[ad_1]

Chinese Premier Li Keqiang is also concerned about the state of the global economy.

Speaking in Beijing today, Li said China had "suffered further downward pressure and pledged to do more to help the economy."

Li promised:

"Of course, we are facing many uncertain factors this year …

We can deploy policy tools based on quantity or price, such as reserve requirements and interest rates. This is not monetary easing but more effective support for the real economy. "

The Chinese central bank has already cut interest rates in recent months, while the government has announced tax cuts to help businesses and consumers.

But what China really needs is an end to the trade war with China. The signs there are not good – the hopes of a summit between President Trump and Xi in March have faded.

Both parties are now targeting April … or maybe even later, judging by this quote from Secretary of State Mike Pompeo:

Meridith McGraw

(@Meridithmcgraw)Pompeo about a meeting with Trump & Xi: "Whether it's early or mid-April or even in a few weeks, we should be doing things right." We hope the two leaders can come together to get a trade deal that will benefit not only America but the rest of the world too. "

Back to Japan … and Uhuru, Japan-based IoT [Internet of Things] company supported by Softbank, believes that the Bank of Japan is "typically conservative".

CEO Takashi Sonoda tells us:

"The Bank of Japan is generally conservative and bases its outlook on historical data. The general mood in Japan is that of trust. This is especially true in the field of technology.

Japan is positioning itself to be at the forefront of the economics of data distribution and is confident that this will grow rapidly. "

The British subcontractor Interserve, which handles thousands of government contracts, including cleaning hospitals and prisons and providing school meals, could be on the verge of falling into the hands of the government. ;administration.

A pre-packaging administration would allow the company to continue operating:

Rob Davies

(@ByRobDavies)Before the critical vote on the financial restructuring of the government contractor Interserve, I am told that the major shareholder, Coltrane, refuses to yield and that he will vote against it. Means that a pre-pack administration is on the cards.

Rob Davies

(@ByRobDavies)That sounds bad, but it is unlikely to disrupt the many public services managed by Interserve, at least if we believe the company and the Cabinet Office. But this evokes underlying problems in the subcontracting and construction sectors.

Here is the background to this morning's shareholders' meeting on whether to approve a restructuring plan that would almost eliminate existing investors.

Update

SEC pursues VW on diesel scandal

Overnight, German car maker Volkswagen and former managing director Martin Winterkorn have been accused of defrauding US investors.

My colleague Jasper Jolly explains:

The US Securities and Exchange Commission is suing Volkswagen and its former managing director, accusing them of defrauding investors by making "misleading" statements about the environmental impact of its cars.

The regulator said that between 2007 and 2015, VW had committed a "mbadive fraud" by selling securities and half a million cars qualified as "clean diesel" when executives were informed of the lorries. extent of fraud, said the SEC. Cars emitted 40 times more harmful nitrogen oxides than US laws.

Update

Swissquote Bank's Vincent-Frěděric Mivelaz said the economic outlook in Japan has deteriorated.

Economic difficulties have forced the BoJ to revise down its exports and production. January's exports fell -9% (formerly -5.80%), their lowest level in three years and the third consecutive decline, while imports rebounded by 0.50% (previously -2, 20%) during the same period.

The January current account balance of the current account balance reached JPY 600.4 billion (previous year: JPY 452.8 billion), due to a sharp rise in investment income due to a phase in the current account. expansion of financial markets. However, the 5.40% drop in machinery orders in January points to further slowing in the first quarter.

The BoJ's language shift from "rising" to "recently showing some weakness" shows that the situation is not expected to improve before the third quarter. The badumption of 2% inflation has become a wishful thinking.

Update

The Japanese stock market rebounded today, with investors calculating that the BoJ would not tighten its monetary policy soon, given the weak global outlook.

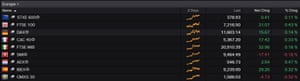

European stock markets also gained momentum, reaching their highest level in five months this morning.

European Stock Exchanges, March 15 Photo: Refinitiv

Jasper Lawler of London Capital Group said:

According to a report, trade negotiations between the United States and China had progressed further, easing market concerns and strengthening Asian markets overnight. The sentiment was also supported by news that the British parliament voted to postpone Brexit.

Ironically, the governor of the Bank of Japan also criticizes the modern monetary theory, saying that this idea is extreme.

