[ad_1]

The videoconferencing company Zoom aims to file a public S-1 by the end of March, according to a new report in Business Insider that adds that the company could be made public in April.

Business Insider announced last month that Zoom had filed confidentially with the SEC to make it public, just months after Reuters announced that the San Jose, California-based company had chosen the Morgan Stanley investment bank to conduct its eventual IPO.

We sought the opinion of the company.

Zoom was valued at $ 1 billion when it last funded in 2017, in the form of a $ 100 million check from Sequoia Capital. Reuters sources said they expect the company to obtain a multibillion-dollar value during the IPO.

The company, created in 2011, raised $ 145 million in total, including Emergence Capital and Horizons Ventures. Early funders include Qualcomm Ventures, Yahoo's founder, Jerry Yang, WebEx founder Subrah Iyar, and former Cisco SVP Dan Scheinman, who has been an active angel investor for years.

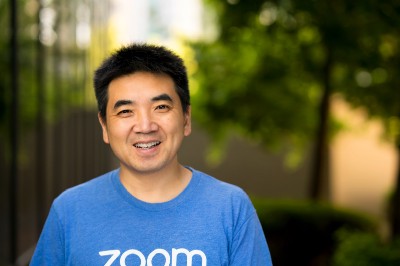

Last year, we had the opportunity to meet CEO Eric Yuan at a small event organized by venture capital firm NextWorld Capital. He talked about coming to the United States as a student from China and having applied for an American visa nine times in two years before receiving it and arriving in Silicon Valley in 1997. We also talked about his experience as the 10th employee of WebEx and his frustration that the company's code remained stubbornly unchanged after being sold for $ 3.2 billion to Cisco in 2007.

He was not alone, clearly. When Yuan decided to found Zoom, 45 WebEx employees joined him, a decision they are probably grateful for now. Aside from the financial benefits, Yuan was ranked at the top of the annual list of top rated CEOs of Glbaddoor last year.

We can delve further into Zoom's health once his S-1 report is made public. In the meantime, you can check our chat here.

Source link