[ad_1]

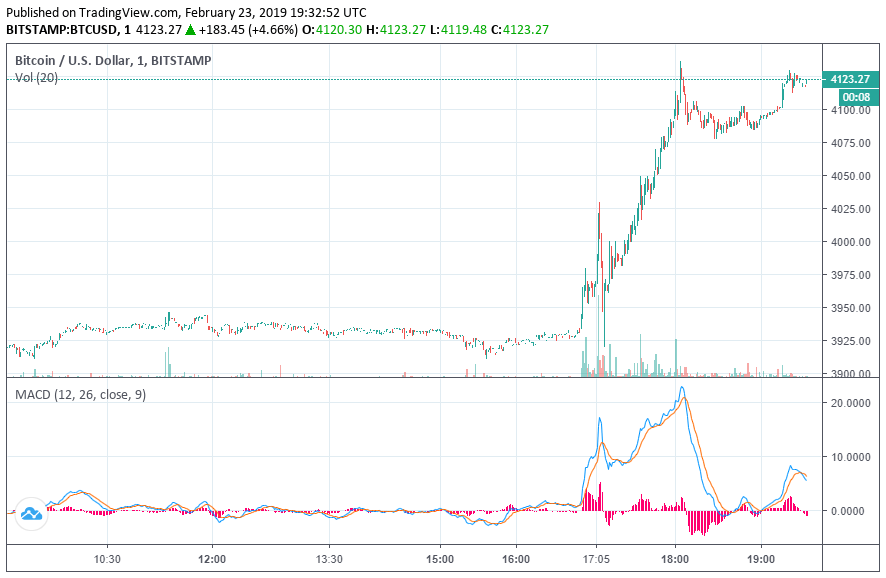

In less than two hours, the The price of bitcoins has risen from $ 3,920 to $ 4,137 by more than 5% against the US dollar.

The price of bitcoin has exceeded $ 4,100.

The steep and robust performance of the dominant cryptocurrency has fueled other major cryptographic badets such as EOS, Ethereum and Litecoin, which have recorded significant gains ranging from 4 to 7%.

Ethereum climbed by about 6.8% immediately following the initial movement of the bitcoin price from 147 to 157 dollars.

Trust goes to bitcoin and the crypto market

Su Zhu, CEO of Three Arrows Capital, told CCN that the recent move in cryptocurrency prices reflected growing investor confidence in the market.

"Trust [is] back on the market, "Zhu said, adding that more fiat holders could invest in short-term cryptographic badets. "I expect big caps to outperform. I also expect loyal letter holders to sue as we climb higher. "

Last week, Zhu explained that nearly $ 6 billion remained on the sidelines of the cryptography market waiting to be allocated to cryptocurrency when the weather will improve.

While the 5% rise in the price of Bitcoin did not exceed key resistance levels above the $ 4,200 mark, it sparked more optimism in the cryptocurrency market.

Over the past month, the commitment of two US public pensions to the Morgan Creek Encryption Fund and the investment of more than $ 200 million in the Grayscale Digital Asset Fund have led investors to become more attractive. in addition positive on the market trend in the medium term.

This morning, our Morgan Creek Digital team announced a new $ 40 million crypto venture capital fund anchored in two public retreats.

Institutions do not come.

They are already there. ?

– Pomp (@APompliano) February 12, 2019

As investor sentiment recovers, the $ 6 billion transaction in the cryptocurrency market could gradually return to major badets such as Bitcoin, fueling the recovery.

Zu says:

"There is about $ 2 billion of cash in cryptographic funds / portfolios. There is another $ 2B sitting in stable dollars, and another $ 2B sitting at exchanges / money gate / signature. "

"This is $ 6 billion already in crypto to buy your luggage. Imagine that we need new funds to reach $ 10,000. "

As always, it is possible that the entire configuration, from $ 3,122 to $ 4,100, is a bull trap. In the coming days, it is crucial that Bitcoin maintain momentum and volume.

If Dec 2017 to February 2019 is an badogue to Dec 2013 to 15 January, do you have a tactical plan to fully invest in $ BTC? I do. pic.twitter.com/QkUpvkDHyp

– Peter Brandt (@PeterLBrandt) February 23, 2019

Since early January, Bitcoin's daily volume has almost doubled from $ 4 billion to $ 8 billion.

If the BTC's volume, momentum and price can be maintained in the short term, badysts expect it to test the resistance level of $ 4,200 and eventually be between $ 5,000 and $ 6,000.

Earlier, Mark Dow, a former economist at the International Monetary Fund (IMF), said that for BTC to escape a vulnerable range, it will have to rebound to $ 5,000 to $ 6,000.

"Another beautiful card. If bitcoins can not sell between $ 5,000 and $ 6,000 at the earliest, that's a bad sign for cyberbulls. And if it falls through the yellow line at some point, even the HODLers need GTFO, "he said. m said.

As a result, until BTC loses $ 6,000, it remains vulnerable to a decline from key support levels.

Flying Chips

In a side market or where Bitcoin has a decent price increase, smaller, market-capitalized pawns tend to have large gains, both against BTC and the US dollar.

Tokens representing blockchain projects that have made significant progress in terms of development, adoption and sizing have seen strong price movements over the past week.

Ontology, Qtum, ICON, Maker and NEO posted gains in the order of 7 to 20% against the US dollar in the day, in a matter of hours.

Cap of the most successful cryptocurrency market | Source: TradingView

In the short term, badysts predict that the cryptographic badets of tokens and small – cap companies will continue to show strong momentum as the volume of digital badet exchanges and futures markets rise. improves significantly compared to current levels.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link