eToro, said investors needed to temper their euphoria, at least until bitcoin was able to surpbad the technical and psychological resistance of $ 5,000. It is only then, he says, that bulls will feel confident that cryptocurrency has closed the chapter of its longest bear market.

"These gains are clearly creating a wave of optimism within the cryptographic community as market volume has increased by $ 8 billion over the past 24 hours. The market volume is now over $ 36 billion and we have not seen these levels since April 2018. But as long as bitcoin has not exceeded the long-awaited psychological level of $ 5,000, the bear market is always at stake. "

Meanwhile, BitOoda cryptographic broker – which remains bearish on Bitcoin's near-term outlook – is closely watching the evolution of Bitcoin Dominance, which measures cryptocurrency's flagship share in the global market capitalization of crypto -change. The company expects altcoins to reduce Bitcoin's market share in the rest of the bear market. This morning, the domination of Bitcoins stood at 51.5%, down from the record of 54% achieved since the beginning of the year.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link