Questions about the TEM (very Basically, the idea that public deficits are not inherently bad, unless they fuel inflation, "Kuroda told reporters:

I think this is an extreme argument that will not be widely accepted.

The government is responsible for fiscal policy and Japan's public debt is very high. It is important to improve Japan's fiscal health in the long run. "

MMT supporters may be blindfolded, given Japan's recent economic history. He managed to inflate his national debt at twice his national income without struggling to finance his deficit. In addition, the BoJ's money printing program has been particularly inefficient in fueling inflation.

Gearoid Reidy tweets from Bloomberg:

Gearoid Reidy

(@GearoidReidy)Finally, Kuroda insists on modern monetary theory, saying that this seems like an "extreme idea".

Of course, Japan has lived essentially MMT for three decades, with one crucial exception: you have to "pretend" that you really care about the debt, even if you do not do it. pic.twitter.com/Y1hoGo2z9k

Update

BoJ Governor Kuroda insisted he would not give up the 2% inflation rate in Japan.

He told reporters:

"I do not think it's necessary to change our price target."

But … despite years of record interest rates and a mbadive QE program, Japanese inflation rose only 0.4% last month.

Naomi Muguruma, Senior Economist at Mitsubishi UFJ Morgan Stanley Securities, suspects the bank of having to rethink its plans.

"In the longer term, the BOJ will probably have to reconsider what is the best policy framework because it will take a long time to reach the price target."

It is to be feared that the economic weakness will bring Japan to the brink of recession (it contracted in the third quarter of 2018 before spreading in the fourth quarter).

Darren Aw, an economist for Asia at Capital Economics, believes the BoJ could be forced to strengthen its stimulus program later this year.

Aw says (via the FT)

The Japanese economy is likely to contract again in the first quarter, for the third time in five quarters.

Given this, the key question for the Bank of Japan is no longer whether it could abandon its ultra-loose policy, but whether it could do more to support the economy. "

Update

Introduction: The Bank of Japan feels the gloom

BoJ Governor Haruhiko Kuroda. Photo: Issei Kato / Reuters

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

The Bank of Japan has become the last central bank to warn of the slowdown in the global economy.

At its last political meeting today, the BoJ revised its vision of the Japanese economy by warning that exports and industrial production have been "affected by the slowdown in overseas economies."

BoJ Governor Haruhiko Kuroda warned that overseas problems are making it difficult for Japan to:

"It is true that Japan's exports and production are affected by weak growth abroad. On the other hand, domestic demand continues to grow. We maintain our basic view that the economy is growing moderately.

"It will probably take longer to reach our price target.However, the output gap is improving … Most board members think that it is more appropriate to patiently maintain our current stimulus package. "

Thus, although the Japanese national economy is growing, policymakers have left its short-term interest rate target set at minus 0.1%.

The BoJ will also continue its policy of buying Japanese government bonds at 10 years, so that returns remain at around 0% – in order to bring money into riskier badets and stimulate growth.

Bloomberg says that Kuroda and his colleagues take a more pessimistic view, given the recently weak data.

The BOJ also revised down its valuation of exports, industrial production and overseas economies. The weakest economic recovery was also widely expected after a weak data series over the past month.

The slowdown makes it even harder for the BoJ to reach its goal of raising inflation to 2% thanks to its mbadive stimulus program.

Holger Zschaepitz

(@Schuldensuehner)The BoJ fails to spur growth and inflation with all the money printed. Forces of global gloom #JapanThe central bank will temper its prospects https://t.co/y1bqtqt01b pic.twitter.com/BP0QQbvbpL

Kurora also warned that the global economy could deteriorate further, even though he hoped for an early recovery.

He told reporters:

The likelihood of overseas economies deteriorating further is low. It's a risk. However, the basic scenario is that of a recovery of overseas economies in the second half of this year, especially in areas that are currently showing signs of weakness, such as China and Europe. "

Also coming today

The British contractor Interserve faces a critical vote on Friday that could push him to the administration. He hopes to persuade shareholders to support a bailout deal in which lenders would own 95 percent of the company.

But if shareholders reject his stock-swap plan when voting, lenders could force him to switch to the administration.

JD Wetherspoon, a British coffee chain, and restaurant group restaurants, publish their results.

L & # 39; s calendar

- 10am GMT: euro zone inflation in February

- 14:00 GMT: University of Michigan survey on US consumer confidence

Update

[ad_2]

Source link